According to the Carbon Disclosure Project (CDP), more than 1,200 companies worldwide have adopted internal carbon pricing to date, with an annual growth rate of over 10%. The key driver behind this rapid increase is the recognition of internal carbon pricing as an important assessment item by the Task Force on Climate-Related Financial Disclosures (TCFD). As a result, companies will be required to produce not only annual financial reports, but also the TCFD. Unlike sustainability reports, the TCFD emphasizes risk quantification and its linkage with financial performance. Given the potential adoption of TCFD by companies, the implementation of internal carbon pricing will be necessary.

Why should businesses adopt internal carbon pricing?

Internal carbon pricing has been recognized as an important assessment tool for three reasons. Firstly, it serves as a reference for investment decision-making, often through the introduction of “implicit pricing” or “shadow pricing.”For example, companies can calculate the average cost per unit of carbon reduction based on past carbon reduction projects to establish an implicit price. When the cost of a carbon reduction initiative falls below the implicit price, it indicates that the company is encouraged to invest, and conversely, the investment should be put on hold. Taking Astellas as an example, its Irish factory proposed an investment plan to build its own wind turbine in 2011, which was postponed as the estimated carbon reduction cost per unit of US$840 per tonne was higher than the implicit price of US$730 per tonne set by the company. It was not until recent years did the company start to invest in such renewable energy projects due to the decline in construction costs of wind and solar power that brought the carbon reduction cost down to less than US$730 per tonne.

Secondly, it accelerates low-carbon transition and innovation, commonly achieved through the adoption of an internal carbon fee to establish a climate fund. The internal carbon fee is a type of practice to embed carbon footprint in operations, which is calculated by multiplying the emissions of each unit by a pre-determined rate. The fee is then paid into the company's carbon reduction fund, which can be used for carbon reduction investments or incentives for carbon reduction. The internal carbon fee system also promotes consensus on carbon reduction within the company, channeling resources to low-carbon investments.

A well-known example is Microsoft, which has incorporated its global operations across more than 100 countries within its regulated scope of internal carbon pricing, with the fee covering Scope 1, 2 and 3 emissions[1]. The calculation is determined by the internal fund demand divided by emissions during a specific period. Since 2020, the company has adopted a fixed rate ranging from USD 5 to USD 15 per tonne based on specific projects, with the funds generated allocated for renewable energy procurement, emission offset investments, and environmental technology innovation.

The last benefit is to assist businesses in achieving their carbon reduction targets, commonly through the adoption of internal emissions trading or internal carbon fee to influence employee behavior and promote various energy-saving projects. Similar to the EU emissions trading system (ETS), internal emissions trading involves the establishment of a reduction target and allocation of emission allowances. The model allocates emission allowances to regulated departments, allowing them to design their own carbon reduction measures or purchase allowances from other departments, with the price level determined by supply and demand.

British oil company BP, for instance, allocates allowances based on a 1% reduction in annual emissions for each business unit and assigns serial numbers, years, and issuers to the allowances for trading and tracking purposes. Subsequently, its Alaska oil field business purchased allowances from the gas exploration and collection business in the Midwestern and Western U.S. since they did not meet their goals, with the prices ranging from USD 7 to USD 36 per tonne.

