24/7 carbon-free energy trend

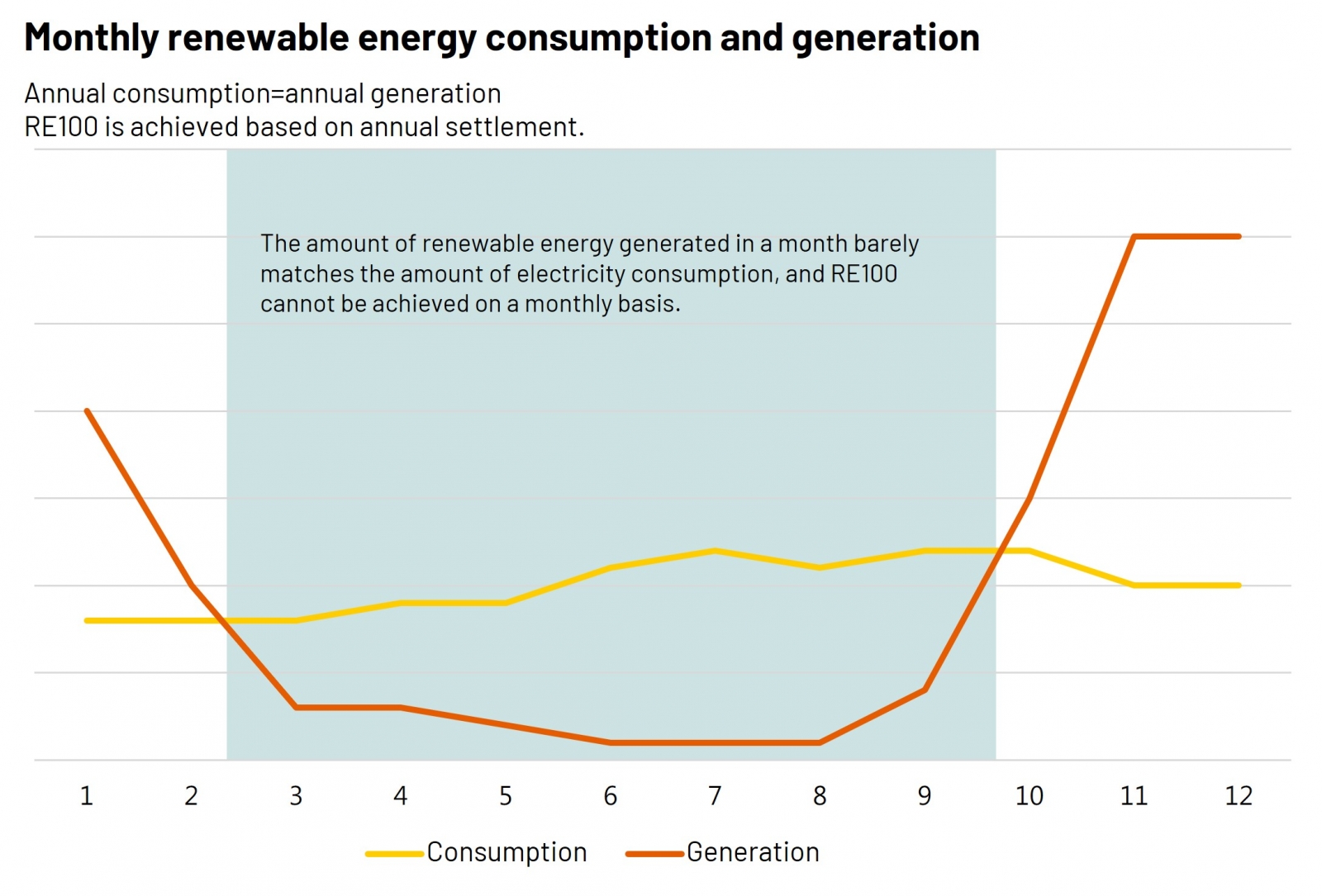

According to Our World in Data, energy use accounts for 73.2%1 of the total carbon emissions. Such a high proportion has made renewable energy the key to achieving net zero emissions and has driven governments and companies to set a target of 100% renewable (RE100). Figure 1 below illustrates monthly renewable energy consumption and generation, assuming that annual consumption is equal to annual generation2 . Due to the intermittency of renewable energy sources (e.g., solar power generation is most efficient at noon and in summer; offshore wind generation is three times more efficient in winter than in summer), RE100 cannot be achieved on a monthly basis. However, settling electricity on an annual basis is not rigorous enough and has been considered "greenwashing" by a growing number of advocacy groups and major brand owners in recent years.

