As the wave of net-zero emission sweeps over the globe, an increasing number of multinational and large-sized local companies are pledging to achieve carbon neutral. However, businesses may experience difficulties, such as lack of renewable energy generation or process equipment that is too complicated and expensive to be fully replaced in the short term. Therefore, carbon credits (carbon offsets) have become a common approach to offsetting one's own carbon emissions under the time pressure to meet the target. Given their wide variety worldwide, carbon credits vary greatly in terms of methodology, pricing, as well as the types required for different markets and application scenarios. Therefore, companies need to assess carefully whether the carbon credits in which they intend to invest are eligible for future offsets.

Types of carbon credit

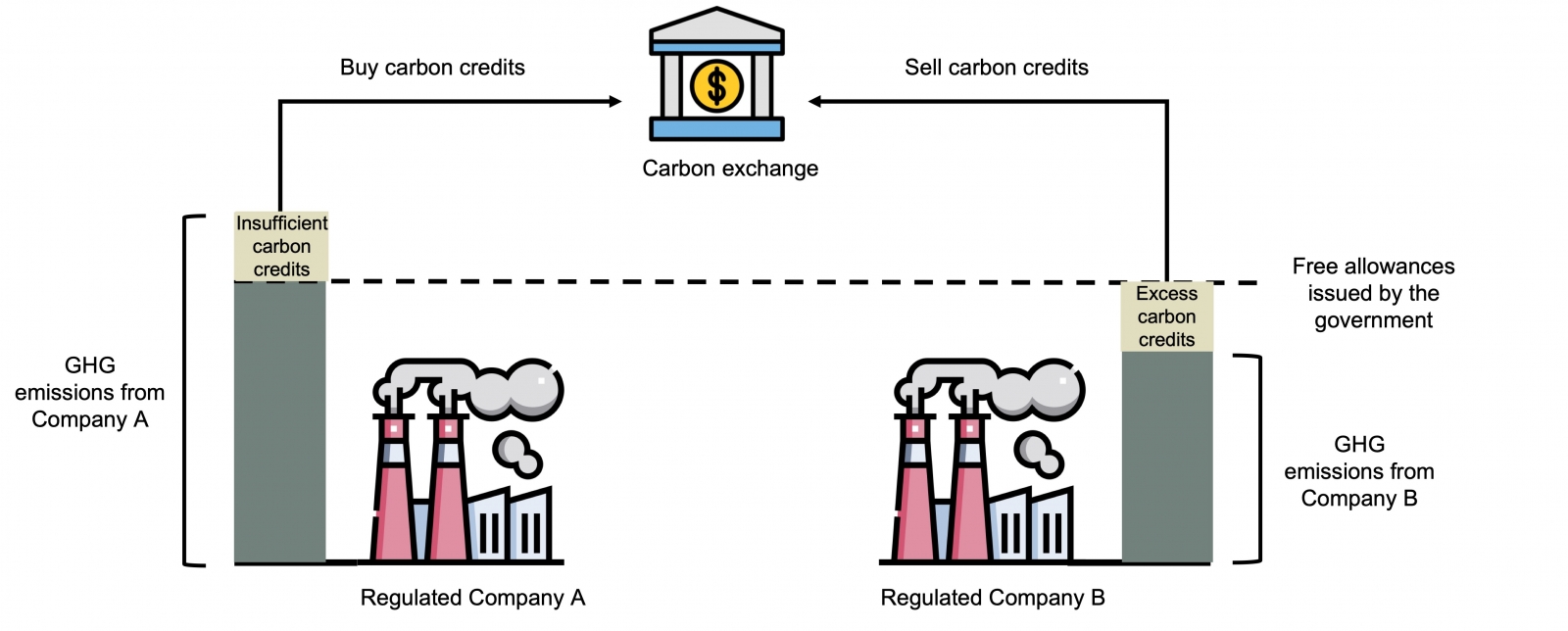

There are two types of carbon credits based on their sources: mandatory and voluntary. Mandatory carbon credits, also known as allowances, are issued by governments under a emissions cap-and-trade regulatory program, such as the EU Emissions Trading Scheme (EU-ETS). Under the system, a government sets a cap on greenhouse gas emissions and issues allowances to regulated companies, which can sell and buy credits to meet their targets. Most of the companies participating in the mandatory market belong to heavy industry and are therefore often the priority targets for regulation, such as the cement industry and steel industry.