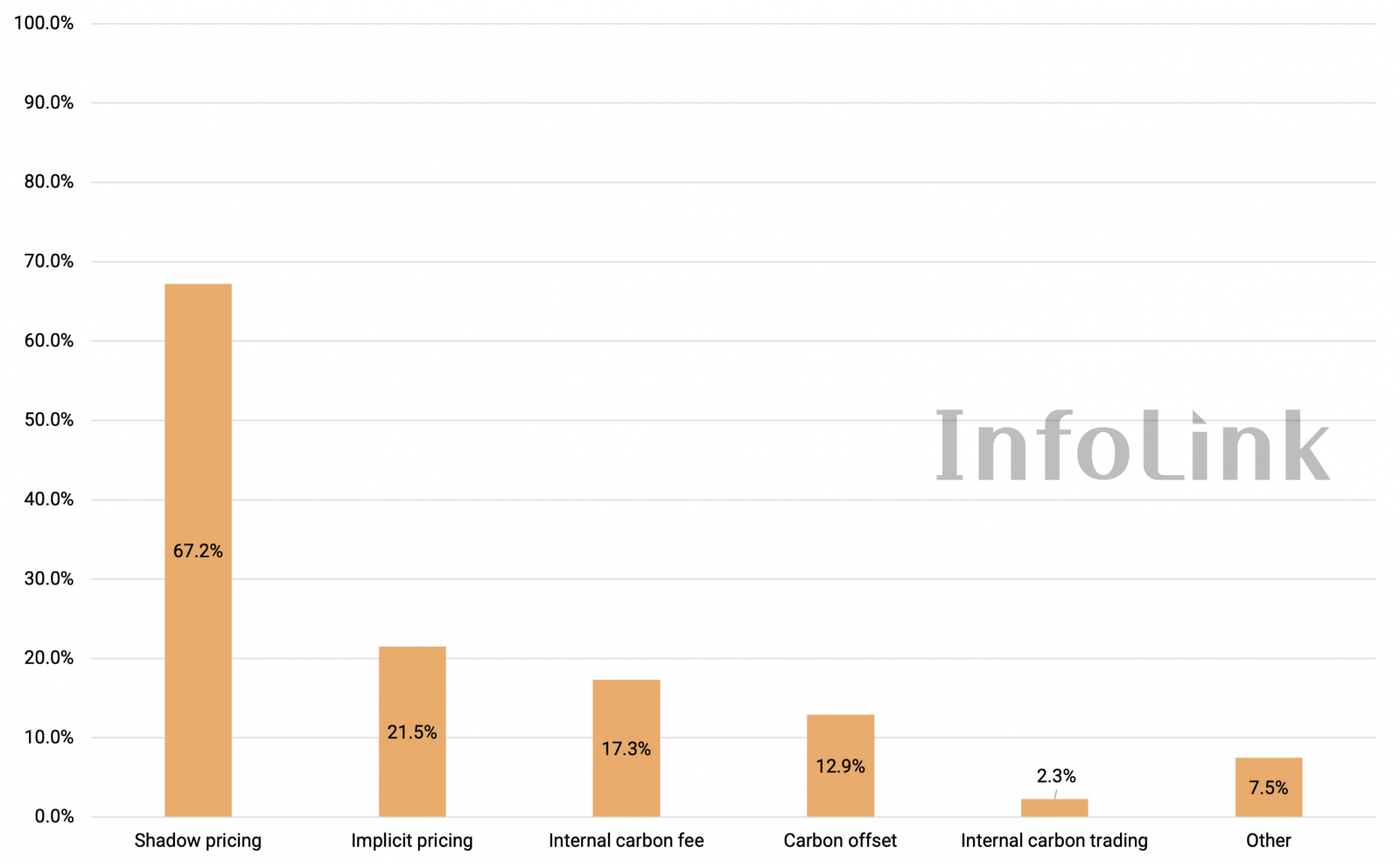

Considering the three main benefits mentioned above, businesses can choose the appropriate pricing method based on their needs and objectives. The current pricing methods adopted by businesses is illustrated in Figure 1 below.

Figure 1. Proportion of various internal carbon pricing methods used[2]

