.jpg)

India overtakes China in new steel capacity, raising carbon concerns. (Photo: iStock)

The global steel industry has seen a steady increase in decarbonization initiatives, but actual progress remains limited.

A new report reveals that India has now surpassed China in new steelmaking capacity, positioning itself as a pivotal player in the global transition to green steel. However, unless India moves away from its coal-heavy production methods, it risks slowing down the entire industry's decarbonization efforts.

Low-carbon steel capacity rises but still misses climate targets

Since 2021, the U.S.-based think tank Global Energy Monitor (GEM) has published annual reports tracking global steel production capacity.

Its latest report, released on May 19, highlights significant growth in steelmaking capacity using low-carbon technologies like electric arc furnaces (EAF) and direct reduced iron (DRI) over the past five years. EAF capacity alone has grown by nearly 11%, and is projected to increase another 24% by 2030.

By then, global steel demand is expected to exceed 2 billion tonnes annually. Steel produced using EAF could reach 868 million tonnes per year, representing 36% of total capacity. However, this remains one percentage point short of the International Energy Agency’s (IEA) benchmark for staying on track with global climate goals—signaling that coal-based steelmaking still dominates the industry.

According to the report, planned steel production using traditional high-emission blast furnace (BF) technology currently accounts for about 303 million tonnes per year, concentrated mainly in China and India. While China remains the global leader in total steel capacity, it is gradually expanding its use of EAFs, which now make up nearly one-quarter of its production.

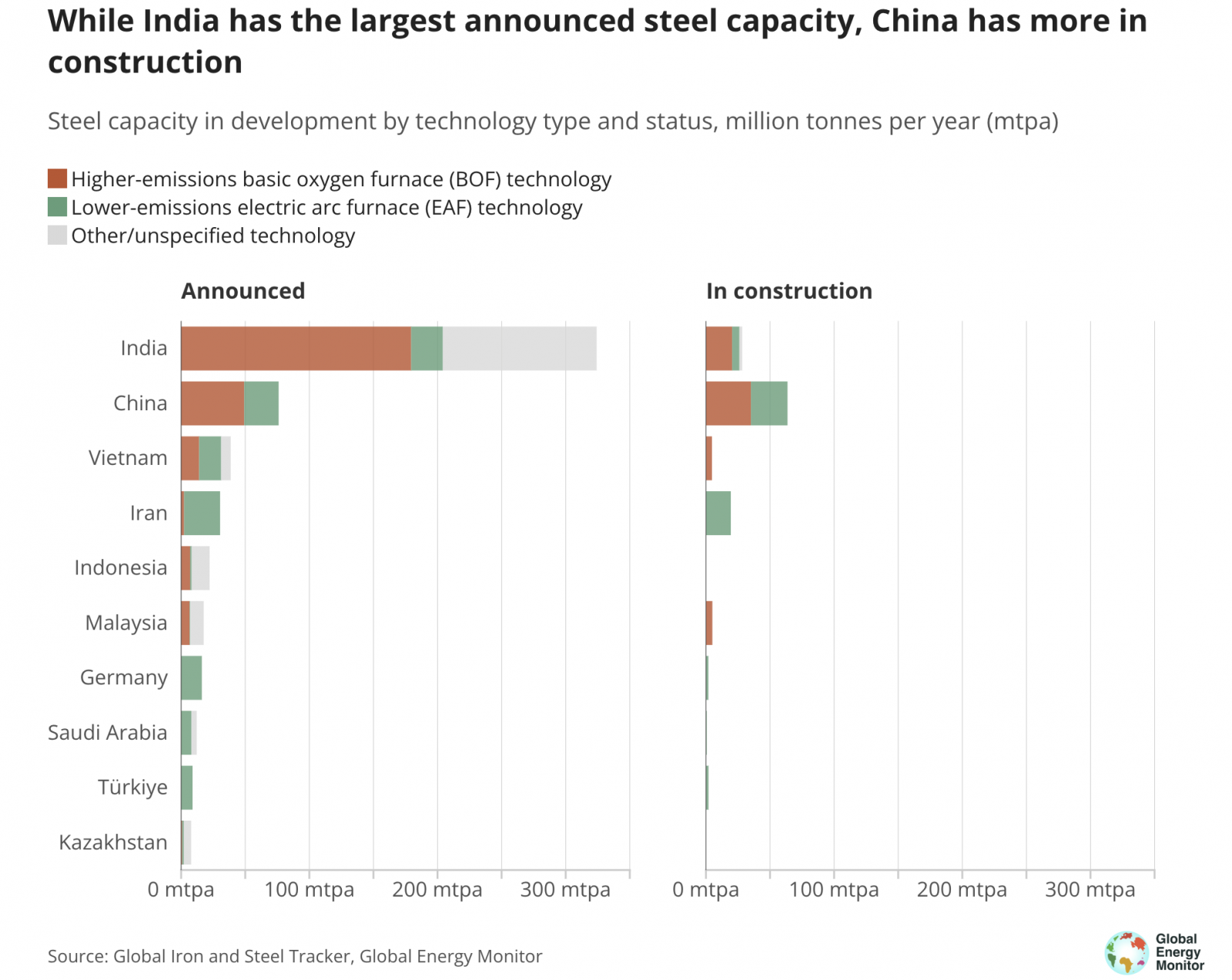

According to the GEM report, India leads in newly built steel production capacity, followed by China, Vietnam, Iran, and Indonesia. (Source: GEM)

India surpasses China in new steel capacity

India now leads the world in new steel plant construction, accounting for 40% of global planned capacity—well ahead of China’s 16%. Even more concerning is that India is responsible for 57% of the world’s new coal-based steel capacity. The report also reveals that India's carbon emissions per tonne of steel are 20 to 25% higher than China's, adding pressure on the country to address its climate impact.

Astrid Grigsby-Schulte, project manager of GEM’s Global Steel Plant Tracker, emphasized in a statement that India is now central to global efforts to decarbonize the steel sector. “If India does not increase its plans for green steel production, the entire sector will miss an important milestone.” she warned.

Source: GEM

.jpg)