Dialogue Earth speaks to CEO of Climate Bonds Initiative, Sean Kidney, about the future of China’s green and sustainable finance

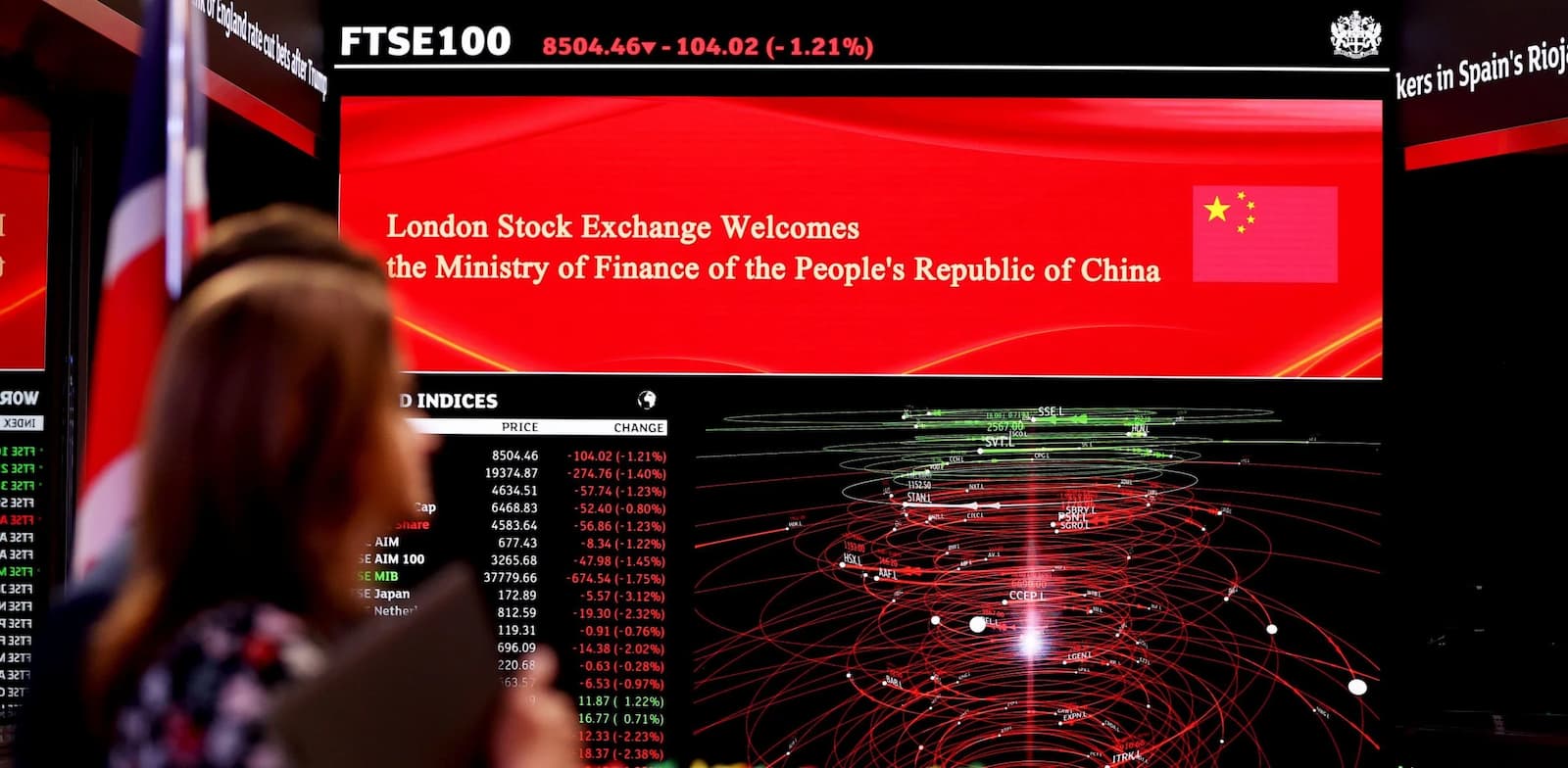

China’s green finance sector is internationalising. In April 2025, it issued its first sovereign green bonds, in London (Image: Li Ying / Xinhua / Alamy)

Since offering its first bond focussed on environmental outcomes ten years ago, China has become one of the world’s top issuers of these green bonds, as well as bonds linked to positive social change.