State of internal carbon pricing by corporates worldwide

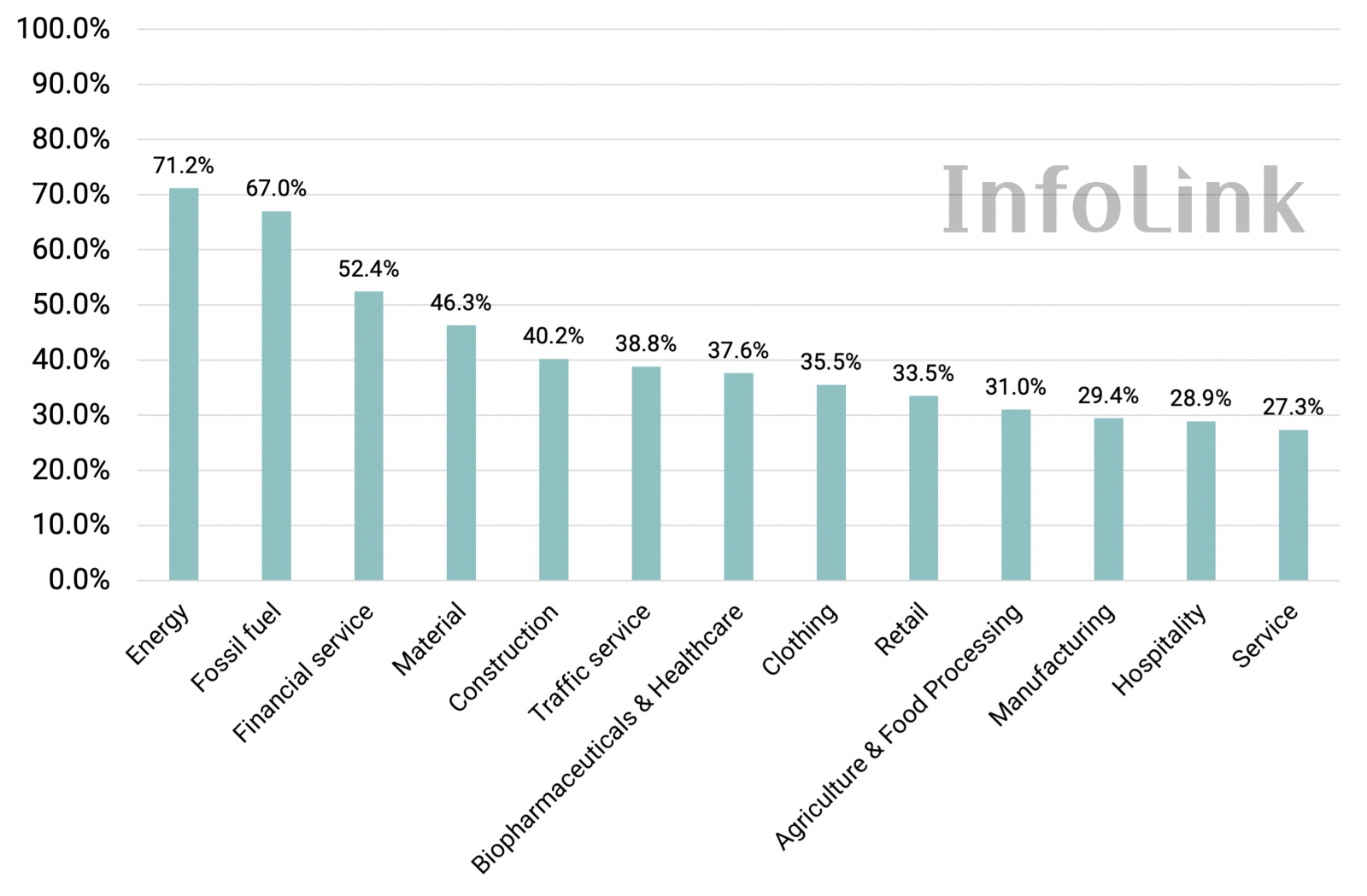

Although internal carbon pricing is gaining popularity, there are still significant differences in their adoption rates across different industries. Currently, the energy and fossil fuel industries are more visibly impacted by climate change and are the first targets for many carbon emissions regulations, leading to implementation by as many as 60% to 70% of companies, such as Shell and BP. Furthermore, due to the proactive adoption of TCFD and CDP by the financial sector to assess environmental risks in their investment portfolios, their adoption rate has rapidly increased by 6% annually.

Figure 2. Industries using internal carbon pricing

In terms of regions, Europe currently takes the lead in the number of companies implementing internal carbon pricing. However, Asia stands out as the top performer in terms of growth, experiencing a 10% increase in 2022 compared to 2021 (around 5% in Europe), with the majority of the increase coming from Chinese companies. Over the next two years, Asia is expected to see an additional 520 companies introducing internal carbon pricing, surpassing Europe's 360, the Americas' 250, and Africa's 20. This reflects Asian companies' heightened awareness of the net zero trend and their proactive deployment.

Who should adopt internal carbon pricing?

Internal carbon pricing is a top-down carbon management tool that aligns with internal assessments and carbon reduction practices within a company, aiming to transform existing operational behaviors and enhance competitiveness. It requires a well-designed and regularly revised pricing methodology, system, and implementation across departments. The motivation of enterprises to implement the system can be categorized as promoting low-carbon investment, improving energy efficiency, and changing operational behaviors, all of which are spontaneous rather than coming from external pressure. Therefore, internal carbon pricing is suitable for companies that have calculated carbon emissions data, under less pressure to reduce emissions, or have achieved process optimization. For companies facing urgent carbon reduction pressure, changes in materials, process optimization, and energy-saving measures remains a top priority.

[1] Scope 3 emissions specifically target business travel, with the rate increasing from USD 15 per tonne to USD 100 per tonne starting from 2022.

[2] Source: CDP report