Southeast Asia has been the preferred location for many industries to build factories due to its excellent location and abundant human resources. Taking advantage of local policies to attract foreign capital, as well as preferential taxation and other supporting measures, many foreign investors and manufacturers have flocked to the region. However, Southeast Asia's energy supply capability is relatively weak owing to inadequate energy infrastructure in the region. Coupled with greater fluctuations in energy demand in the tropical region, many factories there often experience power outages. Moreover, Southeast Asian countries still rely heavily on fossil fuels despite the rise of renewable energy, meaning that exporters to Europe and the U.S. could face high carbon tax in the next three to five years. Therefore, the availability of local renewable energy has become an important element of a company’s factory planning in Southeast Asia. This article aims to provide businesses with an overview of the current market situation and procurement methods for renewable energy in Southeast Asia, which can serve as a reference for establishing their plants in the region.

Renewable energy market dominated by unbundled RECs

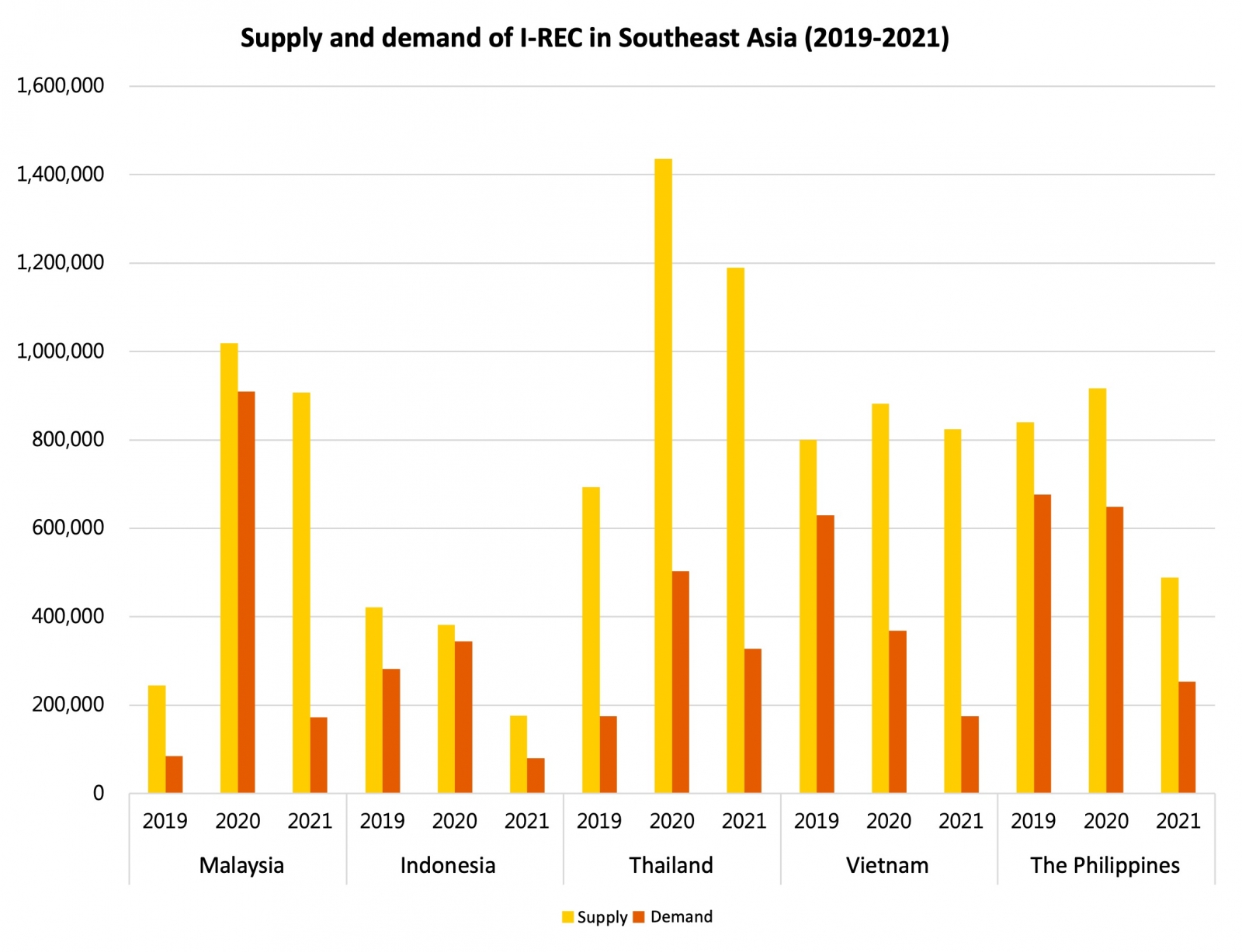

Unbundled Renewable Energy Certificates (RECs), such as I-RECs and TIGRs, are primarily used in Southeast Asia as evidence of renewable energy use. These international RECs function as temporary market instruments to support countries that have yet to complete their energy transition or are still in the process of transitioning. Before 2020, when renewable energy awareness was low in Southeast Asia, a few companies that needed to purchase renewables primarily used I-RECs to fulfill their renewable energy goals. However, the trend of purchasing renewable energy changed after 2020, as governments and international renewable energy regulations became increasingly stringent, which led to a sharp decline in demand for I-RECs. Figure 1 below shows supply and demand for I-RECs in five Southeast Asia countries from 2019 to 2021, with a consistent inverted U-shaped trend. In particular, demand declines by more than 50% in 2021 for all countries except Thailand. While unbundled RECs remain the dominant market instrument for renewable energy procurement, it’s apparent that such mechanism is gradually withdrawing from the market.

Market mechanisms in transition

In early 2022, Europe and the U.S. began promoting 24/7 clean energy and restricting the use of various unbundled RECs, while emphasizing that renewable energy and RECs should be traded as one through methods such as power purchase agreements (PPAs). This is one of the main reasons that demand for I-RECs in Southeast Asia is decreasing. In addition, Southeast Asian governments are also taking action to introduce national RECs as well as PPA mechanisms. Table 1 below