Trade barriers, such as the China–United States trade war, are government-induced tariffs or sanctions on imported goods to reduce the trade deficit. Today, a new form of trade barriers has emerged – the Carbon Border Adjustment Mechanism (CBAM). The EU proposed the 2030 Fit for 55 Package in July 2021, which includes the CBAM and requires importers to declare the embedded carbon emissions of products and surrender the CBAM certificate as the carbon emissions payment of imported products. The purpose of establishing such a barrier is to avoid carbon leakage, preventing companies from relocating factories to countries with relatively loose carbon emissions regulations and promoting practical carbon reduction.

Once countries establish a CBAM, businesses will face the following four challenges coming from governments and industries. In face of carbon emission-related uncertainties, companies should deploy carbon reduction actions in advance to minimize risks.

Carbon fee, carbon tax and carbon reduction cost:

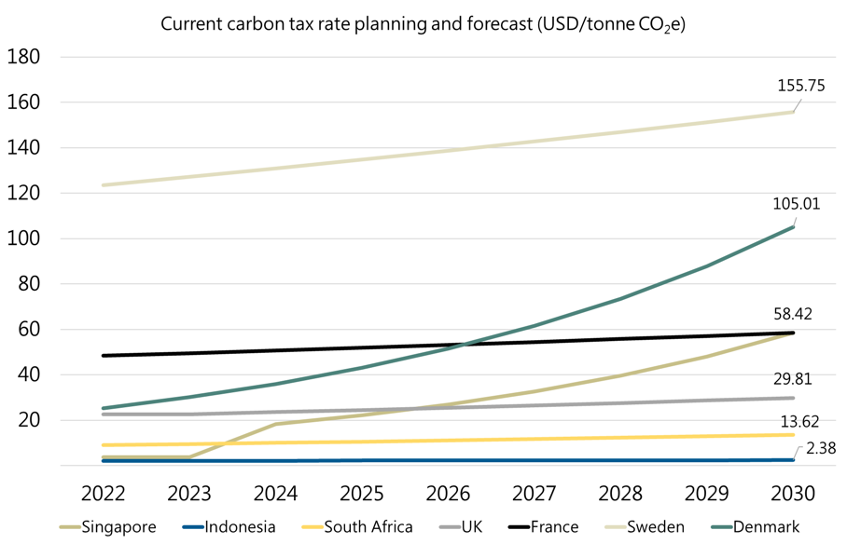

In order to be in line with the international market, countries across the globe have successively planned to introduce a domestic carbon trading scheme or impose a carbon fee or carbon tax. Among the countries that have adopted a carbon tax, Sweden levies the highest tax at 120 U.S. dollars per tonne of carbon dioxide equivalent. It is worth noting that although many countries have introduced carbon taxes, the price is generally low, mostly below US$ 50 per tonne. When the price does not reach a certain level, it is difficult to function as a restraining role. The target price or price growth rate is therefore an important factor that must be considered when formulating policies.

Figure 1 below shows the current tax rate planning and forecast for countries introducing a carbon tax. Except for Singapore and Denmark, which have set price targets for 2030, the rest have yet to set clear targets or percentage increase, so the price is estimated based on the current tax rate and inflation rate in the country. The figure below clearly shows that the restraining effect would decline if only inflation is considered without growth rate, which leads to limited contribution to carbon neutrality for a company or country. In addition to paying carbon fees and carbon taxes, actual investment of companies in carbon reduction, such as replacing traditional high-energy-consuming equipment, may also lead to higher costs. Therefore, companies should evaluate carefully and choose the most appropriate carbon reduction plan when making decisions.

Figure 1: Current carbon tax rate planning and forecast

Changes in the evaluation factors of product competitiveness:

In the past, prices played a decisive role in product competition and bidding. However, whether the product is eco-friendly has gradually become one of the evaluation criteria. Products with low carbon emissions will have competitive advantages in the purchase price and commodity selection.