By the end of 2024, the country had issued USD 555.5 billion of green, social and sustainability bonds, as well as sustainability-linked bonds. This is according to the latest annual report by Climate Bonds Initiative (CBI), a non-profit working to drive capital into climate action.

The report shows that while green bonds remain dominant, social and sustainability-linked bonds grew sharply in 2024, signalling a more diversified market.

The green and sustainability bond market is just one part of China’s broader sustainable-finance landscape, which is evolving rapidly amid the intensifying global impacts of climate change and geopolitical turbulence.

Perhaps most notably, China’s green finance sector is also internationalising, with its first sovereign green bond issued in London earlier this year.

Dialogue Earth spoke with Sean Kidney, CEO and co-founder of CBI, about the state of green finance in China today, and where it is heading.

The interview has been edited for length and clarity.

Dialogue Earth: Green bond issuance in China dipped in 2022 and then rebounded strongly. What is driving the current growth?

Sean Kidney: The 2022 dip reflected a wider global contraction. But as a share of overall bond issuance, green bonds held up well, and with markets recovering, they now form a big part of the rebound.

.jpg)

Sean Kidney at an event in Mumbai in September 2025 (Image: Climate Bond Initiative)

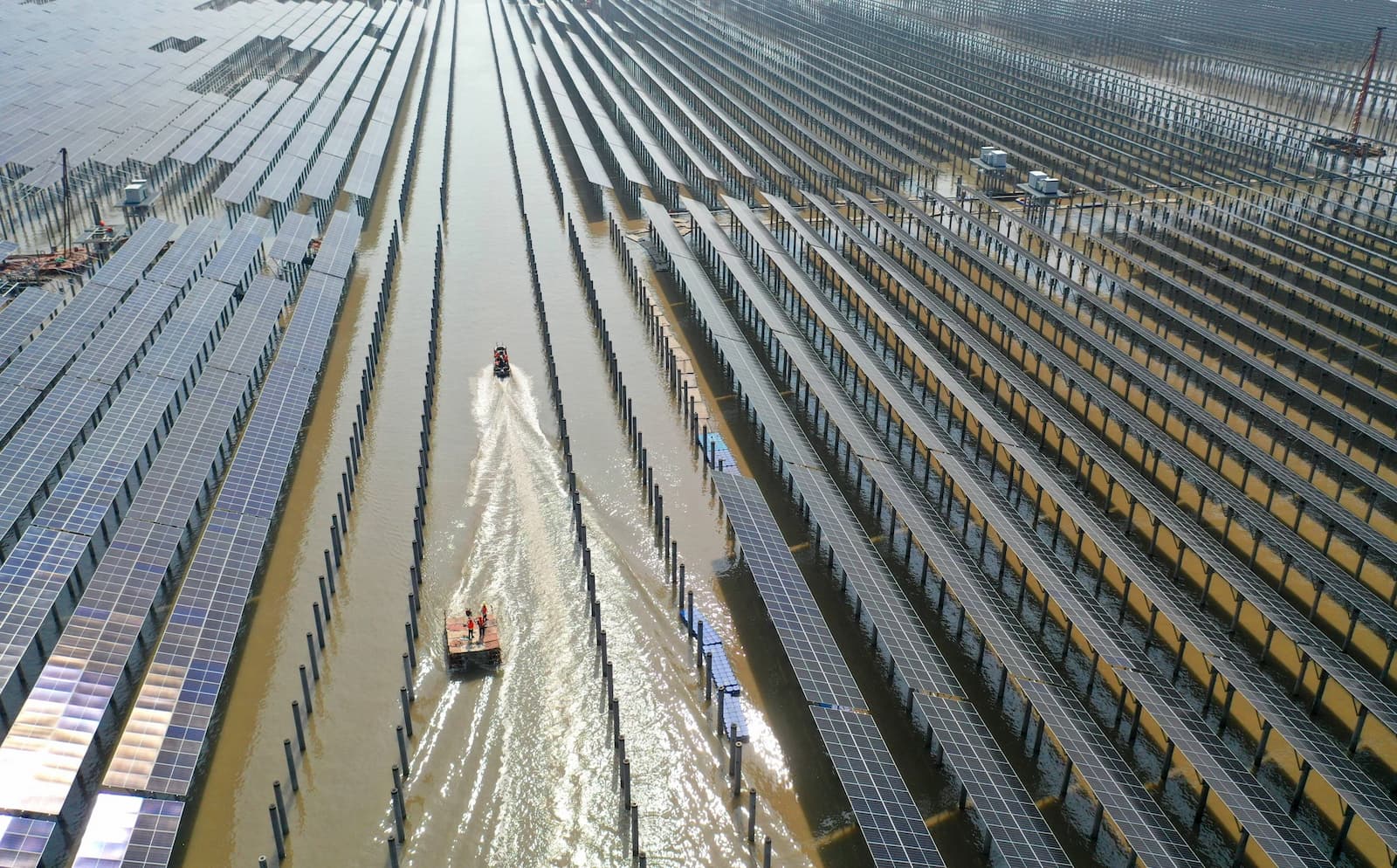

Growth rests on three factors. First, new green projects generate financing needs. A solar farm, for example, usually begins with short-term loans. Once it’s up and running these loans can be refinanced through green bonds which provide longer-term, lower-cost capital.

Second, the definition of green projects has expanded. Efforts to transition heavy industries towards cleaner processes are now eligible for green financing, as are activities to make China more resilient to climate change impacts.

Third, incentives matter. Early growth came from People’s Bank of China measures, such as cheaper capital at the wholesale lending window, which encouraged banks to hold green bonds. Later, regulations from the China Securities Regulatory Commission (CSRC) and the National Development and Reform Commission (NDRC) – China’s top economic planning body – gave further support.

Now the market resembles that of the west, with more price discovery – meaning prices are set more by investor demand than by policy incentives, a sign of greater market maturity.

Further incentives are likely, some at low cost. One tool would be to require a certain percentage of bank bond issuance to be green as a prudential measure. That is, a regulatory safeguard to reduce banks’ exposure to high-carbon assets that may lose value as the climate transition accelerates.