Figure 1. Monthly renewable energy consumption and generation

After matching all its energy consumption with RE100 in 2017, Google launched the 24/7 Carbon-Free Energy initiative in 2021, in partnership with Sustainable Energy for All (SEforALL) and the United Nations. The initiative requires all of its operations around the world to use carbon-free energy 24/7, as settled in hours. As of May 2023, more than 100 companies and organizations have signed up to the initiative, with the goal of achieving all-time carbon-free energy use by 2030.

Is the 24/7 mechanism becoming mainstream?

While the concept of 24/7 renewable energy use has emerged, which will boost the installed green energy capacity of the market, it requires not only adequate renewable energy facilities, but also a robust grid system and load-matching capabilities. As most countries lack of these conditions, the market mechanism will gradually shift to 24/7 green power, with the transition currently underway.

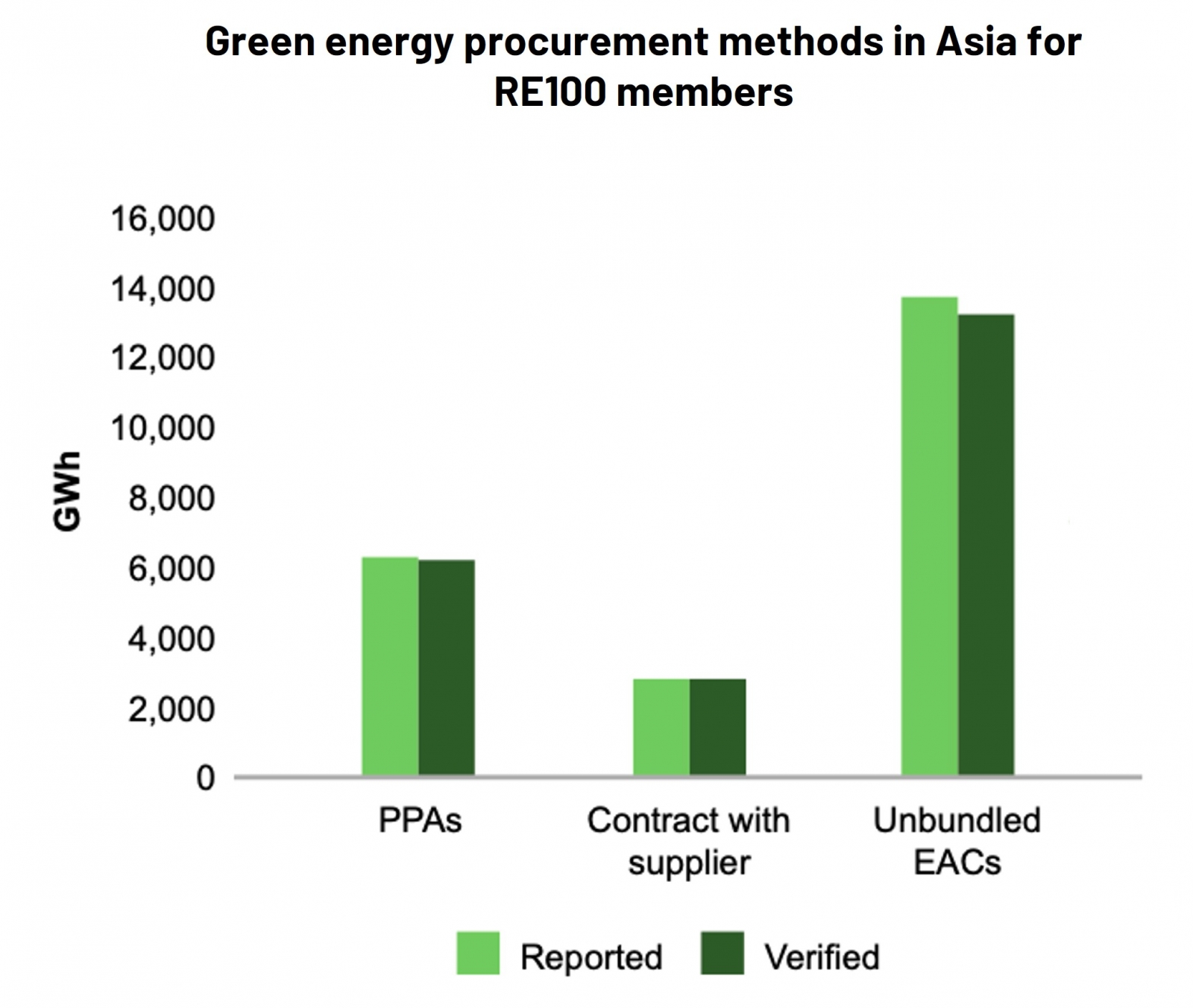

Figure 2. Green energy procurement methods in Asia for RE100 members

Source: Driving renewables in a times of change, RE100, 2023

Globally, the primary method of green-energy procurement instrument is Renewable Energy Certificates (RECs), particularly in Asia. According to RE100's 2023 Annual Report (see Figure 2 above), more than half of RE100 members' renewable energy purchases in Asia are made through RECs, making it the most common form of approach to achieving annualized RE100. Different from purchasing unbundled RECs, signing power purchase agreements (PPAs) involves a power matching process as the purchase entails actual electricity. Therefore, the settlement method varies depending on the regions' electricity markets. For example, in Taiwan, both conventional and green electricity is settled monthly; therefore, PPAs signed in Taiwan are also matched on a monthly basis.

