Although the use of renewable energy is a market trend, it increases costs and inconvenience for businesses to purchase electricity. Such concern becomes the reason why many enterprises hesitate to go green. This chapter analyzes the challenges enterprises may encounter in the market and provides renewable energy strategies.

Plan A and Plan B

.png)

Figure 1. Renewable energy strategy assumptions for Taiwanese companies

Assuming a company has an annual electricity consumption of 3 million kWh in Taiwan and has not yet purchased any renewables or installed any facilities. If the company wants to achieve RE30 by 2040, there are two pathways and scenarios with different mid-term goals. Plan A is to achieve RE20 by 2030 and Plan B is to achieve RE10 by 2030. Both scenarios are based on average annual growth.

.png)

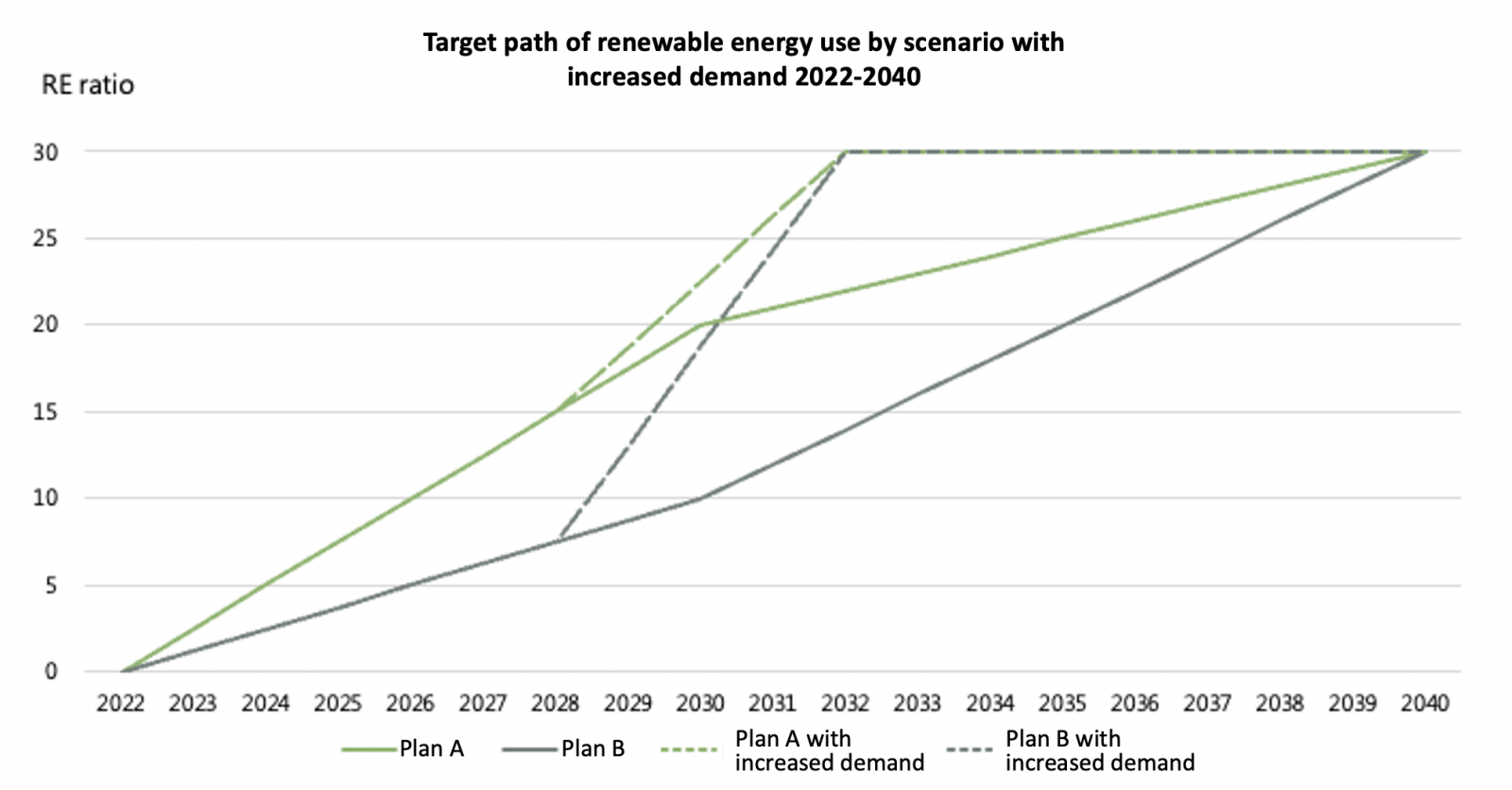

Figure 2. Renewable energy roadmap of Plan A and Plan B

Best solution to a static market

In terms of cost, Plan B has an absolute advantage. The main approach to purchase electricity sourced from renewables in Taiwan is signing a Power Purchase Agreement (PPA)[1], which is valid for five to ten years. In other words, if a company signs a PPA in Year X, the PPA prices stay the same as the prices agreed in Year X in the next five to ten years.