What progress has been made in expanding the green catalogue so it includes “transition” projects to make China’s heavy industries cleaner, and “resilience” projects to adapt the country to climate change?

In July, the People’s Bank of China updated its Green Finance Catalogue, an important step. The main change is the inclusion of a wider spectrum of climate-mitigation projects, meaning those that reduce or prevent greenhouse gas emissions, and support for producers and buyers of green goods. I expect this will be complemented by a dedicated catalogue for eligible transition projects, further expanding the scope while ensuring both lists can work in harmony.

Taxonomies such as the catalogue outline what needs to be done. They are essentially shopping lists for the future. Finance reflects change and can accelerate it by creating demand for eligible projects. The real driver, however, is credible industry-level transition plans. Eleven Chinese provinces now have such plans, including Hebei, which produces 12% of the world’s steel and has a serious steel transition plan.

There is also a strong case for a resilience taxonomy, given increasing climate impacts in China. In Hong Kong, we are already working with the Monetary Authority on applying our Climate Bonds Resilience Taxonomy (CBRT). Similar approaches could be taken on the mainland. Resilience finance will be a necessary next frontier.

In April, China issued its first sovereign green bonds in London. What does this imply?

Sovereign green bonds are now a major global growth area, with around 40 programmes in total, and they are usually oversubscribed. China issued USD 800 million in London – small compared to many of its green bond issuances – but it was reportedly seven times oversubscribed and at a good price.

To reduce risk, large institutional investors, such as pension funds, sovereign wealth funds and big insurance companies, need diversified portfolios that reflect the structure of the global economy. Because of their size, they rely on the economy as a whole improving. While portfolios tilt toward domestic markets, investors still hold assets globally. With China now a major part of the world economy, access to investments backed by it is critical.

Direct investment in China is complicated by capital controls, making overseas sovereign bonds valuable. Yet very little Chinese sovereign debt has been available internationally, and none in the green segment until recently, so strong demand is no surprise. Structural reasons for demand will persist. Some US investors may withdraw but that would be to avoid being targeted politically rather than out of concern for return on investment.