Market transition process

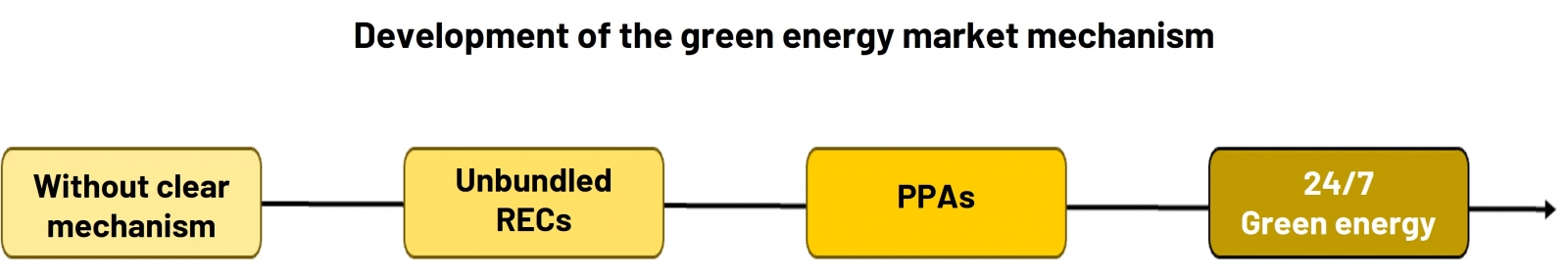

Figure 3. Development of the green energy market mechanism

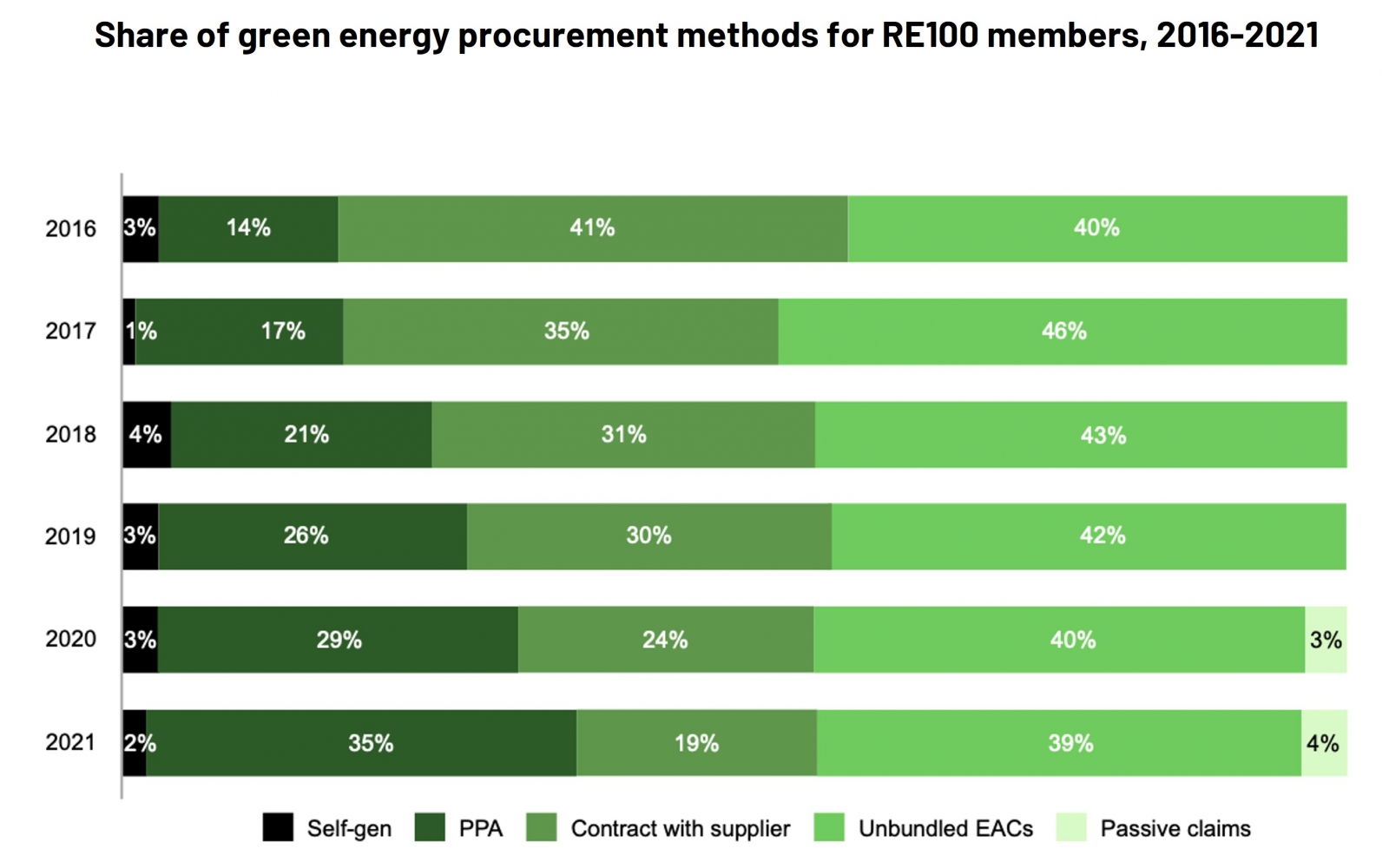

Overall, PPAs are much more stringent than RECs and more flexible than 24/7 use of green energy. As leading companies are implementing 24/7 mechanisms and the greenwashing issues of unbundled RECs pose a challenge to credibility, PPAs have become the primary mechanism for the transition phase (see Figure 3 above), which is also reflected in RE100 members' renewable energy purchases over the years (see Figure 4 below). While unbundled RECs account for the majority of renewable energy purchases between 2016 and 2021, the proportion of PPA signings increased each year, reaching 35% in 2021, only 4% less than unbundled RECs.

