Alternatives to wind and solar energy

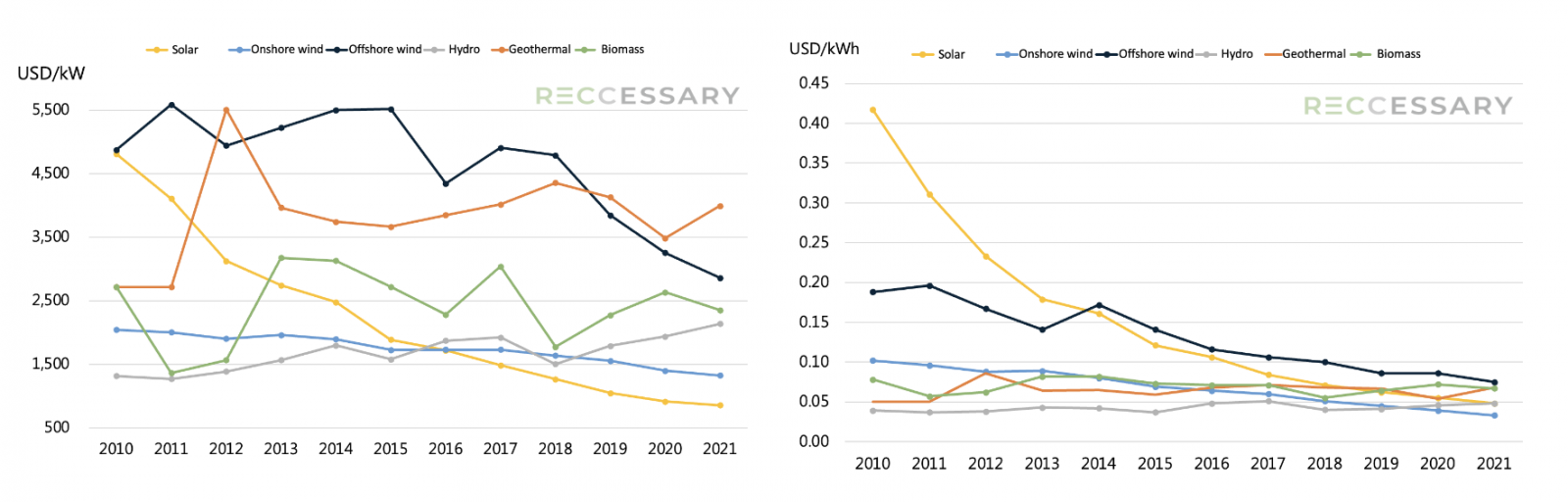

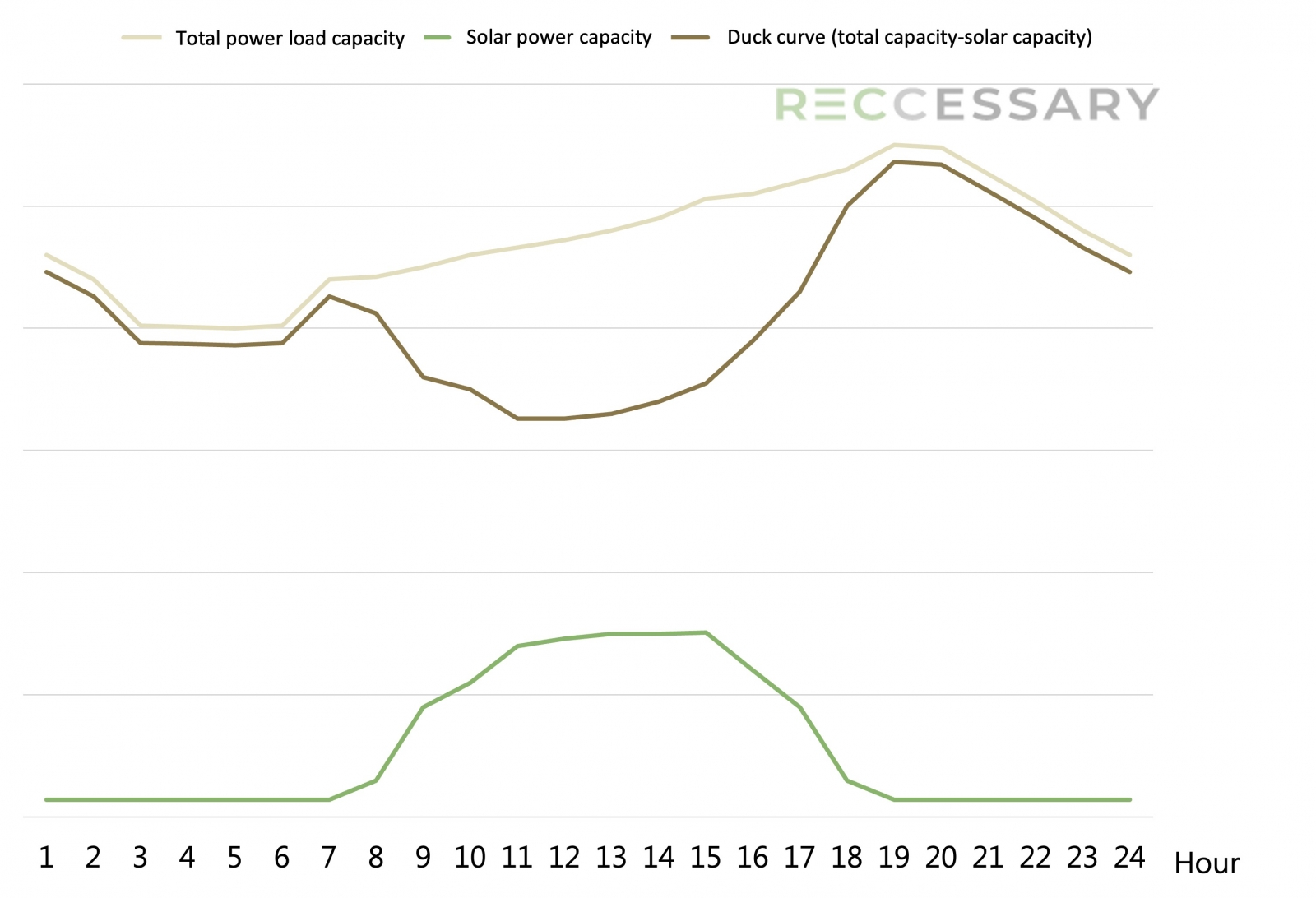

According to the International Energy Agency (IEA), hydro, wind, and solar are the most widely used renewable sources due to their cost-effectiveness and efficiency, accounting for more than 90% of all renewable energy use (see Figure 1 and 2 below). Despite the significant cost advantage, high intermittency[1] of wind and solar energy requires market participants to develop strategies accordingly. It is nearly impossible for businesses to achieve 100% renewable energy use (RE100) depending solely on wind or solar energy, especially with the bundled REC[2] mechanism and 24/7 use of renewable energy. Therefore, most companies that have completed RE100 will use 10% to 15% of more stable renewable energy sources, with biomass being the majority. Due to the intermittency of solar energy, the electricity distribution shows a duck curve (see Figure 3), which leads many countries to introduce renewable energies with higher stability in recent years to stabilize their power grids.

Figure 1. Global renewable energy installation costs 2010-2021 (Left)

Figure 2. Global renewable energy levelized cost of electricity 2010-2021 (Right)

Figure 3. Hourly power load curve diagram

The ASEAN Energy in 2022 report reveals that the cumulative capacity of ASEAN's biomass and geothermal energy is notable, totaling more than 10%. Compared with the global renewable energy mix, ASEAN possesses potential for renewable energy development beyond wind, solar, and hydro. This article will focus on Thailand’s biomass energy development.

