.jpg)

(Photo: iStock)

South Pole, the world's leading carbon project developer, was accused in October 2023 by media and internal whistleblowers of overstating the climate benefits of carbon credits generated by its Kariba REDD+ project, a large-scale forest conservation project, by a factor of at least five. Several media outlets and auditors have also found flaws in the project's accounting, with its financial flows difficult to track and much of the revenue appearing to flow back to South Pole and its partner Carbon Green Investments (CGI).

Despite South Pole's claims that the carbon credits sold under Kariba REDD+ are valid, questions have been raised about their quality. Major brands, including Gucci, Volkswagen, Nestlé, and McKinsey, have all purchased carbon credits from the project and claim carbon neutrality. However, when the controversy erupted, these companies had no choice but to accept damages or be labelled "greenwashers" or even face lawsuits.

Related reading: Global trend in anti-greenwashing: Government responses and corporate strategies

Potential greenwashing despite certification

In fact, all of South Pole's carbon credits have been certified in accordance with Verra's regulations, but the issue of flawed credits has still arisen. Meanwhile, The Guardian and German media Die Zeit have reported Verra that "Only a few rainforest projects show evidence of reduced deforestation, and 94% of carbon credits yield no climate benefits."

The issue of over-crediting and lack of methodological rigor in the REDD+ project, though denied by Verra, has raised significant concerns in the market. With Verra-certified carbon credits accounting for 35% of the market share and REDD+ projects accounting for 44% of the trading volume, this event has unsurprisingly led to the lowest level of carbon credit retirements in seven years in 2023. Subsequently, Verra's CEO announced his resignation, followed by the release of the organization's new methodology and plans for ongoing reforms, with a complete overhaul of the methodology for REDD+ projects expected by 2025. The unreliability of Verra-certified carbon credits has forced many brands to remove claims related to environmental friendliness, posing challenges to the development of the voluntary carbon market.

