The Asia Climate Summit (ACS), held by IETA, is one of the most prominent carbon market conferences in Asia. (Photo: IETA)

The annual Asia Climate Summit (ACS), hosted by the International Emissions Trading Association (IETA), one of the world’s three major carbon market organizations, is among the most influential carbon market gatherings in Asia. This year’s summit took place in Bangkok from July 8 to 10, drawing more than 900 delegates from international organizations, businesses, and governments, including the United Nations, World Bank, and Google.

RECCESSARY attended the event and, based on discussions with developers, institutional investors, and experts, summarized three major trends and opportunities shaping Asia’s carbon markets.

Trend 1: Too many methodologies spark anxiety, unified standards in demand

The voluntary carbon market is expanding rapidly worldwide, but its fragmentation and lack of unified standards have become a central concern at this year’s summit. Developers, certification bodies, and investors noted that methodologies are still governed separately by different standard-setters such as Gold Standard and the Climate Action Reserve (CAR), making it difficult for projects to comply with multiple requirements and significantly raising verification and communication costs.

For instance, if a developer uses Gold Standard’s methodology, the resulting carbon credits cannot be directly listed on other registries such as Verra, creating substantial barriers to market entry.

Although mechanisms such as the Integrity Council for the Voluntary Carbon Market’s (ICVCM) Core Carbon Principles (CCP) label and Carbon Offsetting and Reduction Scheme for International Aviation (CORSIA) have been introduced to improve the quality and verification of carbon credits, they have yet to address the underlying issue. Many participants at the summit stressed that the market urgently needs a more authoritative and unified framework.

Article 6.4 of the Paris Agreement, overseen by the United Nations Framework Convention on Climate Change (UNFCCC), is seen as one potential solution. With its foundation of international legitimacy, it could play a key role in establishing unified standards and rebuilding market trust. The mechanism could both reduce the risks developers face in aligning with multiple standards and support countries in achieving their nationally determined contributions (NDCs).

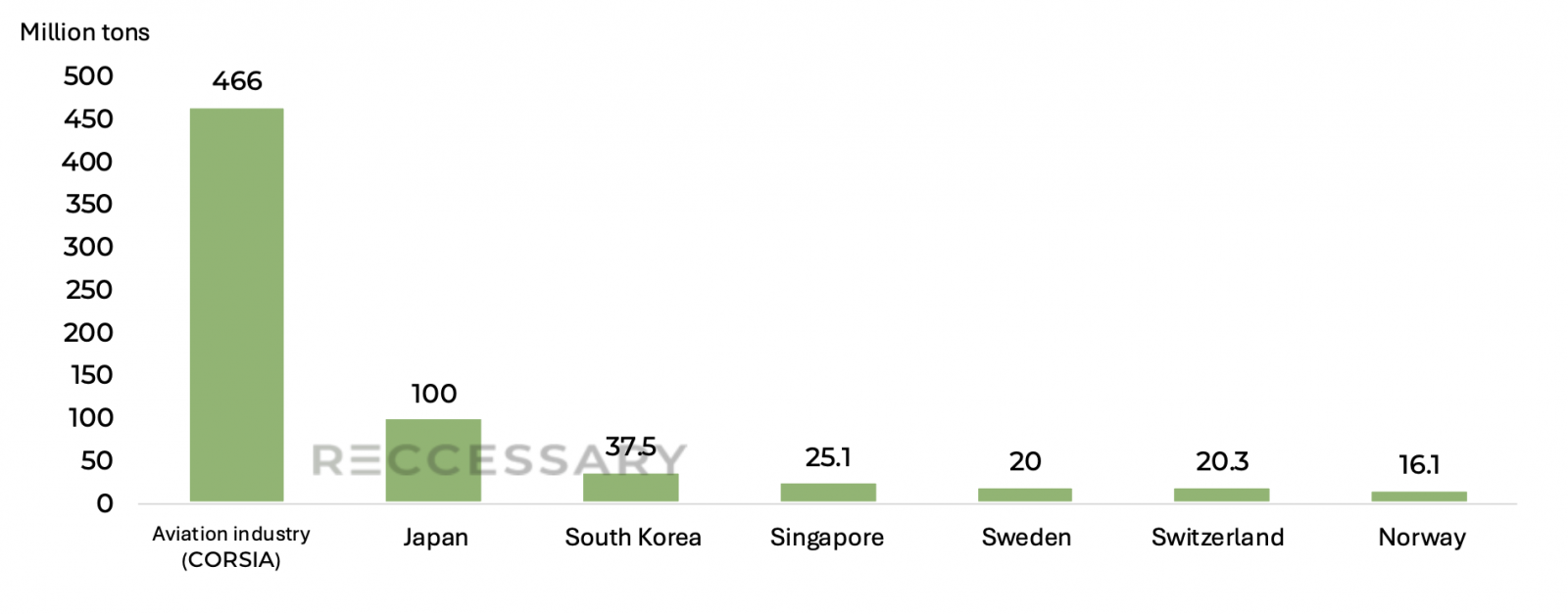

Figure 1. Projected demand for Internationally Transferred Mitigation Outcomes (ITMOs) by 2030 [1]