Figure 1. Mandatory market operation

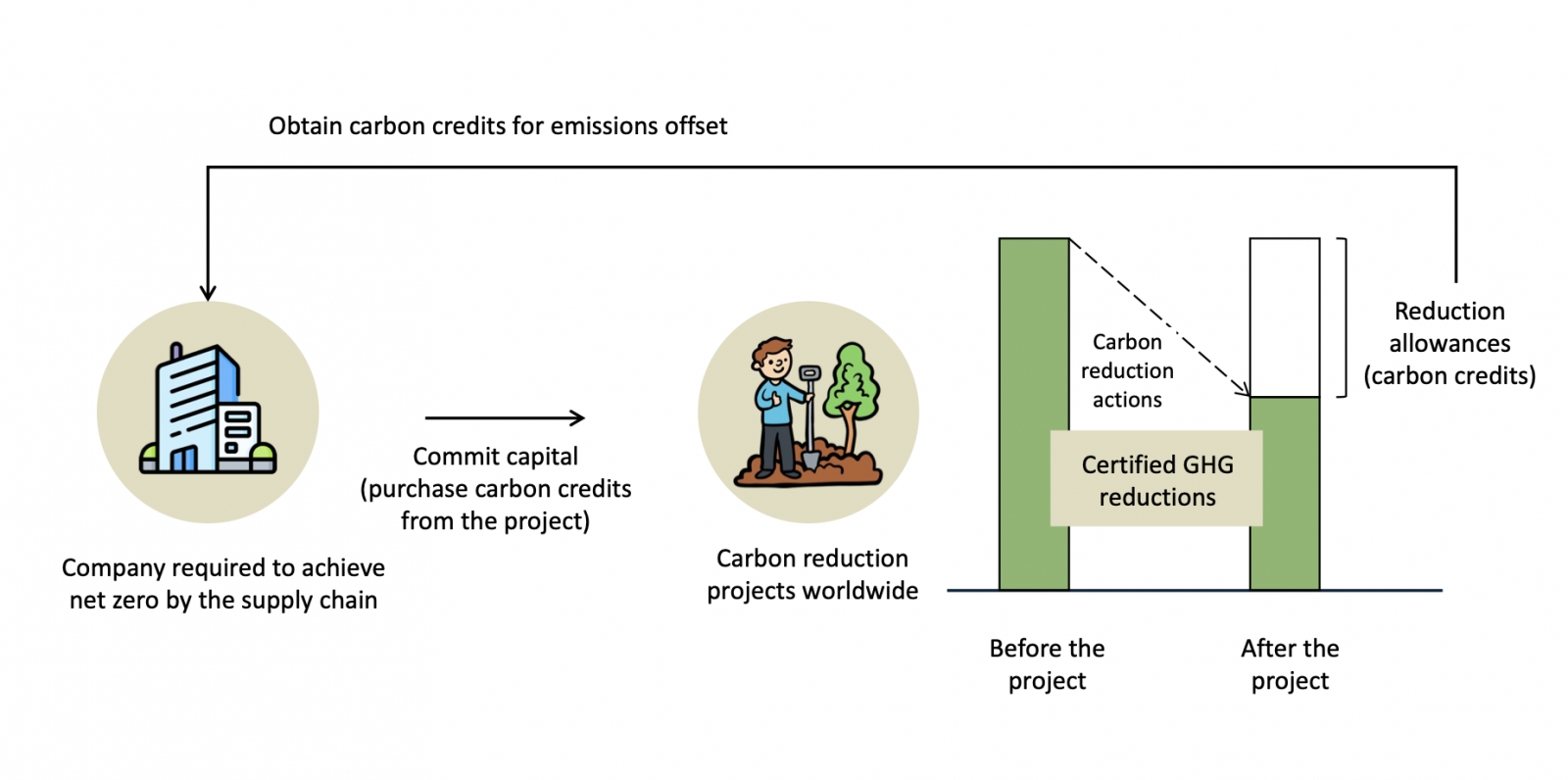

Voluntary carbon credits, on the other hand, are traded to certify the effectiveness of emissions reductions. Many companies are currently facing a situation where the national government has yet to mandate carbon neutral, but they are facing (or have faced) pressure to go green in their supply chains amid the net zero trend, forcing them to enter the race against capital, time, and sustainability. This article will focus on the development of voluntary market and carbon credit acquisition to provide companies with feasible solutions.

Figure 2. Voluntary market operation

Current status of voluntary carbon credits

The Clean Development Mechanism (CDM) is the world’s first international carbon finance scheme established by the UN, the issuer of the certificate to prove emission reduction represented by the carbon credits. Unlike independent organizations, the UN's carbon credits are retired after purchase and cannot be re-transferred. As the legal source of the CDM is the Kyoto Protocol, which expired in 2020, the CDM is no longer accepting new cases. Those who already hold carbon credits will have to wait until the next Climate Change Conference to know how to operate, and the future development of the CDM also awaits for resolution.

The table below shows four carbon credits issued by independent international organizations, each with their own methodologies, namely the Verified Carbon Standard (VCS) by Verra, Climate Action Reserve (CAR), Gold Standard (GS) and American Carbon Registry (ACR). All of these are internationally recognized standards that have been adopted by many major brands.

Table 1. Comparison of international carbon credit standards

| | Verified Carbon Standard (VCS) | Climate Action Reserve (CAR) | Gold Standard (GS) | American Carbon Registry (ACR) |

| Carbon credit | VCU | CRT | | ERT |

| Participation restrictions | N/A | |||