Biomass power generation process and investment potential in Thailand

There are more than 20 types of biomass in Thailand, but some of them are difficult to obtain or have low conversion efficiency. Table 1 below lists only some of the common biomass types in Thailand along with their prices and power coefficients. It is worth noting that their density, particle sizes, and moisture content vary, which can affect the cost of transportation, storage and pre-processing, as well as the adaptability of conversion technology.

Table 1. Biomass price and power coefficient in Thailand

.jpg)

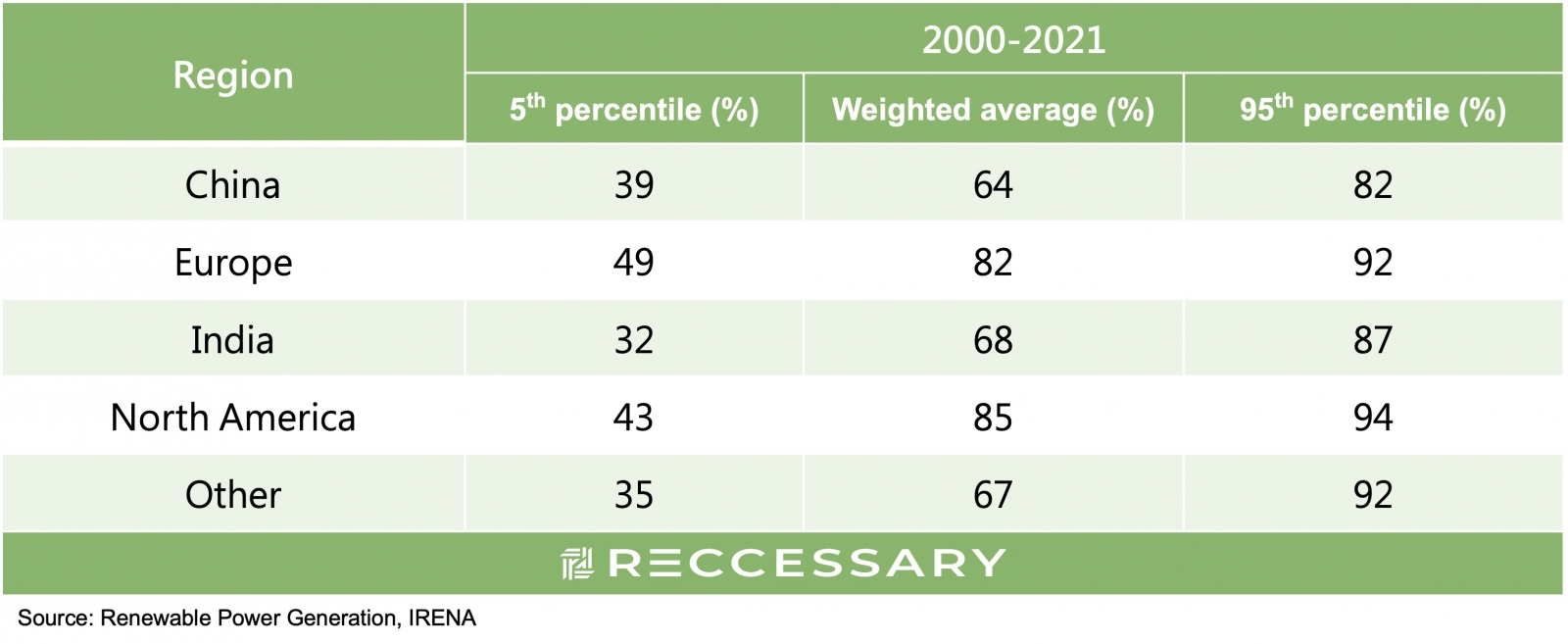

The capacity factor of a biomass power plant is typically between 85% and 95% if the resources are available evenly and uninterruptedly throughout the year. However, there is still a huge amount of biomass from seasonal agricultural waste, which can significantly reduce the capacity factor of power plants. In the case of biomass power generation in Thailand, the average capacity factor falls in the range of 60% to 70%. According to the International Renewable Energy Agency (IRENA), North America currently has the world's highest average biomass capacity factor of 85% (see Table 2 below), due to the high density of farmland and forests in the United States, where a large amount of biomass is available.