Figure 4. Share of green energy procurement methods for RE100 members, 2016-2021

Source: Driving renewables in a times of change, RE100, 2023

Current situation and challenges of PPA in Asia Pacific

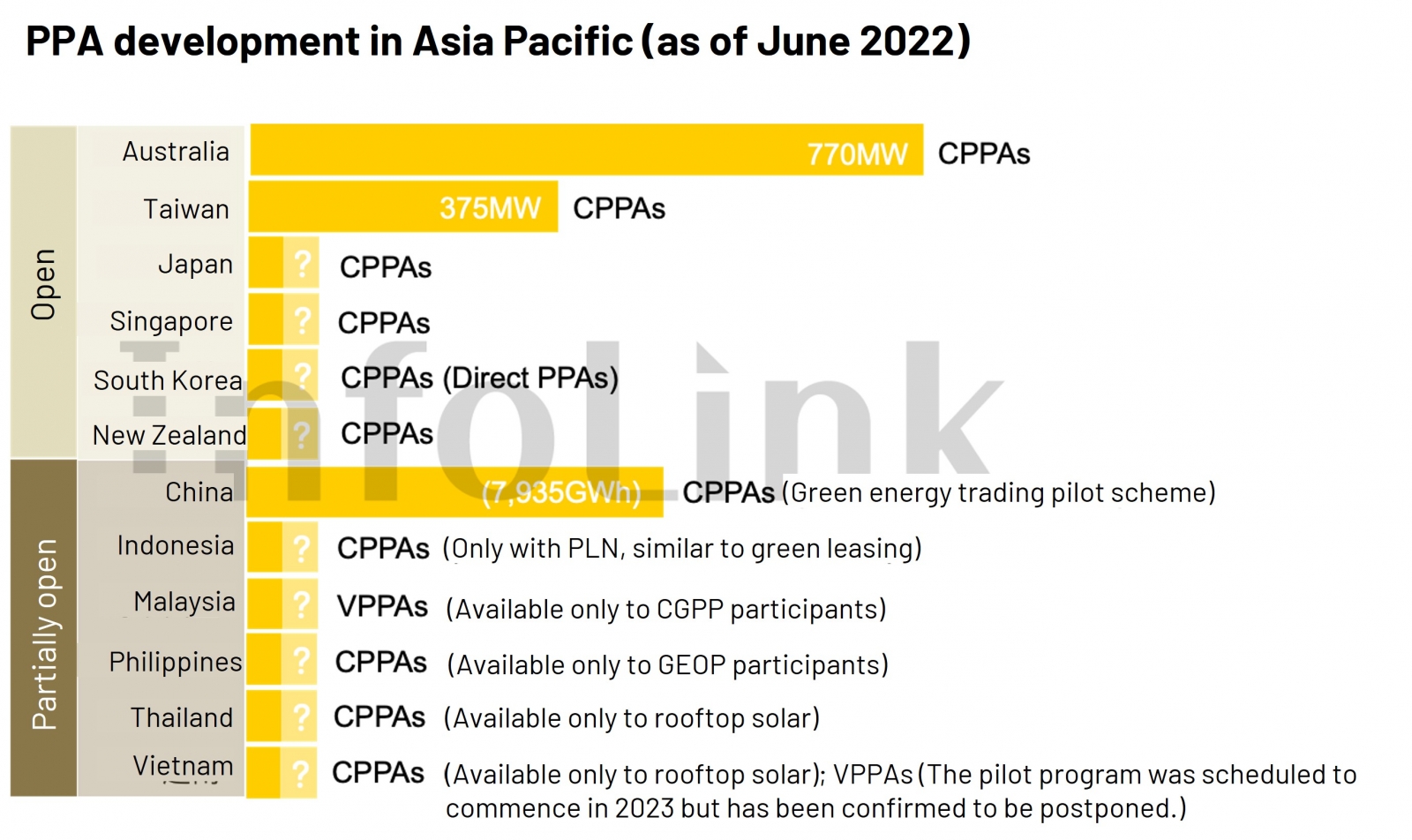

Compared to Europe and the U.S., the number of PPAs signed in Asia is significantly lower because they are not available in many markets, as PPAs is a relatively new market mechanism. In Asia Pacific, only New Zealand, Australia, and Northeast Asia are open to PPAs, with Australia having the largest signed volume. On the other hand, PPAs signed in China and Southeast Asia are subject to certain restrictions and are not open to the market as a whole. PPAs in these regions are usually signed through projects and put out for tender for market participants. However, most of the projects are pilot projects with relatively small trade volume.

Figure 5. PPA development in Asia Pacific (as of June 2022)

In Asian countries, especially in Southeast Asia, transmission and distribution are controlled by state-owned power companies, which play a key role for the introduction of PPAs due to the need to rely on the launch of national programs. In addition, whether necessary conditions of the grid system (e.g., the ability of the grid to accommodate high intermittency of renewable energy and adequate load matching capability) are met can also affect the implementation of PPAs in the region.