The entire renewable energy market is still in short supply, driving prices up. However, the price increase will gradually slow down after renewable energy installations are connected to the grid and begin to supply electricity. This is the main reason why Plan B has a cost advantage. From a perspective of static market, it is expected that the PPAs signed later will be less expensive.

However, as it is impossible for the market to remain static, it’s difficult for companies to make decisions on the use of renewable energy based solely on cost. According to risk matrix diagrams in many CSR reports, it can be found that a high share of enterprises put "increasing demand for the use of renewable energy" in the quadrant of “high probability of occurrence” and “high level of impact.” If these two variables are considered, can Plan B still have the advantage?

Hedging instruments for dynamic markets

In the following part, market variables are added to a static market for scenario simulation.

Figure 3. Renewable energy roadmap of Plan A and Plan B in scenario

Under such a market scenario, the renewable energy paths of Plan A and Plan B will be changed as the above table. If a company wants to purchase a large amount of renewable energy in Taiwan, the main method is to sign a PPA. For electricity sellers, each PPA signed represents a customized order, for the seller needs to find a suitable renewable energy project according to the requirements of the enterprise. In addition, purchases of too large an amount are unfavorable because a new farm will need to be built, which adds to the cost. Therefore, finding a seller can be challenging if a large amount of PPAs is required in the short term. Even if a seller is found, the amount of PPAs required, time of grid connection, and room to bargain may not fulfil the expectations. Since PPAs are signed later in Plan B, it is more urgent to acquire renewable energy than in Plan A, making Plan B less advantageous in cost.

