Indonesian President Prabowo Subianto’s newly established sovereign wealth fund, Danantara, has identified renewable energy as one of its key investment areas. (Photo: Presidential Secretariat of Indonesia)

Indonesia is emerging as a promising destination for energy transition investments. Two of the country’s leading sovereign wealth funds have recently reaffirmed their commitment to scaling up investments in clean energy.

At the same time, the European Chamber of Commerce in Indonesia (EuroCham Indonesia) is advocating for the development of low-carbon fuels such as bioenergy, encouraging local companies to tap into global decarbonization trends to drive export-led industrial growth.

INA, Danantara target nickel processing, clean power, and grid upgrades

At the Energy Transition Forum co-hosted by the Financial Times and Nikkei on June 25, Indonesian Investment Authority (INA) and the newly established sovereign fund Danantara outlined their upcoming investment priorities, naming electric vehicle battery supply chains, solar energy, and grid modernization among key targets.

INA CEO Ridha Wirakusumah noted that renewable energy currently accounts for about 12% of INA’s US$4 billion portfolio and is expected to rise to 15–20% this year. The fund is not only supporting the early retirement of coal plants but also focusing on geothermal, solar, and waste-to-energy projects.

Ridha highlighted a solar power project under discussion that could break the record for the largest installed capacity in the country. In the EV space, INA is prioritizing nickel processing, an essential link in battery manufacturing, leveraging Indonesia’s abundant mineral resources to build a competitive position in the global EV supply chain.

In May, INA, Danantara, and French mining giant Eramet signed an MoU focused on building a domestic nickel ecosystem for EV battery materials. The agreement was witnessed by French President Emmanuel Macron and Indonesian President Prabowo Subianto.

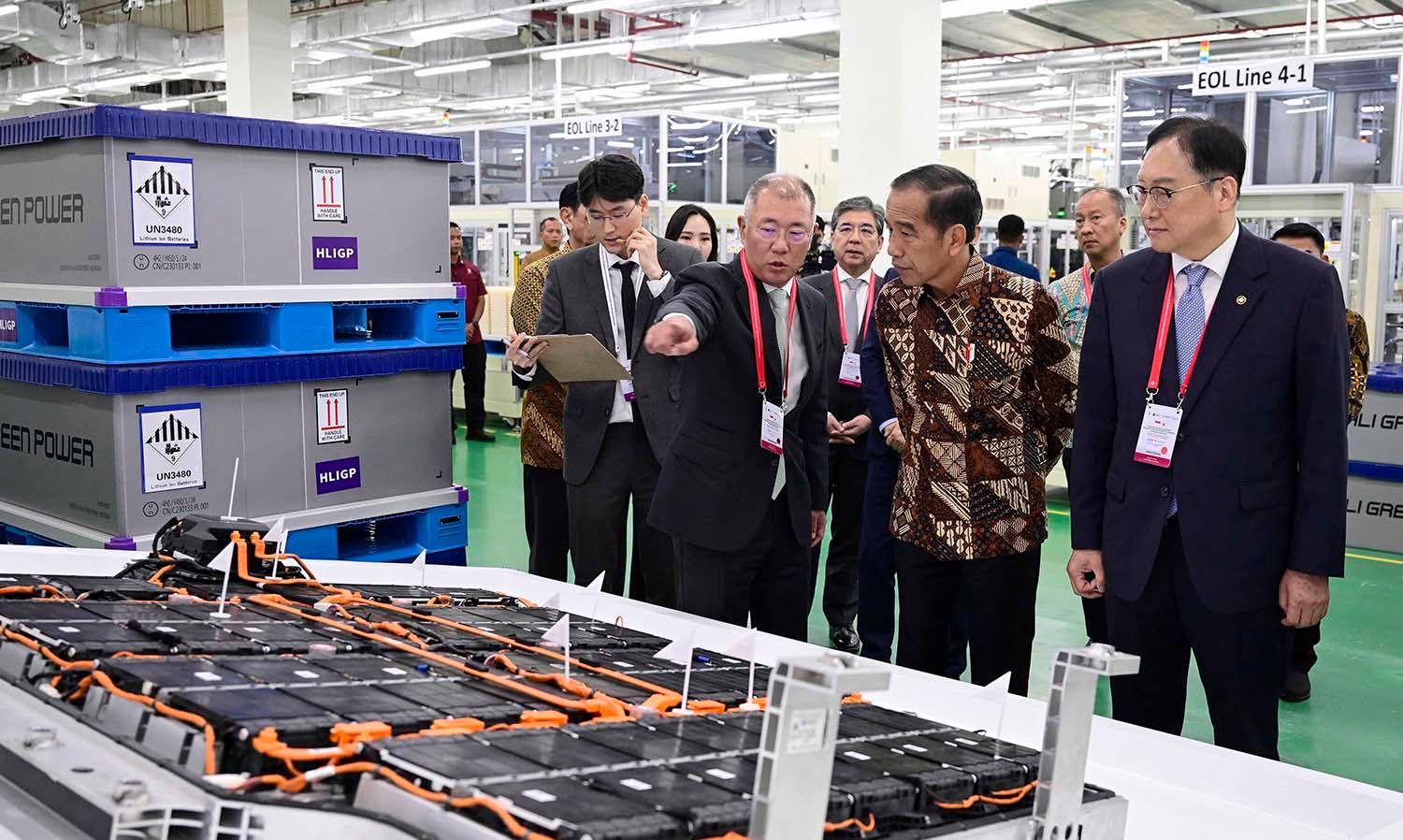

Indonesia has singled out the EV battery supply chain as one of its top priorities for future investment expansion. Pictured is Former Indonesian Pictured is former president Joko Widodo at the inauguration of an EV battery plant in 2024. (Photo: MOTIE)

Foreign stakeholders urge acceleration of low-carbon fuel exports

Danantara Chief Investment Officer Pandu Sjahrir, also speaking at the forum, emphasized the fund’s dual focus on nickel processing and upgrading the national power grid. Indonesia’s outdated electricity infrastructure, originally built to serve fossil fuel plants, is now seen as a major bottleneck to renewable integration.

Danantara, launched in February under the Prabowo administration, is authorized to manage the assets of key state-owned enterprises such as the national oil company Pertamina. The fund oversees assets worth over US$900 billion and is pursuing nine strategic investment areas, including mining for battery minerals, biofuel agriculture, and renewable power.

Foreign investors see Indonesia’s vast natural resources and strategic location as offering immense export potential. Thomas Wagner, head of EuroCham Indonesia’s energy working group, recently stated at a geopolitical forum that Indonesia should move swiftly to develop low-carbon fuels, including bio-based sustainable aviation fuel and bio-methanol, which could generate up to US$8 billion annually in exports.

Wagner urged Indonesian companies to take a proactive stance in capturing surging global demand and benefiting from favorable policies. Waiting for ideal market prices or political clarity, he warned, could result in losing ground to competitors in Malaysia, Japan, and South Korea.

Source: Nikkei Asia, Jakarta Globe, Indonesia Business Post

.jpg)