SCG, Thailand’s largest cement producer, implements multiple low-carbon solutions to meet 2050 net-zero goal. (Photo: SCG)

Cement is tightly linked to national economic development, particularly in emerging markets undergoing rapid infrastructure expansion. However, the sector is also a major source of carbon emissions.

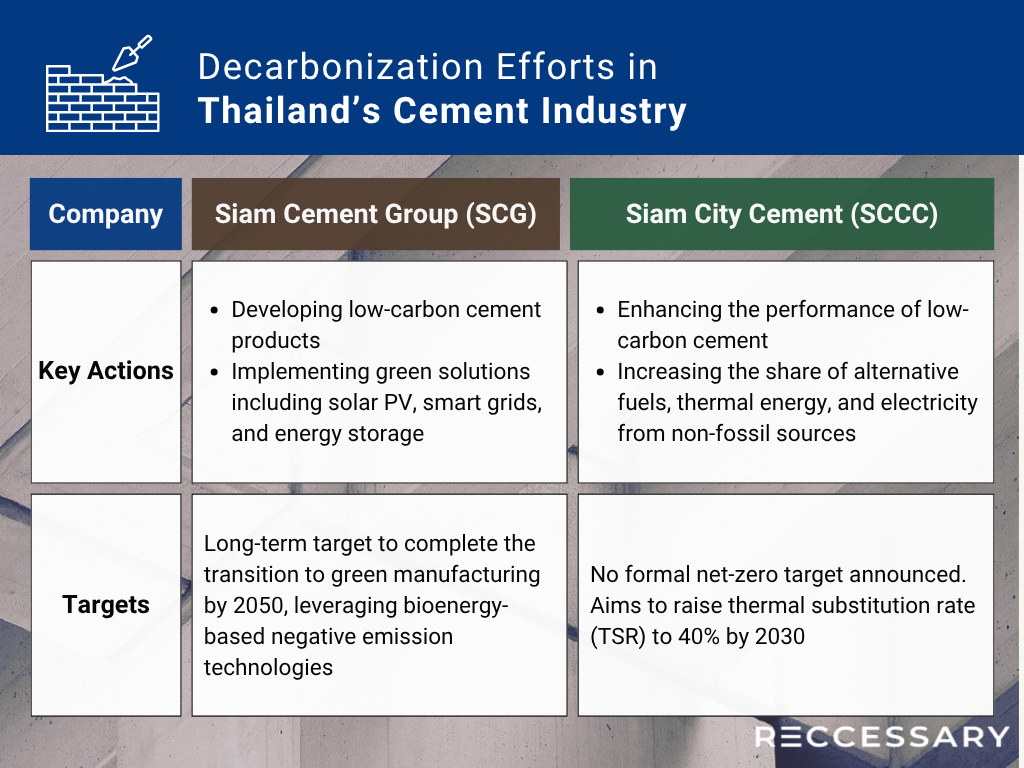

Thailand’s two leading cement producers—Siam Cement Group (SCG) and Siam City Cement Public Company (SCCC)—are tackling decarbonization from different angles. SCG is venturing into the renewable energy business, while SCCC is focused on reducing its clinker ratio and increasing the share of alternative fuels.

SCG enters power sector and sets three-phase net-zero roadmap

Cement production is both heat- and electricity-intensive, making it a key sector for emission reductions. SCG primarily substitutes coal with biomass and refuse-derived fuel (RDF), and is also promoting the cultivation of energy crops like bamboo and Napier grass. It has been recognized as a highlight project in Saraburi Province’s Low-Carbon City Sandbox initiative. However, its use of alternative fuels remains relatively modest, at about 28.5% in 2024.

SCG operates five business units, with its cement-focused division actively deploying green solutions such as solar PV, smart grids, and energy storage. It has also entered the renewable electricity retail market through power purchase agreements (PPAs), enabling rapid green power acquisition, emission reductions, and a new revenue stream.

SCG’s low-carbon cement has evolved into a second-generation product that emits 15–20% less CO₂ than traditional Portland cement. A third-generation version under development aims to cut emissions by 40–50%. Its Ultra-High Performance Concrete (UHPC), developed as a downstream product, offers superior strength and durability while reducing emissions by 20–60% compared to conventional concrete.

SCG applies an integrated risk management approach that considers economic, social, and environmental megatrends. It identifies 16 key risks, including the regulatory uncertainty around low-carbon transitions, which it classifies as moderate risk and addresses through dedicated management strategies.

The group aims to achieve net-zero emissions by 2050, with a roadmap divided into 3 phases:

Phase 1 (2020–2030): Reduce Scope 1 and 2 emissions by 25% compared to 2020, shift from fossil to clean energy, and roll out low-carbon products.

Phase 2 (2031–2049): Focus on green process innovation and deep tech R&D, especially carbon capture, utilization and storage (CCUS), and hydrogen technologies, while scaling clean energy systems.

Phase 3 (2050): Complete the transition to green manufacturing and adopt bioenergy-based negative emission technologies to enhance clean tech competitiveness.

SCG’s Net-Zero Roadmap (Photo:SCG)

SCG’s 2024 sustainability report identifies CCUS as key to achieving a 48% GHG reduction and outlines plans for phased implementation starting with cost assessment and infrastructure development. The company also highlights hydrogen, oxyfuel combustion, and biochar carbon removal as priority technologies.

SCCC outperforms on decarbonization with clinker cuts and fuel switch

Smaller in scale, Siam City Cement (SCCC) has not set a formal net-zero target but aims to meet three climate-related goals by 2030:

1. Cut net emissions to 470 kg CO₂ per ton of cement

2. Reduce electricity consumption by 10%

3. Source 20% of electricity from alternative fuels

Key environmental data for Siam City Cement in 2024. (Photo: SCCC)

According to company data, SCCC hit key milestones in 2024, including reducing net emissions to 562 kg CO₂ per ton, lowering its clinker factor to 69.2%, and raising its thermal substitution rate (TSR) to 28%—all outperforming projections.

TSR saw a notable increase from 21% to 28%, largely due to improved pre-treatment and control of waste materials sourced from other industries, which enhanced their thermal efficiency when converted into fuel. Increased use of biomass fuels also contributed to reducing reliance on coal.

.jpg)