.jpg)

(Photo: iStock)

Introduction

Malaysia is seeking foreign investments across high-end sectors including electric vehicles, carbon capture, and semiconductor. For this reason, the Malaysian government is en route to foster a conducive business environment, including creating greater and easier access to renewable electricity. For many industries, scope 2 emissions make up the largest portion of their carbon emissions. Sometimes capable entities may rely on on-site solar for self-consumption, but such option would not suffice the appetite of energy intensive entities.

Apart from self-consumption solar, currently there are mainly three ways for companies to green their energy use in Malaysia: 1) unbundled renewable energy certificates (RECs), 2) power purchase agreements (PPAs), and 3) the Green Electricity Tariff (GET) program. Each of the options have their advantages and considerations, companies should pursue the option, or a combination of options, most suitable to their targets and locations. This article delves into the existing ways and prospective measures companies may consider as they enter Malaysia.

Background

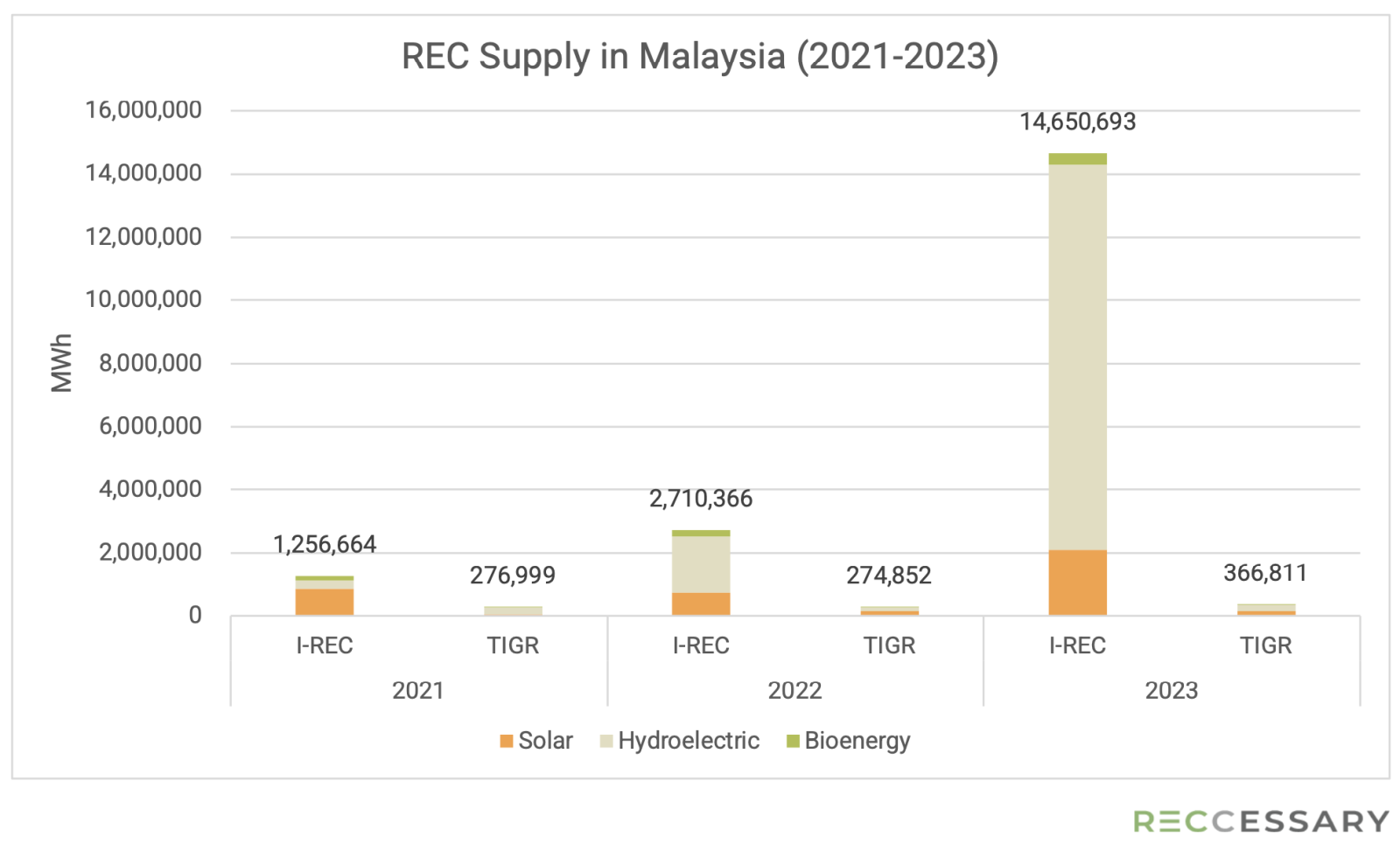

In 2023, the use of renewable energy certificates increased by 75% from 2022 in Malaysia, signifying growing corporate demand in reducing scope 2 emissions. But how can businesses access to the power produced? Renewable electricity supply in Malaysia can be dissected into three regional power companies: Tenaga Nasional Berhad (TNB) in Peninsular Malaysia, Sabah Electricity Sdn Bhd (SESB) in Sabah, and Sarawak Energy in Sarawak (see Figure 1). Each company offers varying arrays of options for corporate green power procurement. The following paragraphs will first discuss options available on the national level and then focus on additional options in Peninsular Malaysia.