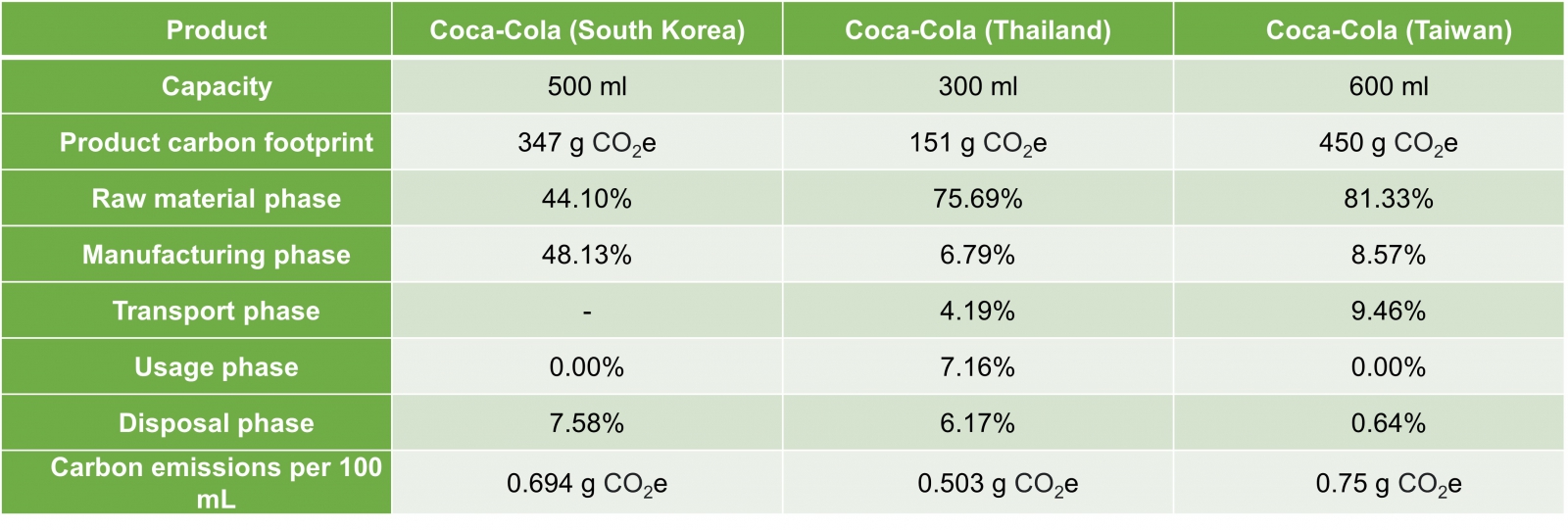

The table below is a comparison of carbon emissions of Coca-Cola produced in different countries. Except for South Korea, where the main source of emissions is in the manufacturing phase, all the others are generated in the raw material phase. A comprehensive assessment of the carbon emissions per 100 mL of Coca-Cola shows that the carbon footprint is the lowest in Taiwan, followed by South Korea and Thailand. Due to the non-uniform calculation standards of various countries, there may be some differences from the actual situation. However, such comparisons will become more and more accurate and common, and enterprises can also use this to evaluate whether the location of factories is suitable.

Table 1: Carbon emissions of Coca-Cola produced in different countries

Market participation threshold and restrictions:

Taking the CBAM proposed by the EU as an example, importers must declare the quantity of imported products, the carbon emissions of imported products and the number of certificates to be surrendered. Enterprises must calculate the carbon footprints of products and earn certification from an accredited third-party agency for declaration, otherwise a fee will be charged based on the top 10% of emissions. Conversely, if an enterprise does not calculate its carbon footprints, there are only two options left. One is to pay a higher fee; the other is to not enter the market. Either way is a loss for the enterprise.

Risk of cooperation:

In addition to the relevant regulations set by government agencies, many industries or large enterprises will implement stricter, advanced regulations and require the supply chain to achieve goals jointly to achieve carbon neutrality. Therefore, although many small and medium-sized enterprises do not face government regulations directly yet (policies usually prioritize high-carbon industries such as steel, cement, etc.), there will still be supply chain procurement pressures. For example, Apple has demanded carbon neutrality in its supply chain and products by 2030, while shipping company Maersk has committed to sourcing or stockpiling 100% net-zero-emission steel by 2050.

Followed by the introduction of CBAM, carbon credits will become the next competition for enterprises. Carbon credits can be divided into mandatory (e.g., Emissions Trading System, ETS) and voluntary (e.g., Certified Emission Reduction, CER, and Voluntary Emission Reduction, VER) based on categories, content and acquisition. The types of enterprises that can participate are not the same, and they may not be fully circulated or converted with each other. However, they must eventually move towards a benchmark that can be compared with each other. As the system becomes mature and the carbon trading system of each country and state has developed a certain scale, the systems may start to merge and develop a more negotiable carbon credit secondary market similar to today's securities trading. This explains why more and more companies have begun to deploy carbon reduction actions. In addition to responding to regulations, the carbon credits obtained through carbon reduction will become a new key to corporate profits, opening a game-changing pathway.

Sources:

Carbon pricing of the World Bank

Korean carbon label

Thai carbon label

Taiwanese carbon label