(Photo: iStock)

The World Bank released its "State and Trends of Carbon Pricing 2024" report on May 21, marking the first time Taiwan's carbon pricing policy has been included among the 75 operational carbon pricing instruments globally. Experts view this development positively and urge Taiwan to accelerate the implementation of carbon fees as planned.

The report highlights that last year, global carbon fee collections reached a record $104 billion. However, it also notes that current carbon prices remain too low to drive the necessary changes to meet the Paris Agreement targets.

Expert calls for swift action on carbon fees in Taiwan

The report indicates that while the adoption of carbon pricing has been constrained over the past year, there are signs that middle-income countries will join the carbon pricing ranks in the future.

Currently, 75 carbon taxes and emission trading systems (ETS) are in operation globally. Recent implementations include new carbon pricing policies in Taiwan, China, and Guanajuato, Mexico. In Japan, a new voluntary emission trading system (GX ETS) was established in October 2023, with plans to transition to a mandatory ETS by 2026.

The report marks Taiwan's debut in implementing carbon taxes and fees. Researcher Sherry Hu (胡湘渝) from RECCESSARY expressed optimism about this milestone. She emphasized the need for Taiwan to expedite the establishment of carbon fees and adhere to the scheduled implementation.

"As an export-oriented country, Taiwan will face challenges from carbon tariffs imposed by other countries. Delaying the introduction of a carbon tax and fee system would essentially mean paying fees to the EU. Reasonable implementation of carbon pricing is crucial for effectively aligning with international standards," she said.

Hu also stressed the importance of accompanying price adjustments with relevant supporting measures, such as free allowances, offset systems, or preferential rates, to prevent excessively high carbon reduction costs for businesses and to avoid the risk of green inflation.