Figure 1. Regional map of Malaysia

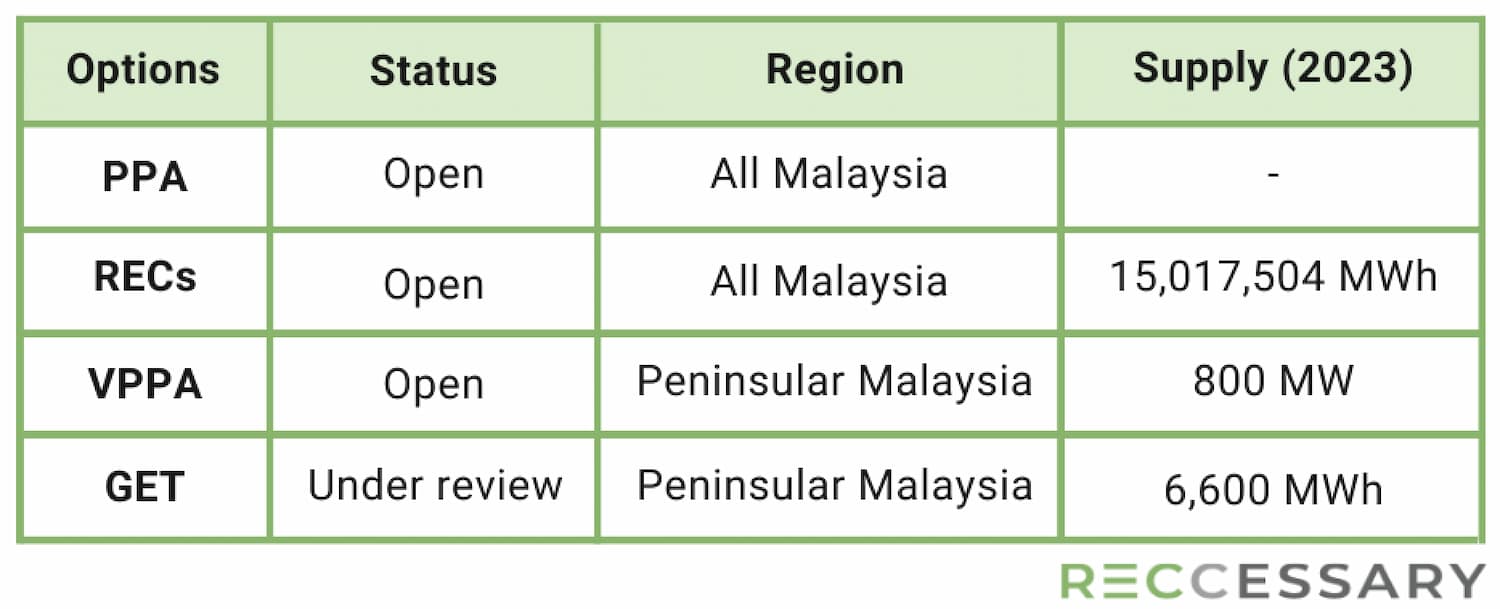

Green power purchase options and corporate consumer eligibility

All of Malaysia

On the national level, there are two pathways for businesses to decarbonize their energy sector. One is through buying RECs and the other is through PPAs. Purchasing RECs is thus far the easiest way to decarbonize an industrial entity’s energy usage. The most used RECs are I-RECs from hydro and solar, with the latter priced at a higher average. The mechanism of unbundled RECs purchase means that customers do not need to change their electricity utility, they are simply buying green electricity receipts to offset brown electricity they have been using. Another way to procure green power is through signing PPAs, which compared to unbundled RECs allow companies to acquire RECs along with the actual electrons from renewable sources. Unlike REC’s competitive market of brokers, signing a PPA for renewable energy in Malaysia entails different rules in different regions as the paragraphs below elucidate.

Sabah and Sarawak

In both Sabah and Sarawak, SESB and Sarawak Energy are the sole offtakers of all electricity generated in the respective region. In this case, interested buyers of renewable energy would negotiate PPA contracts with SESB or Sarawak Energy and not with renewable power producers. However, for consumers in Sarawak, the new amendment to the Electricity Bill late last year stipulates that prospective solar producers may sell their power to consumers other than Sarawak Energy if the latter does not require it.

Peninsular Malaysia

There are comparably more renewable electricity procurement options for corporate consumers in Peninsular Malaysia. The first is the virtual PPA (VPPA) mechanism under the Corporate Green Power Program (CGPP) commenced on November 7, 2022. In a VPPA, a corporate consumer draws up a financial contract with a solar power producer at a fixed or negotiated price structure for the RECs but still gets the actual power from existing power utility (see Figure 2 for more details).

.jpg)