Efforts of non-profit organizations to improve carbon credit quality

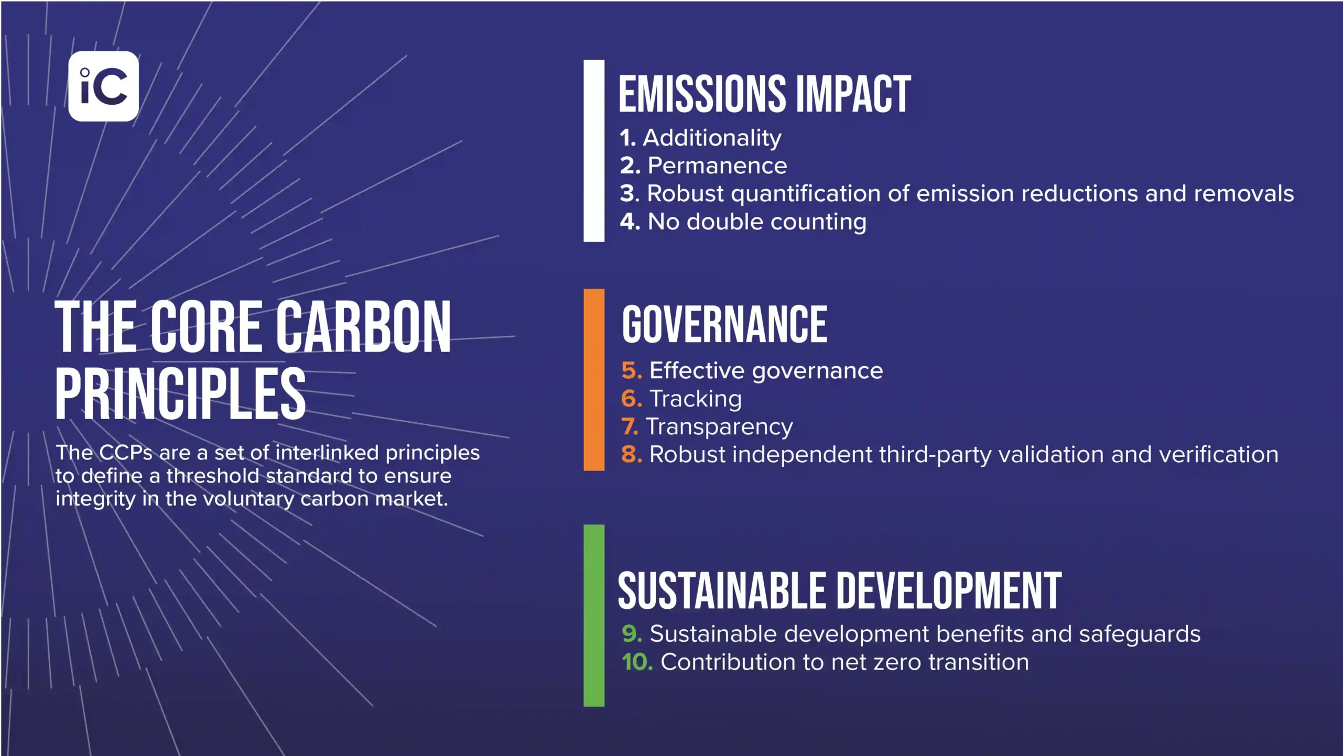

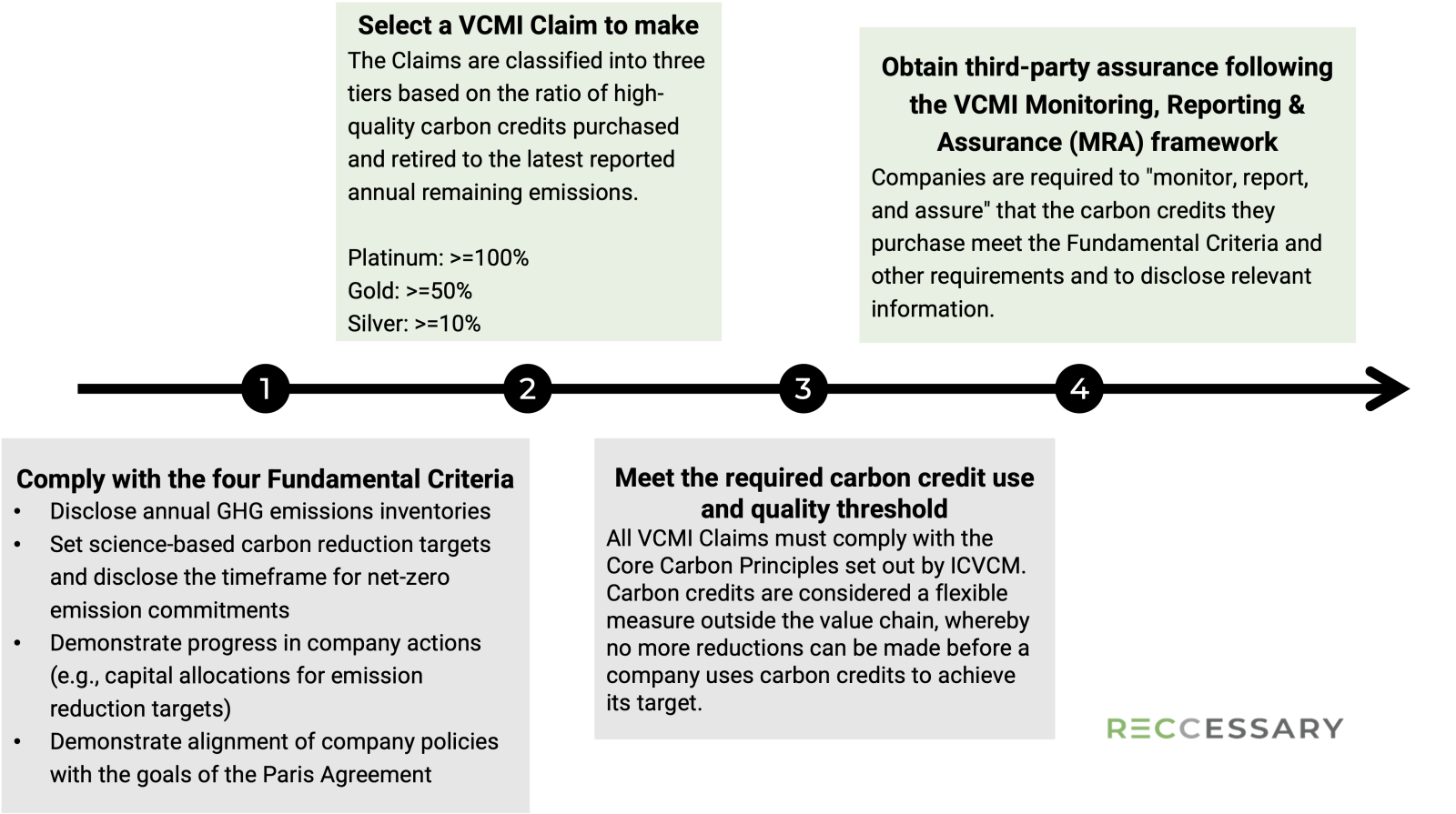

Cases of greenwashing are mainly associated with two factors: poor carbon credit quality and misleading marketing. To address this issue, the EU and US governments have implemented a series of regulations prohibiting the use of misleading terms for marketing purposes. The Integrity Council for Voluntary Carbon Markets (ICVCM) and the Voluntary Carbon Markets Integrity Initiative (VCMI) have also introduced the Ten Core Carbon Principles and the Claims Code of Practice, respectively, for companies to follow. In addition, the ICVCM will assess over 100 carbon credit methodologies in 2024 to ensure their compliance with the principles. Currently, approximately 1% of carbon credits in the market are known to be potentially non-compliant, including project types such as natural gas power generation, waste heat recovery, and industrial energy efficiency. As these projects are unlikely to meet the criteria, they could be labeled as "likely junk," or even banned from issuance.

Figure 1. The Ten Core Carbon Principles[1]

Figure 2. VCMI Claims Code of Practice

How greenwashing affects voluntary carbon market

Amid the wave of greenwashing, suppliers in the voluntary carbon market need to adopt more rigorous methodologies, strengthen monitoring and verification of carbon projects, and establish an open, transparent platform to record activities such as carbon credit issuance, retirement, and transfer in a tamper-proof manner, where blockchain may serve as a necessary and efficient solution.

In addition, companies need to be more careful in choosing carbon credit types and offset proportions to achieve net-zero goals. The authenticity of climate benefits of carbon credits can be ensured through collaboration with insurance companies, rating agencies, accredited carbon project developers, and third-party verifiers. Most importantly, companies must invest in their own carbon reduction efforts and avoid over-reliance on carbon credits to effectively reduce the risk of greenwashing.