shows the renewable energy purchase options and the level of development in five Southeast Asian countries. These countries have other options than using unbundled RECs, such as building generation facilities for self-consumption. While the Corporate Power Purchase Agreement (CPPA) is currently only applicable in the Philippines and is still being piloted in Malaysia and Vietnam, it demonstrates that Southeast Asian countries are making progress in renewable energy procurement as they are developing their electricity markets in a retail and competitive manner. Although the overall progress of renewable energy still lags behind that of Europe and the U.S., these measures can partially satisfy demand for renewable energy for now.

Table 1. Renewable energy procurement options and the level of development in five Southeast Asian countries

| Procurement options | Malaysia | Indonesia | Thailand | Vietnam | The Philippines |

| Virtual Power Purchase Agreement (VPPA) | | | | | |

| Corporate Power Purchase Agreement (CPPA) | V | | | V | V |

| Self-consumption (on-site generation PPA) | V | V | V | V | V |

| Renewable energy products | V | | | | |

| Unbundled RECs | V (mGATS/I-RECs) | V (I-RECs/ PLN REC) | V (I-RECs) | V (I-RECs) | V (I-RECs/ Philippines RECs) |

Renewable energy procurement for Southeast Asian enterprises

Currently, demand for renewable energy in Southeast Asia comes mostly from brand owners. In the Philippines, for example, high electricity prices have made the energy transition an opportunity for local manufacturers to obtain low-cost electricity. More than 90% of Philippine companies obtain green electricity through rooftop solar self-consumption or retail PPAs. Moreover, the Philippines has recently launched the Green Energy Option Program (GEOP), which lowers the threshold for renewable energy procurement and has attracted 19 suppliers as of 2023. While the government has yet to declare its effectiveness, the number of participants is increasing every year, indicating that it is a rising procurement option for those in demand for renewable energy.

It is not difficult for companies in Southeast Asia to meet entry-level renewable energy targets (RE5 or RE10). However, as unbundled RECs raise concerns about "greenwashing" and demand for renewable energy is growing, companies in Southeast Asia should start their renewable energy planning early. Apart from considering a country's market mechanism and renewable energy supply, it is also necessary to take into account the country's grid system and grid-connection when planning. Vietnam, for example, has significant installed capacity of renewable energy but a low supply. Therefore, it is important to avoid being misled by one-sided information to ensure a comprehensive and effective plan for renewable energy implementation.

Learn more: Renewable Energy in Southeast Asia and Global Carbon Market Trend