I expect China will scale up quickly, potentially to USD 100 billion in sovereign green bonds issued overseas by 2030. Scaling up sovereign green bond issuance would push government departments to align with international standards on project eligibility, while also creating benchmark yields that private issuers can reference when pricing their own bonds.

Chinese banks are advancing domestic green finance but are criticised for financing high-emission projects overseas. Why this gap?

The gap has been evident since the 2012 Green Credit Guidelines, which were strong domestically but not applied abroad. Regulators explained that banks followed the requests of overseas clients, meaning host-country governments or companies seeking finance for local projects. Officially, China’s policy has been to respond to host-country needs rather than impose its own agenda. More coordination across Chinese ministries and with host countries can further enable Chinese capital to drive green transition in these countries.

Projects such as this solar farm in Taizhou city, Zhejiang province may be refinanced through green bonds (Image: Imago / Alamy)

The banking regulator did push for more green financing abroad, prompting some banks to withdraw from fossil-fuel lending in certain regions. But discordance persists between different parts of the same banks. This is not unusual globally. For instance, JP Morgan has large fossil-fuel and green-lending operations at the same time.

Ultimately, clients drive outcomes. The greener they become, the more green business banks will generate. Banks should support client transition. Some, like HSBC and Standard Chartered, already do so. For Chinese banks it is less clear. As mentioned, a key indicator will be whether clients have credible transition plans. In China such plans are still emerging.

A cautionary case is Pakistan, where loans for coal plants are now going unpaid. Despite some coal projects, rolling blackouts continue. Households and businesses are increasingly buying solar panels, often Chinese-made and financed with Chinese loans, to secure their own supply but undermining coal-plant revenues. This shows Chinese interests abroad competing with each other.

Problems such as this are likely to ease as China’s 2021 moratorium on supporting new coal projects abroad takes effect.

In 2024, China, the EU and Singapore launched the Multi-Jurisdiction Common Ground Taxonomy. Where does it stand, and what challenges remain?

The Multi-Jurisdiction CGT, based on the 2020 EU-China CGT, was designed to help banks operate consistently across jurisdictions by offering a common framework for green finance criteria. CBI were involved in the European side. It will continue to evolve. Singapore has already joined, and we are talking with Brazil now.

The main obstacle is that the EU has not recognised the CGT for internal use. In China, if you meet CGT you meet the Green Finance Catalogue. In Europe, the taxonomy references many EU-specific laws, making it nearly impossible for outsiders to comply fully.

Another complication is that China’s taxonomy does not yet include provisions to “do no significant harm” (DNSH), meaning damage to other environmental objectives, like biodiversity or water protection. Such provisions are extensive in the EU version. This mismatch makes equivalence politically and technically difficult. As a short-term measure, an interoperability tool is being developed, which we plan to launch at the COP30 later this year. This acts as a workaround until formal recognition of the CGT is resolved.

China is expected to soon submit its updated climate action plan. What do you expect from this new ‘nationally determined contribution’ (NDC) under the UN climate process?

I haven’t tracked detailed language of the latest NDCs, but I anticipate it will be stronger and more ambitious.

Several signs point that way. President Xi’s recent speech signalled broader ambition by aiming to cover all greenhouse gas emissions across every economic sector. Including non-CO2 gases like methane marks a significant advancement for both China’s climate action and global efforts. Li Gao, formerly China’s lead climate negotiator, is now vice-minister for climate – a move to a senior position that sends a strong signal.

The withdrawal of US leadership from the climate-action process also allows China to step up. More importantly, China is making genuine progress. While the replacement of coal with gas is worrying, renewables and electrification have been outstanding. China has built the world’s largest high-speed rail network, electric vehicles are expanding rapidly, and cities such as Shenzhen, Nanjing and Shanghai are highly energy efficient.

This progress provides the basis for more ambition. My current feeling is that China may already have peaked emissions this year, well before the targeted 2030, and will continue to reduce them. That would support a stronger NDC.

Looking ahead, one priority should be making the NDCs a manual for global and domestic investors seeking economy-wide transition-investment opportunities. We are developing means to support these efforts, including guidelines on creating and assessing national transition plans.

Author: Jiang Mengnan

This article was originally published on Dialogue Earth under the Creative Commons BY NC ND licence. Read the original article.

.jpg)