Figure 2. VPPA flowchart

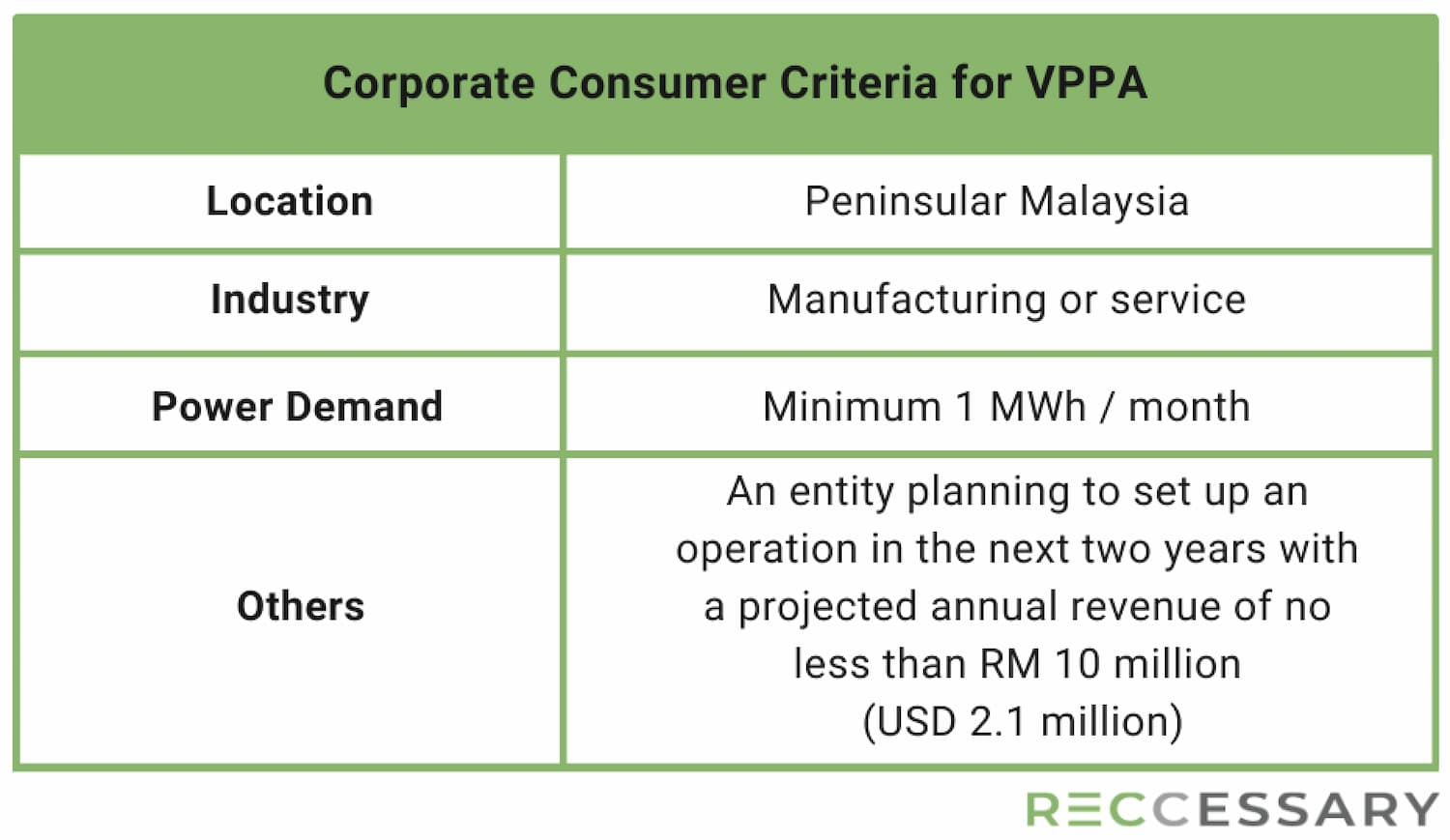

To become an eligible corporate consumer under the CGPP, one needs to meet the conditions summarized in the table below.

Table 1. Corporate Consumer Criteria for VPPA in Peninsular Malaysia

Currently, the latest 800 MW of solar capacity have been subscribed by solar power producers at the end of 2023.

Another option for Peninsular Malaysia corporate consumers is the Green Electricity Tariff (GET) program under the Malaysia Green Attribute Tracking System (mGAT). Essentially, GET is a premium rate consumers pay for bundled RECs, and in the case of this framework, Malaysia RECs (mRECs) which is grid-connected in Malaysia and adopts the I-REC standard. For non-residential consumers, GET must be subscribed in blocks of 1000 kWh. The current tariff rate for Green Electricity is 21.7 sen/kWh (USD 4.6 cent/kWh). Currently the program is being reviewed by the government with the expectation to produce a modified structure with more attract tariff rates and longer subscription period. In 2023, 6600 GWh of Green Electricity quota was available under the program.

Table 2. Latest Green Power Procurement Options Status in Malaysia

Watch for Cheaper Solar RECs and Environmental Considerations around VPPA

Thus far Peninsular Malaysia is the most mature green power market in all Malaysia with various channels for businesses to obtain renewable energy. Currently the most used and supplied method is through unbundled REC purchase, and as shown in the REC supply chart below, hydro RECs are the most accessible and hence on the cheaper end of the pricing spectrum compared to solar RECs.

However, seeing that solar device installation is on the rise and expecting a boom in solar panel deployment in the country through projects like LSS 5, we anticipate that corporates will be able to obtain solar RECs with lower prices in 2024. Another potential development around REC trading this year is cross-border trading announced by the Bursa Carbon Exchange, signaling possible REC supply from neighboring countries with cheaper and more diverse sources.

While RECs are easy to understand and used, it may not be the most stringent standard to meet renewable energy targets, and while PPAs may secure supply for a long tenure of up to 21 years in Malaysia, they also lock in prices that might create unnecessary loss in the future. Given these considerations, corporates may find VPPAs an eclectic choice between unbundled RECs and PPAs. For those considering VPPA, they may also need to think about the environmental values of such mechanism, as it does not reduce the actual scope 2 carbon emission. Companies should evaluate their decarbonization pressure side by side with the costs that come with each option. To learn more about corporate strategy in energy decarbonization please contact the author.

Figure 3. REC Supply in Malaysia (2021-2023)

Sources: I-REC and TIGR registries.