Operating mechanism

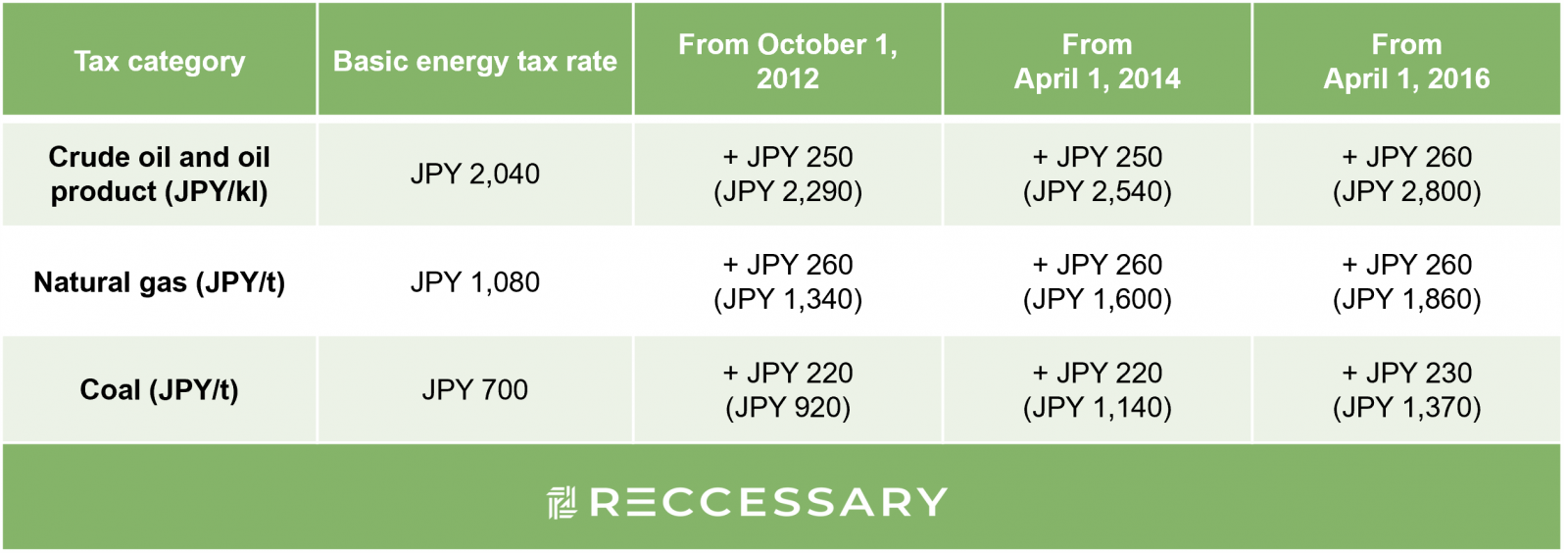

Japan began to implement a carbon tax in 2012. The carbon tax is an additional tax over and above the existing Oil and Coal Tax, which covers oil, natural gas and coal (electricity excluded). The tax rates for the three types of energy are different. Natural gas is taxed the highest rate, followed by fossil fuel, and coal. To mitigate the impact on the industry, Japan adopted a three-stage tax increase.

Table I / Source:Ministry of Environment Japan

In July 2021, the Ministry of the Environment of Japan divided the carbon taxation into four segments: upstream, midstream, downstream, and end users:

- Upstream: The carbon tax is levied on the import of fossil fuels. The advantage is that it is easy to stimulate supply-side investment, and it is convenient to use the existing taxation structure to collect the carbon tax and reduce related administrative costs. The disadvantage is that the carbon tax has limited impact on changing consumer behavior as the carbon tax is passed on to consumers.

- Midstream: Manufacturing plants and power plants are taxed on fossil fuel products (e.g., gasoline, naphtha, liquefied natural gas, etc.) and electricity.

- Downstream: The carbon tax is levied on wholesale retailers for fossil fuel products (e.g., gasoline, naphtha, liquefied natural gas, etc.) and on electricity consumers (factories, office buildings, households, etc.). It is helpful to change consumer behavior due to the clear information of carbon tax price, but the incentives for energy suppliers to reduce emissions are relatively low, and technical issues such as how to control the carbon emission factor per unit of electricity consumption remain to be solved.

- End users: Clarifying the carbon dioxide production during consumption will help to change consumer behavior, but technical issues such as how to evaluate the carbon dioxide emissions per unit of goods and services produced or used remain to be resolved.

Industries eligible for tax refunds and exemptions

To ease burden on certain industries and sectors, Japan has adopted tax refund and tax exemption measures for the following goods:

- Volatile oils for the petrochemical industry

- Special imported coal

- Coal for power generation (Okinawa)

- Fuel oil for agriculture, forestry and fishery

- Domestic asphalt

Use of carbon tax revenue

Japan uses the revenue as a special revenue funds for energy-related measures, such as carbon emissions control, renewable energy promotion, energy saving, and efficiency improvement of fossil fuel use.

- Assist small and medium-sized enterprises in setting up energy-saving equipment.

- Establish a renewable energy foundation to promote renewable energy.

- Promote domestic high-tech energy-saving technology.

Sources

- "Introduction to Japan's Carbon Tax System" Green Energy and Environment Research Laboratories, Industrial Technology Research Institute

- Ministry of Environment of Japan