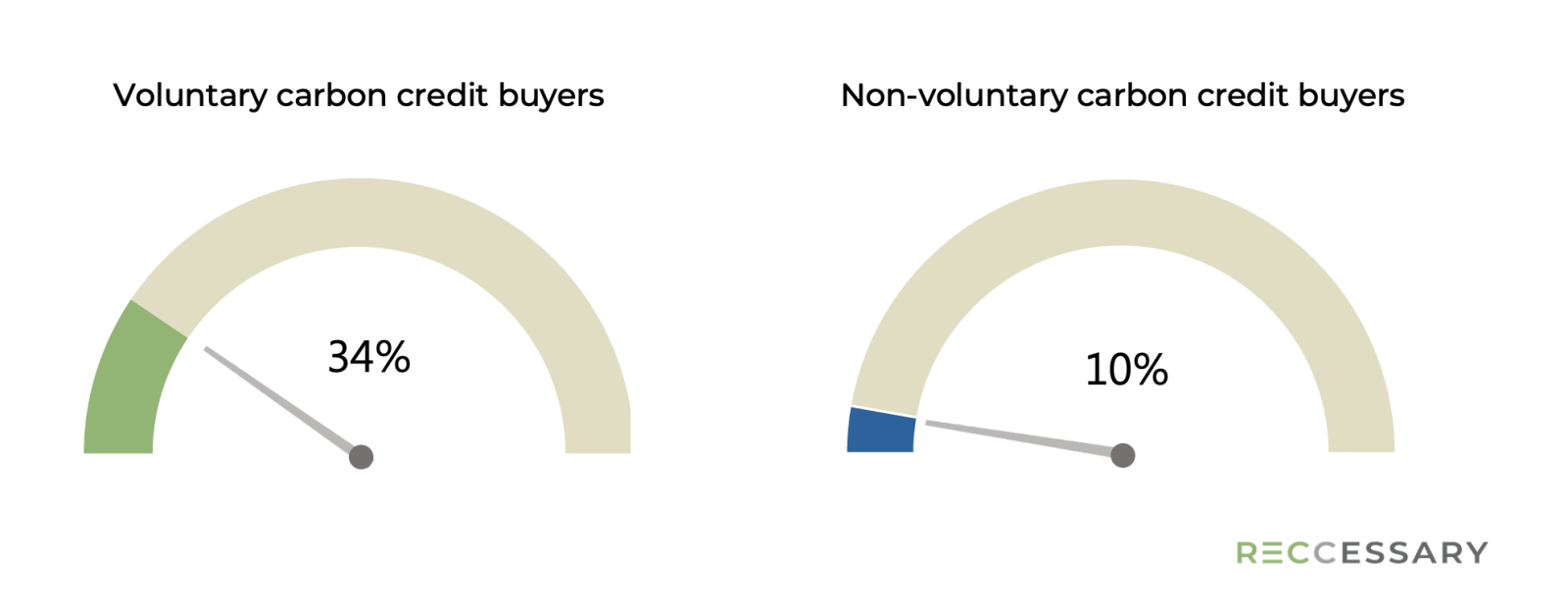

Despite the potential damage caused by greenwashing, statistics show that companies purchasing voluntary carbon credits generally outperform and outpace their peers in climate action (see Figure 3 below), demonstrating greater green competitiveness and adaptability to future market changes.

Figure 3. Proportion of SBTi-verified voluntary carbon credit buyers and non-buyers[2]

Both the issuance and retirement volumes of carbon credits in 2023 were lower than in the past two years, with retirement decreasing by over 10%, mainly from REDD+ and renewable energy. Notably, the market value of the voluntary carbon market is comparable to that of 2022, signaling a shift towards a quality-driven market. Carbon removal projects, despite being fewer in number and higher-priced, grew five-fold in 2023, emerging as a new market trend.

Despite the escalating greenwashing controversy, the voluntary carbon market will continue to grow, as it serves as an important channel for companies and governments to fulfill their climate commitments and some projects have demonstrated environmental benefits.

Overall, stakeholders can no longer rely on carbon credits as a shortcut, as the market is expected to undergo three changes:

- High-priced, high-quality carbon credits will lead the market, with carbon removal projects particularly favored.

- Methodologies, third-party verification, and post-purchase marketing will be more tightly regulated. With the release of the EU's Empowering Consumers for the Green Transition Directive, it is believed that similar regulations will be introduced in other regions.

- The period from 2024 to 2026 will be critical for developing greenwashing countermeasures, with rapid progress expected in revising related standards following the controversy. Companies seeking to enter the market must closely monitor regulatory updates.

The growing attention on carbon reduction has brought not only stricter regulations and standards to prevent greenwashing, but also higher expectations from consumers and stakeholders for corporate climate action. While the greenwashing issue poses challenges for the voluntary carbon market, it also creates opportunities. By strengthening regulation, verification, transparency, and credibility, the voluntary carbon market will be able to overcome the hurdle and achieve sustainable development. It requires the concerted efforts of governments, businesses, and non-profit organizations to promote the robust development of the market and effectively reduce global greenhouse gas emissions.

[1] Source: ICVCM website

[2] Source: Ecosystem