.jpg)

(Photo: iStock)

What is the best way to decarbonize your power use in Southeast Asia? This article explains the 4 major power purchase mechanisms and their advantages and considerations. To better evaluate the best option for corporates, the 4 mechanisms are compared at the end.

1. Renewable Energy Certificates

Each REC represents for 1 MWh of renewable energy and the purchase of which helps to finance the take-off of renewable energy projects. For corporate users, RECs can be used to reduce their Scope 2[1] emissions by making claims that for each REC they purchase 1 MWh of their electricity comes from renewable energy sources. Essentially, RECs are a product that matches electricity use to renewable energy supply.

2. Corporate Power Purchase Agreement (CPPA)

A corporate power purchase agreement (CPPA) is a long-term contract, usually lasts from 5 to 20 years, depending on market maturity. PPAs ensure that the consumers are paying for the use or creation of renewable energy and not just using unbundled RECs to offset emissions from energy consumption. In short, in a PPA, RECs come with the electricity. There are mainly two types of PPAs, direct PPA (DPPA) and virtual PPA (VPPA).

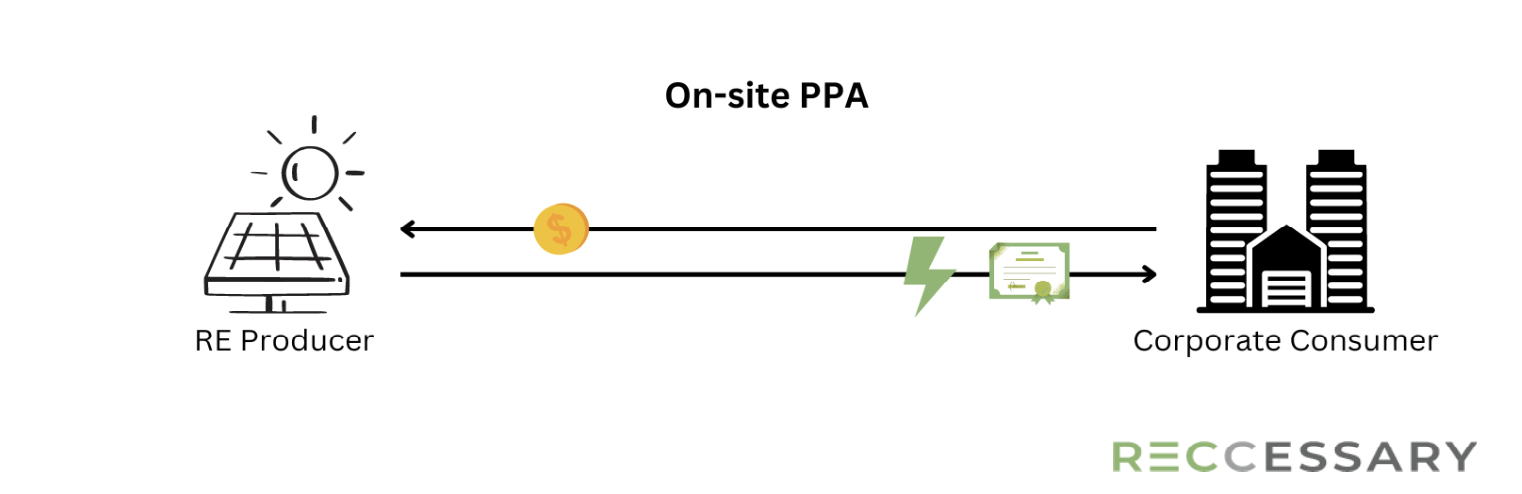

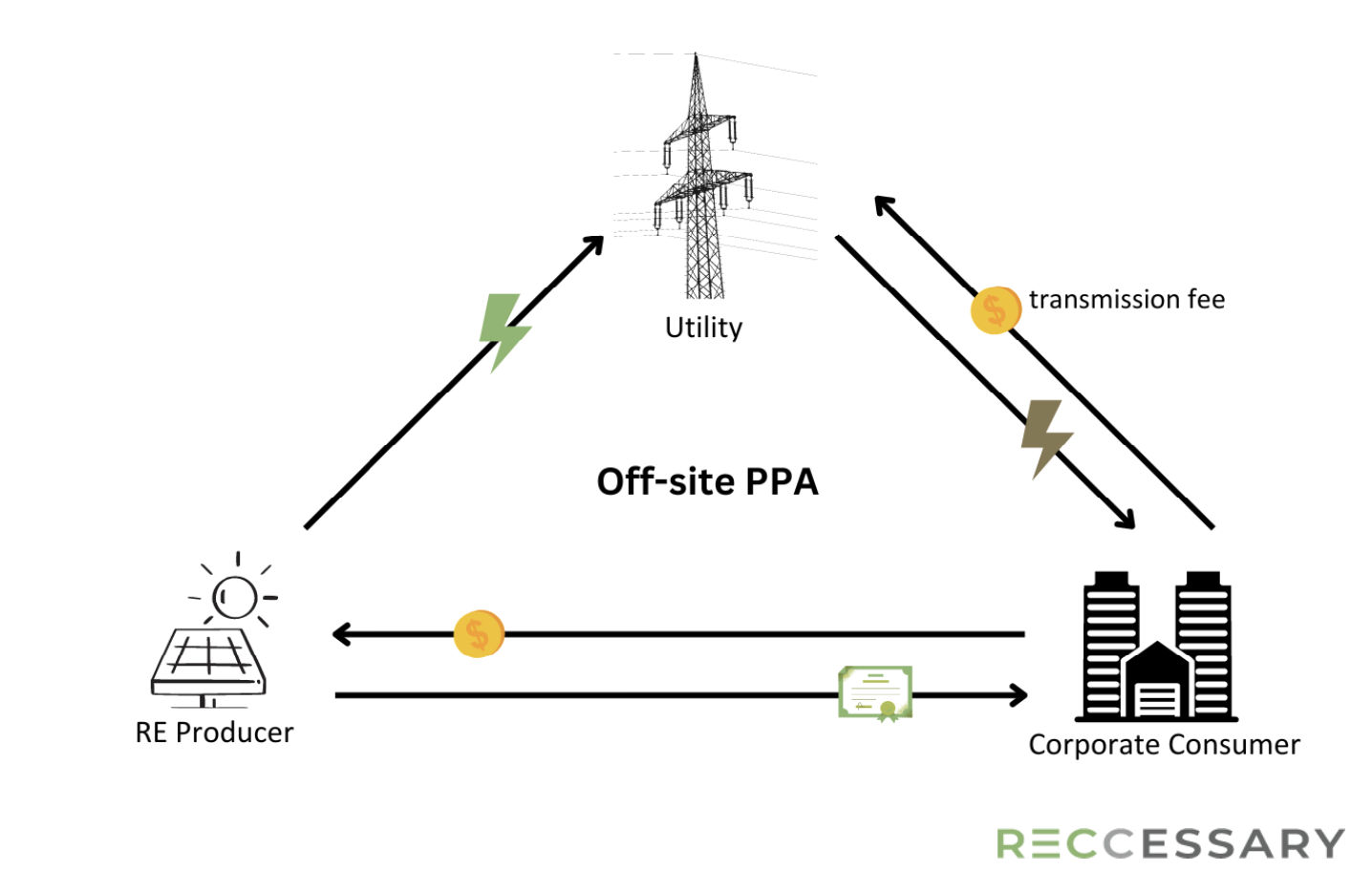

2.1. DPPA, or a physical PPA, is where the power supply comes from renewable energy generators that is either located on-site or off-site of the corporate consumer premise.

A DPPA contract is signed between the consumers and the power producer, in the case of an off-site PPA, corporate consumer may need to pay a sleeving fee to electricity utility for power transmission. However, grid connection requirement can limit the ability of big corporations that have operations in different places to acquire renewable power. Due to the locational requirement and contract length, a DPPA is more suitable for entities that have long-term plans to stay on one site. The advantage of a DPPA is the absence of upfront cost of power devices as it is paid for by the power producer who obtains ownership of the renewable power generator.