Table 2. Global biomass capacity factor by region

Thailand's advantage in biomass power generation is the low cost of biomass; however, most types of biomass have low energy density and require large amounts collected for processing prior to power generation, which may result in high transportation costs if the distance between the power plant and feedstock is not within a certain radius. Due to this characteristic, the size of biomass power plants is limited. Currently, the size of all biomass power plants in Thailand is under 20 MW.

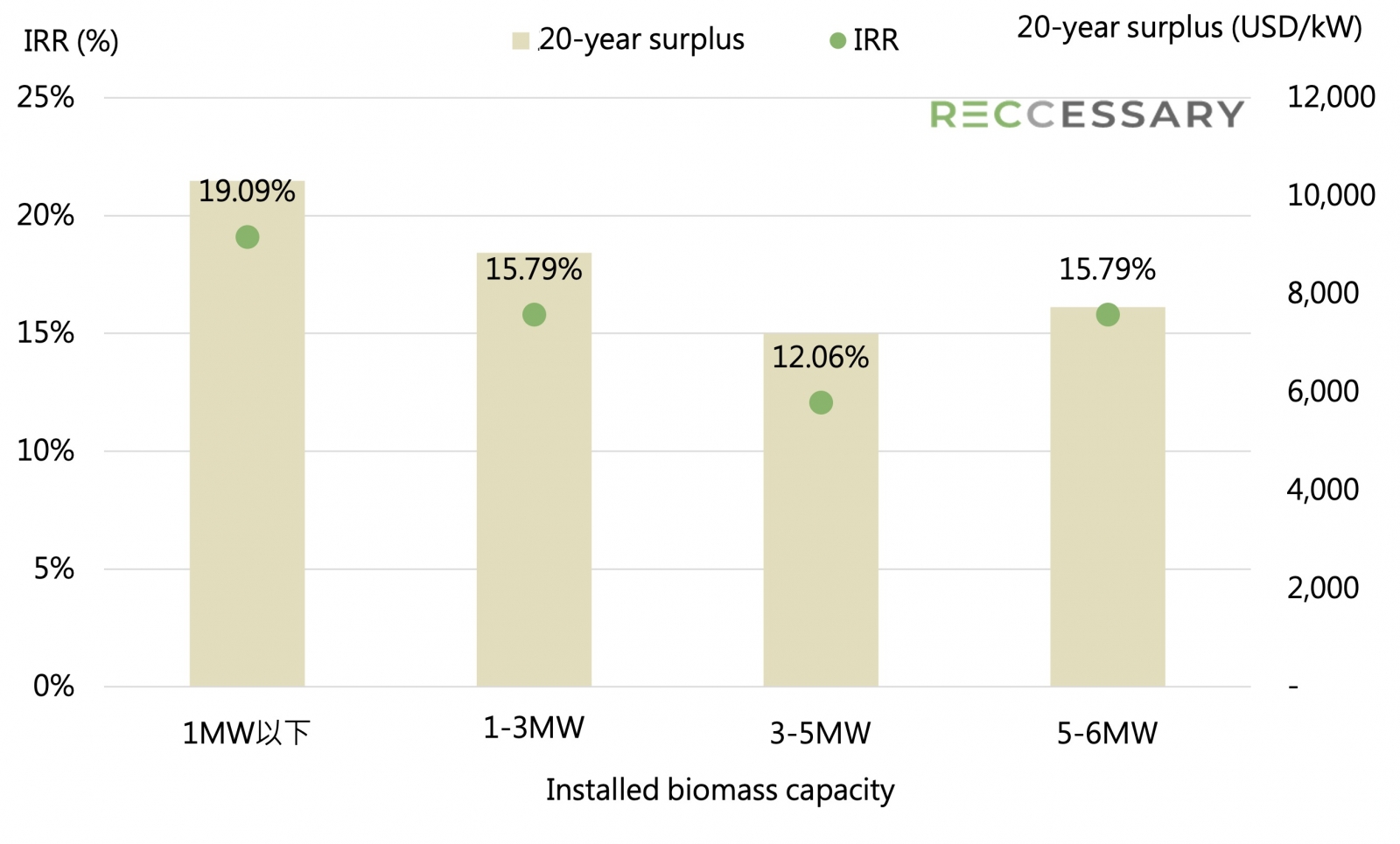

The following four capacity ranges, less than 1 MW, 1-3 MW, 3-5 MW, and 5-6 MW, are used as the assumptions for the next internal rate of return (IRR) for bioenergy in Thailand. The four scenarios are assumed because only sites under 6 MW are eligible for payment under Thailand's feed-in tariff scheme, thus the maximum capacity of 6 MW and the four capacity ranges of feed-in tariff are used as the dividing lines. The most important variables affecting the four scenarios are the installation cost of the overall system, maintenance cost, and feed-in tariff.

Thailand's feed-in tariff consists of a fixed-based tariff (FiTF) and a variable-based tariff (FiTv), which is only available for biomass power plants up to 6 MW, as the Ministry of Energy of Thailand intends to encourage the development of Very Small Power Producers (VSPPs) of renewable energy. The FiTF is the initial installation cost and the maintenance cost per kWh incurred over the life cycle of the system, which increases with smaller installed capacity; the FiTv is the cost of raw materials that changes over time. According to the latest announcement by the Ministry of Energy of Thailand, the feed-in tariff of biomass falls around 4.24 to 5.34 baht/kWh, or 14.7 to 18.5 cents/kWh, the highest for both fixed and variable tariffs as small sites (<=1MW) are not economically viable.

Figure 4 below shows the IRR of installations in Thailand and the 20-year surplus per kW, calculated on the basis of the variable factors on the cost side (installation and maintenance cost) and revenue side (the feed-in tariff) as well as the following three conditions:

- 20-year life cycle

- 70% bank financing with a 7-year repayment period at 3.1% APR

- 1.6% annual equipment decay rate

