In recent years, carbon markets have gained increasing attention from governments, corporations, and investors. In Southeast Asia, Thailand and Malaysia have established voluntary carbon credit trading platforms and exchanges in 2022. Unlike mandatory carbon allowances, voluntary carbon credits can be generated and traded in different locations, making them an essential instrument for many multinational companies to achieve carbon neutrality. However, as more countries and companies commit to net zero, the price of carbon credits has been rising, making it an issue that cannot be ignored by governments and businesses to gain a competitive edge in this emerging market.

Thailand and Malaysia open door to carbon trading

Southeast Asia is experiencing rapid development in the voluntary carbon market, with Thailand and Malaysia following Singapore's lead by actively establishing related systems. Holding an advantage of being home to numerous international companies, Singapore has become the first country in the region to develop a voluntary carbon market. The country allows companies to purchase carbon credits around the world to offset emissions from factories in different regions, thus helping it move towards its goal of becoming a carbon trading hub. In contrast, Thailand and Malaysia have high demand for emissions offsets due to the development of domestic industries. Malaysia's industry and petrochemical sector generate a large amount of carbon emissions, thus driving demand for carbon credits. Moreover, both countries possess abundant natural resources that enable them to develop renewable energy and reforestation projects, giving them an advantage in supplying carbon credits.

FTIX, Thailand's new carbon trading platform launched by the Federation of Thai Industries, has been offering trading services for carbon credits, renewable energy, and renewable energy certificates (RECs) since mid-January this year. The platform serves as a channel for Thai exporters to purchase carbon credits to assist them in complying with the emission standards of importing countries. According to government estimates, a total of 12,000 companies will register on the platform to trade carbon credits.

In Malaysia, the national Bursa Carbon Exchange (BCX) has completed its first round of carbon credit auctions on March 16, 2023. The auction was held online, with 150,000 of VERRA's registered carbon credits traded. The first two products auctioned were the Global Technology-Based Carbon Contract (GTC)[1] and the Global Nature-Based Plus Carbon Contract (GNC+)[2]. The former was sold at RM18.5 (or US$4.1) per contract, while the latter was sold at RM68 (or US$15.1) per contract. Despite the unsatisfactory price, this is still a major step forward for the voluntary carbon market in Malaysia.