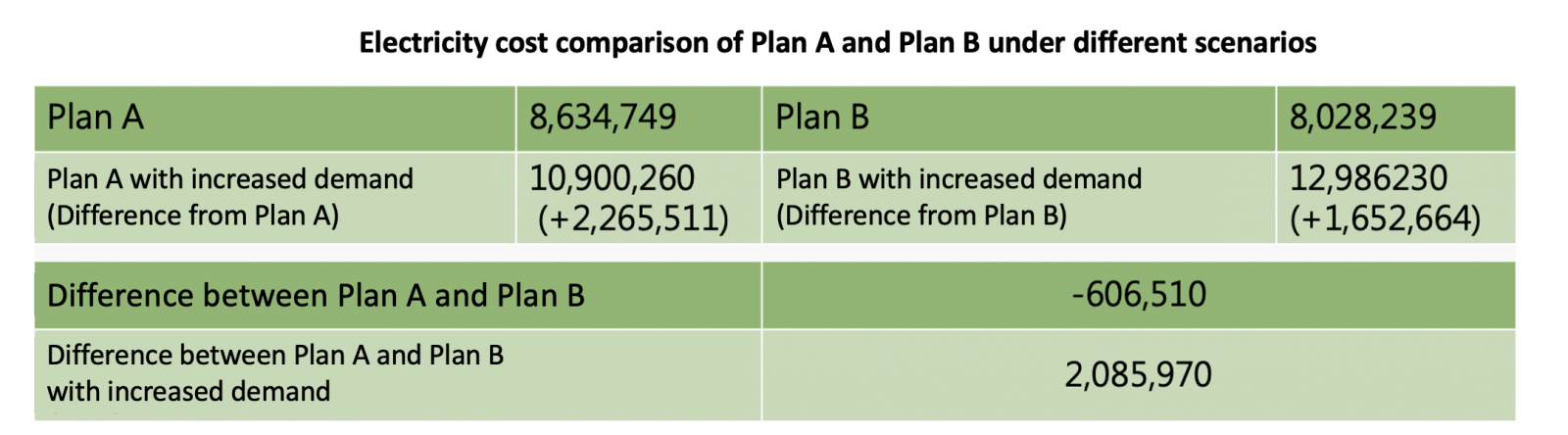

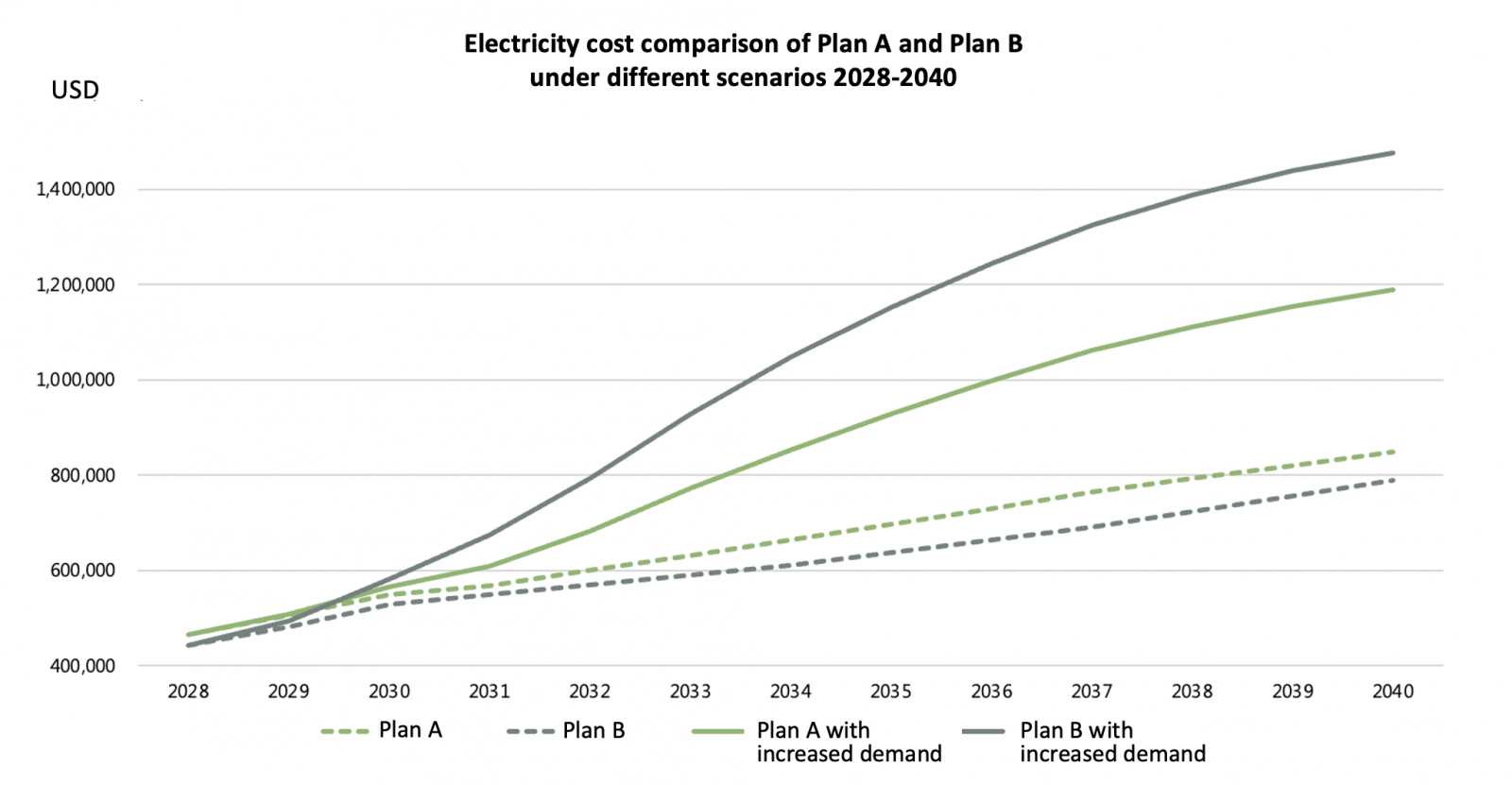

It is estimated that from 2028 to 2040, the total electricity cost of Plan A will increase from 8.63 million to 10.9 million, while cost of Plan B will increase from 8.02 million to 12.98 million due to increasing demand for renewables. There is a gap of more than 2 million U.S. dollars in crisis management expense between the two plans. Looking back at Plan A and Plan B under the assumption of a static market, despite the cost advantage of Plan B, total cost of Plan A from 2028 to 2040 is around USD 600,000 more than that of Plan B. In other words, if a company is willing to adopt Plan A that costs an extra USD 600 thousand, it could avoid the USD 2 million of crisis management expense, which is equivalent to buying a hedging tool that costs USD 600 thousand.

Figure 4. Cost comparison between Plan A and Plan B in scenario

Plan A or Plan B?

Whether to choose Plan A or Plan B depends on the company’s assessment of the probability of greater renewable energy use required in the future. If the odds are considered low, it is not necessary to participate in the competitive renewable energy market. However, it is worth noting that although the current carbon footprint verification still focuses on emissions of the company itself, it is expected that carbon emissions management in supply chains will become a vital issue in three to five years to come, as environmental awareness grows, and the renewable energy use required may increase by then. Therefore, the above dynamic scenario is based on the assumption that carbon emissions management in supply chains will be introduced within three to five years to provide a clear direction of energy strategies.