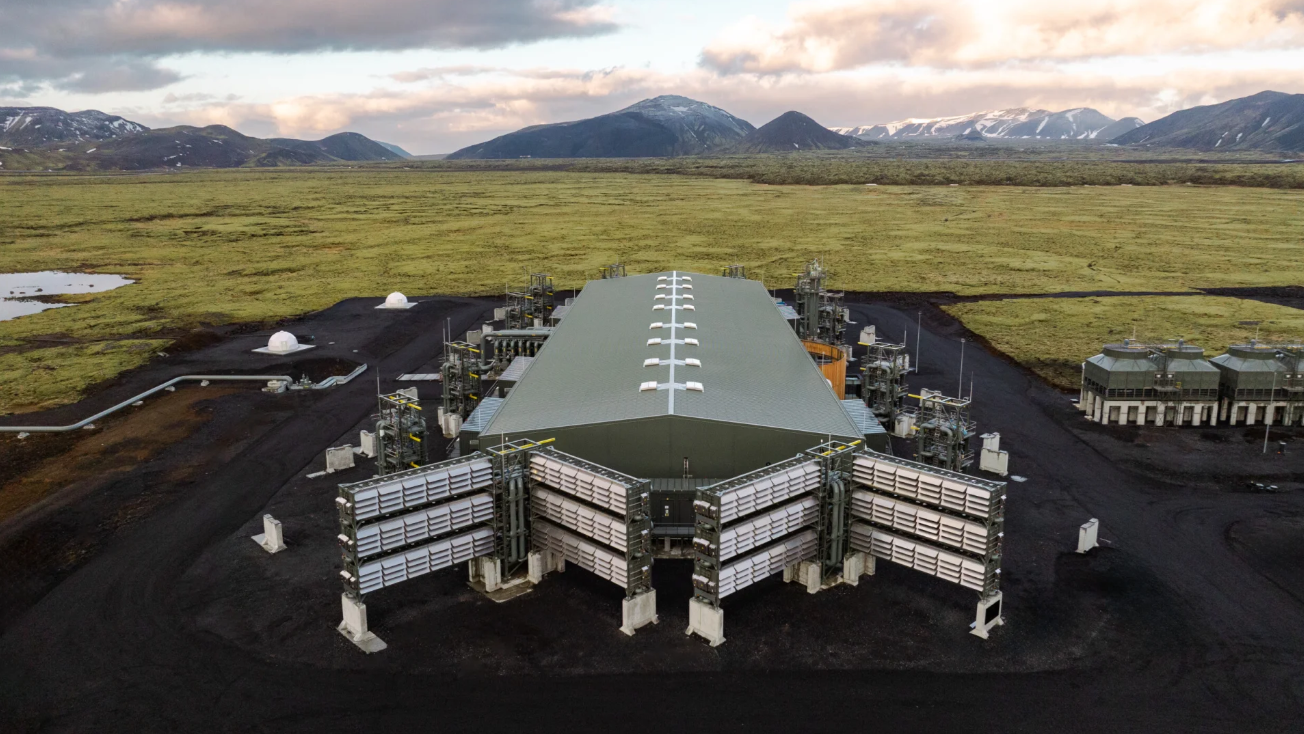

Climeworks cuts jobs amid economic headwinds and market uncertainty. (Photo: Climeworks)

Swiss direct air capture (DAC) pioneer Climeworks recently announced a major round of layoffs, planning to cut more than 20% of its global workforce.

Company executives attributed the move to macroeconomic uncertainty and shifting policy landscapes. However, some industry observers point to deeper issues: an underdeveloped carbon removal market and overreliance on a limited number of buyers.

DAC technology still in pilot phase

On May 21, Climeworks announced it would cut up to 106 positions worldwide, with 78 based in Switzerland.

The press release did not specify which departments would be affected, instead emphasizing the company's continued commitment to enhancing core technologies, diversifying its product offerings, and strengthening its leadership in the carbon removal market.

One week prior to the announcement, co-founders and co-CEOs Christoph Gebald and Jan Wurzbacher issued a statement previewing plans to scale back the team. According to The Guardian, the sources suggested job cuts of over 10%. However, based on total headcount figures cited by Wurzbacher in Bloomberg, the actual reduction exceeds 20%.

Founded in 2009, Climeworks is one of the early innovators in DAC technology. Backed by Singapore’s sovereign wealth fund GIC and the U.S. Department of Defense, the company has raised total close to $800 million to date. It currently operates Orca, the world’s largest commercial DAC facility, located in Iceland. Just last year, Climeworks announced a major technological upgrade aimed at significantly increasing capture capacity and potentially halving costs.

Despite these advancements, DAC remains a high-cost, high-energy process. Climeworks currently charges about $1,000 per metric ton of CO₂ removed—vastly more expensive than the €65 per ton under the EU Emissions Trading System (EU ETS). For most companies, this makes DAC over 12 times more expensive than traditional carbon offset mechanisms, hindering wider market adoption.

Climeworks CEOs Christoph Gebald and Jan Wurzbacher announced plans to downsize the team in a statement released on May 14. (Image: Climeworks)

U.S. project in jeopardy under Trump administration

Climeworks’ plans in the United States have also hit a snag. A previously expected $50 million grant from the U.S. government for a new facility in Louisiana is now at risk of being revoked, possibly under a Trump administration reversal.

Meanwhile, the performance of the Orca facility in Iceland has come under question. Some critics claim that Climeworks has exaggerated the plant’s CO₂ removal effectiveness. Wurzbacher himself admits the technology used at Orca is outdated, and that its efficiency has rapidly declined over four years of operation.

On the demand side, Robert Höglund, co-founder of the carbon removal tracking platform CDR.fyi, noted that the carbon removal sector relies heavily on voluntary corporate purchases. This makes it fundamentally different from sectors like sustainable aviation fuel (SAF), where cost parity with fossil fuels can drive adoption and create stable markets.

Eli Mitchell-Larson, co-founder of the NGO Carbon Gap, pointed out the current imbalance in carbon credit procurement. Microsoft remains by far the largest buyer in the market, underlining the sector’s fragility and limited commercial traction.

Source: Climeworks(1), (2), The Guardian, Bloomberg, Sifted

.jpg)