Future development phases of the Asia-Pacific market

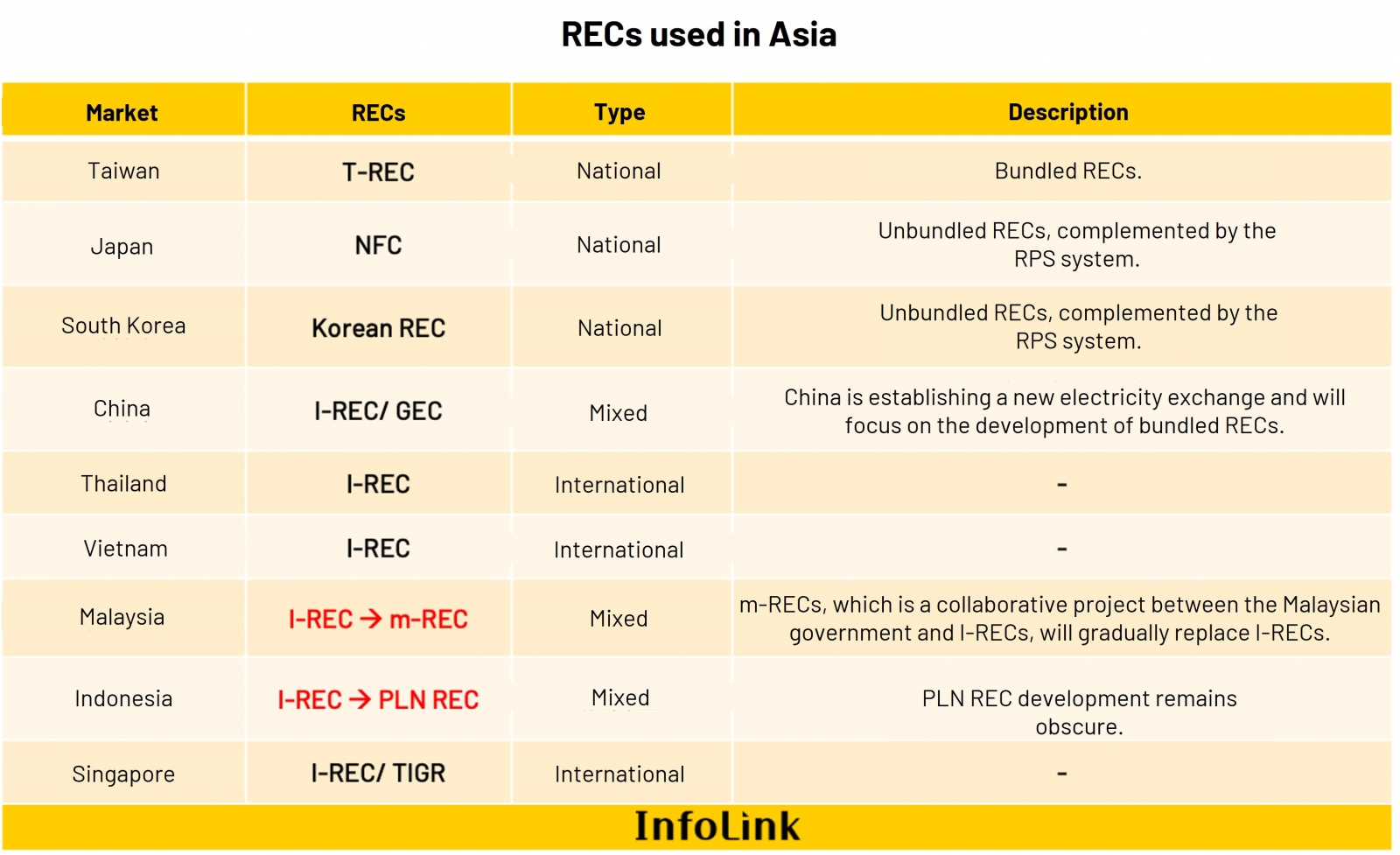

Currently, many Asian countries are not yet affected by the 24/7 clean energy trend and are unprepared for the future phase-out of RECs. InfoLink Consulting projects that the development of the Asia-Pacific renewable energy market will be divided into three phases. In the first phase, international RECs such as I-RECs and TIGRs will be replaced by national RECs tailored to each country's electricity system. In the second stage, a more comprehensive PPA mechanism will be introduced and become the main method for large-scale renewable energy purchases. In the third stage, when the PPA mechanism becomes more mature and stable, the time unit for electricity settlement will be aligned with international standards. Settlement can start from quarterly units to monthly or hourly units.

Table 1. RECs used in Asia

For enterprises, purchasing unbundled RECs is the most efficient and time-saving approach. However, since most companies purchase green energy to meet the supply chain requirements, backlashes against unbundled RECs must be taken into account in the risk assessment. When choosing a renewable energy purchase method, companies should consider the cost effectiveness, environmental benefits, feasibility, and credibility, which requires close cooperation between companies and stakeholders for their needs and to achieve the goal of sustainable development and environmental protection.

1 Source: Emission by sector, Our World in Data

2 The current international definition of RE100 is measured on a yearly basis, meaning that the amount of renewable energy required is the same as the annual consumption.