Voluntary carbon credits bring opportunities to Southeast Asia

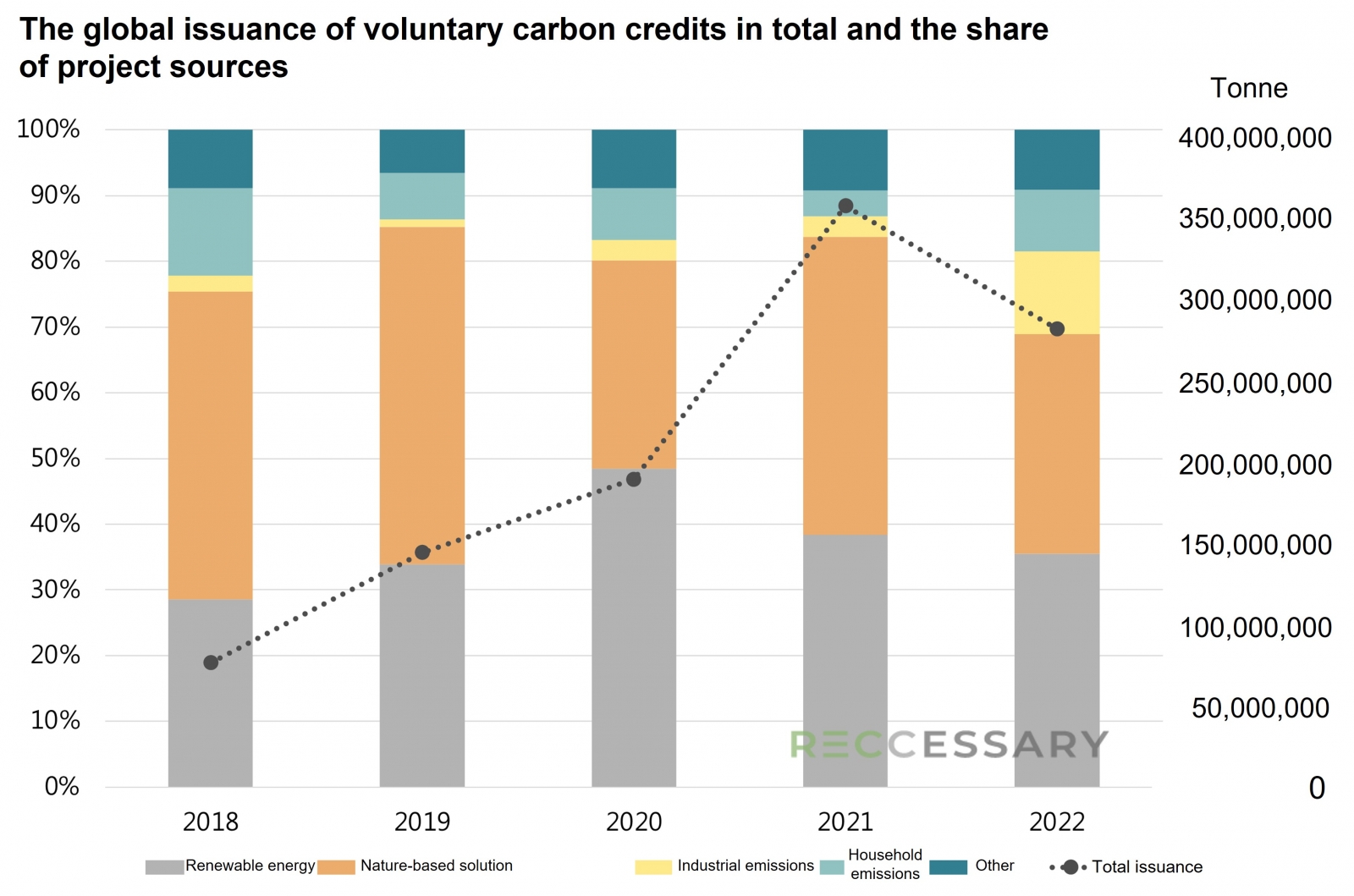

The value of global voluntary carbon market has exceeded $2 billion, with a trading volume of nearly 300 million tonnes of CO2 equivalent. As of today, Southeast Asian countries hold about 55 million tonnes of non-retired carbon credits, or 10% of the world's total. The figure seems low, but there is enormous potential. Malaysia and Indonesia enjoy 55% and 53% forest cover respectively, followed by Vietnam at 47%. Such high forest coverage indicates that there is still huge room for carbon credit development in the future, as forest management, afforestation, and REDD+[3] are all possible channels for carbon credit acquisition. Forest-related activities are currently the world's largest source of carbon credits (see Figure 1 below). Their nature-based feature is highly appreciated by the market, as they are more likely to avoid greenwashing accusations than energy and cooking stoves, with higher prices than other projects, as evidenced by the aforementioned auction price in Malaysia.

Figure 1. The global issuance of voluntary carbon credits in total and the share of project sources[4]

In addition to the promising outlook of voluntary carbon credits, the establishment of carbon exchanges can also increase the potential of national carbon markets. Similar to securities, trading of carbon credits involves an offsetting mechanism that facilitates successful transactions between buyers and sellers, as well as regulatory settlement and delivery. In addition, carbon exchanges can develop and standardize commodity contracts to provide greater security for all types of trading. Southeast Asian countries are rushing to set up carbon exchanges not only to attract global investors to earn revenue from listing fees and commissions, but also to create a large local trading market and make themselves a regional or even global hub for carbon credits.

Businesses benefit from carbon credits

The Southeast Asian governments are developing the domestic carbon markets aggressively, so that they can stand out in the global race towards carbon neutrality, which also gives businesses a great opportunity to surpass their competitors. When carbon credits are not geographically limited, markets around the world can be connected with each other. For example, carbon credits generated in Indonesia can be listed on a voluntary carbon exchange in Malaysia, and then bought and retired by a U.S. company as an emissions offset. In addition to their primary function of offsetting emissions, carbon credits can be used for a wide range of purposes. Since each country has its own exchange and price, investors can take advantage of this market to reduce the cost of offsets or to resell them, which can be an opportunity for companies as the carbon prices continue to rise.