| Average price | US$12/ tonne | US$10/tonne | US$22/tonne | US$10/tonne |

| Whether to register an account | Yes | Yes | Yes. Filling in the ownership of the carbon credit represents completed registration. | Yes |

| Whether carbon credits can be re-transferred or re-traded | Ownership can be transferred on the platform. The price under private transfer is not transparent. | |||

| Whether carbon credits can be acquired by other approaches or converted into each other | Yes. VCS recognizes carbon credits offered by the Clean Development Mechanism (CDM), Joint Implementation (JI) and Climate Action Reserve (CAR), all of which can be converted into VCUs. | Yes. The credits can be converted to VCUs. | No. The carbon credits can only be converted into those certified by the GS; carbon credits of the GS cannot be obtained through other standards. | No |

| Scope of application | Applicable to corporate carbon offsets, such as Apple, and also the International Civil Aviation Organization (ICAO). | Applicable to corporate carbon offsets, such as Disney, Chevrolet, Microsoft, San Francisco International Airport, as well as the ICAO. | Applicable to corporate carbon offsets, also the CDM and the ICAO. | Applicable to corporate carbon offsets, such as Nike, as well as the ICAO. |

| | ||||

* Developers worldwide can register to obtain carbon credits from these standards, and the credits will be published on their platforms after verification.

Since the methodologies and carbon credits of these four standards are not interoperable, it is recommended for the supply chain to apply the same standards as the downstream brand owners to ensure consistency. Purchasing carbon credits directly from these standard platforms can be costly and complicated, which has opened up opportunities for carbon exchanges and independent carbon credit providers to enter the voluntary market. In the next article, we will look at the advantages of carbon exchanges and independent providers that make their place in the market.