The graph shows a V-shaped trend in both the IRR and 20-year surplus per kW, which indicates that biomass power generation sites begin to benefit from economies of scale when their size is larger than 5 MW. However, since Thailand's feed-in tariff for biomass only applies for installations up to 10 MW, it is more attractive to invest in biomass sites smaller than 1 MW in Thailand than in larger installations.

However, the market price of renewable energy is less than two-thirds of the feed-in tariff, making the country's biomass development highly dependent on the government. Therefore, the current development of biomass energy in Thailand is highly dependent on the government's bulk purchase rate system. In other words, if the Thai government abolishes the feed-in tariff for biomass, related investment in Thailand will be less attractive. Thailand is the only Southeast Asian country that supports investment in such new energy with a high feed-in tariff, whereas other Southeast Asian countries face a lack of incentives for biomass investment. Vietnam, for example, announced in September this year that its biomass feed-in tariff fell between 7.03 and 8.47 cents/kWh, not even 5% of the IRR for biomass investment in the country.

Figure 4. IRR and 20-year surplus per kW for biomass installation in Thailand in 2021 by capacity

However, the Thai government cannot always buy all biomass at a high price. Although there has not been any news about the termination of the feed-in tariff for biomass, the announced capacity of it has been decreasing every year. In addition, restrictions on the use of biomass and the limitation of foreign investment ratio are getting increasingly strict every year, meaning a higher threshold for investment in Thailand. Therefore, despite Thailand's aggressive target for biomass power generation, companies are advised to plan early and learn more about the possibilities for biomass investment in Thailand.

[1] Intermittent renewable energy sources (IRES) refer to renewable energy that is time-sensitive and cannot be generated 24/7. Most of renewable energy sources are intermittent, such as solar, wind, etc.

[2] The renewable energy certificate mechanism includes both bundled and unbundled types. For more details, please see the RECCESSARY website.