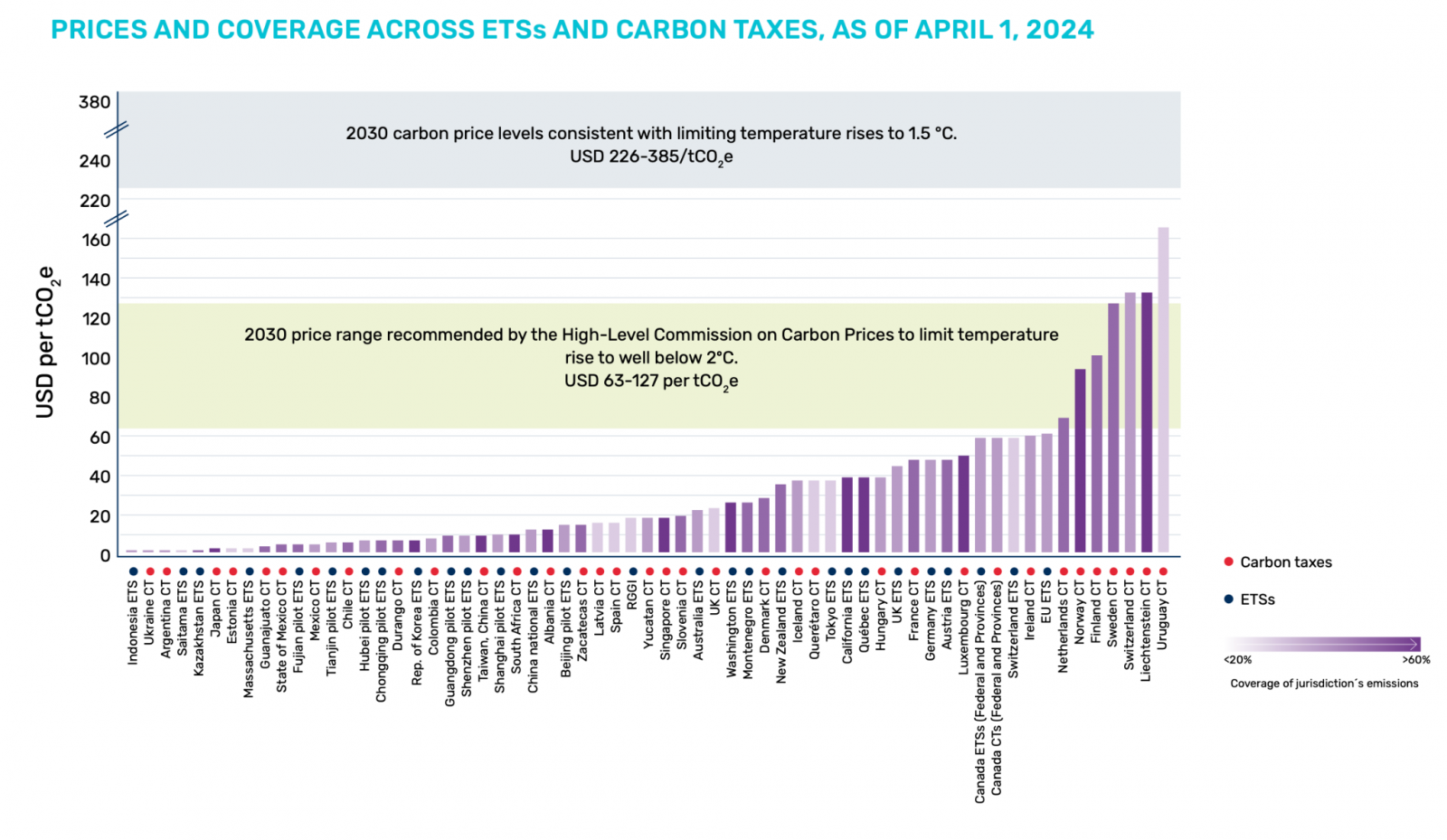

Carbon prices in Asia generally range between $10 to $20 per ton. (Chart: World Bank's State and Trends of Carbon Pricing 2024)

Middle-income countries have made progress

The World Bank is optimistic that middle-income countries will gradually introduce carbon pricing instruments. The report indicates that Indonesia launched an ETS for coal-fired power plants at the beginning of 2023. Turkey plans to start a two-year trial phase for an ETS in the energy and industrial sectors this October, pending legislative approval, with market operators expected to begin by early 2025. India established the legal foundation for a carbon market in 2022 and has built the institutional framework over the past year, outlining the roles and responsibilities of various regulatory bodies.

Current carbon pricing instruments cover around 24% of global emissions. The report notes that while new carbon taxes and ETS under consideration will increase global coverage, it is unlikely to surpass 30% in the short term. This underscores the ambition and scale of action needed to meet the global carbon pricing challenges announced at COP26, which aims to achieve 60% global coverage by 2030. Expanding the coverage of existing or planned instruments will also contribute to reaching this goal.

The report also emphasizes that the European Union's Carbon Border Adjustment Mechanism (CBAM) marks a significant shift in the global carbon pricing landscape, providing strong momentum for carbon pricing initiatives. The EU's CBAM transition period began in October last year, requiring EU importers to report the carbon emissions embedded in imported products such as steel, aluminum, hydrogen, fertilizers, cement, and electricity.

Article 30 of the CBAM regulation also suggests the potential expansion of CBAM to other industrial products. The EU will implement a carbon tax in 2026, which has already prompted governments worldwide to consider carbon pricing to mitigate potential CBAM costs.

The EU's CBAM entered into force in October 2023. (Photo: iStock)

More room for carbon price increase in Asia

A significant highlight from the report is that global carbon pricing revenues surpassed $100 billion for the first time last year, driven primarily by high carbon prices in the EU.

In 2023, total revenues from global carbon taxes and ETS reached $104 billion, marking a real increase of about 4% from $95 billion in 2022. The largest single contributor was the EU ETS, which saw its inflation-adjusted revenues grow by approximately 4% year-over-year, largely due to rising allowance prices. The report indicates that ETSs continue to generate most direct carbon pricing revenues, and reducing free allowances could potentially increase these revenues further.

Examining the global carbon price landscape, researcher Hu noted significant price disparities. According to the report, the expected carbon price in 2030 should reach above $226 per ton. However, current carbon price levels have not yet met this target. To achieve the goal of limiting global warming to within 1.5 degrees Celsius, there is still considerable room for global carbon prices to rise. It is expected that countries will gradually increase their carbon prices to meet the target.

Focusing on Asia, carbon prices generally range between $10 to $20 per ton. For instance, while China's carbon price recently surpassed 100 yuan per ton, it equates to only about $10 per ton, indicating significant potential for further increases.

According to Voice of America, the report said less than 1% of global emissions are covered by a direct carbon price at or above the range recommended by the High-level Commission on Carbon Prices to meet the Paris agreement target of limiting temperature rise to well below 2 degrees Celsius. In 2017, a report by the Commission indicated carbon prices need to be in the $50-100 per ton range by 2030 to keep a rise in temperatures below 2C. Adjusted for inflation those prices would now need to be in a $63-127 metric ton range, the report said.

Importance of voluntary carbon markets increases

The report highlights the growing importance of voluntary carbon markets. Hu said that as of this year, the number of countries implementing carbon credit mechanisms has increased to 35. The significance of voluntary carbon markets is particularly notable in Asia. Thailand's T-VER has been upgraded for the first time in nearly a decade, with enhanced carbon credit standards promoting alignment with international norms and attracting more international investors.

In China, the CCER scheme has been relaunched this year, offering companies a broader range of emission reduction pathways. However, due to the limited number of current methodologies and the discontinuation of old reduction quotas starting in 2025, companies need to remain vigilant about the associated risks.

She recommends that businesses proactively plan their carbon allowance allocations to avoid significant cost increases due to potential future carbon price surges.

Source: World Bank, Reuters