.png)

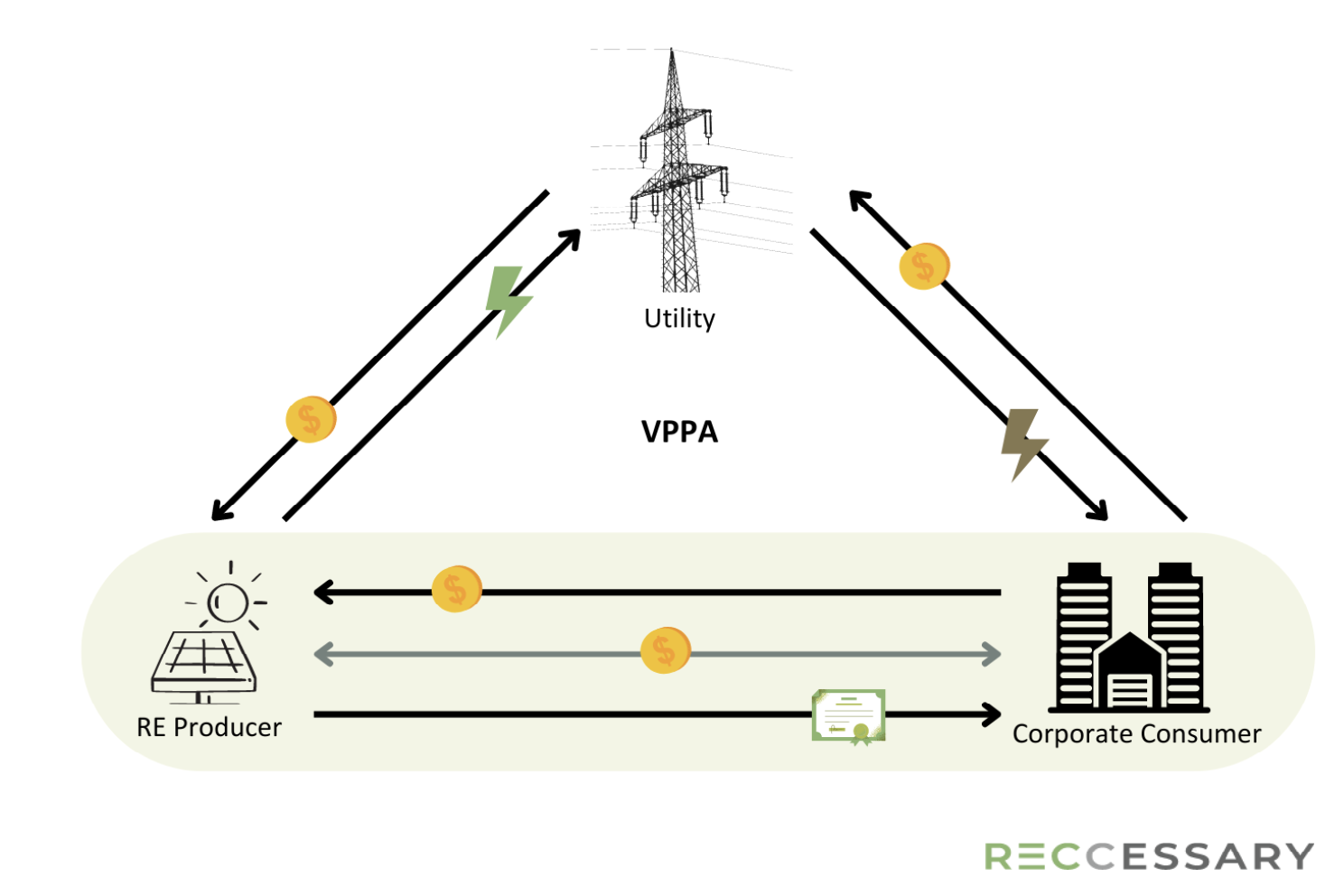

2.2. VPPA is a financial contract between the consumers and the renewable power producers for not the physical delivery of renewable power but the ability to declare support for the increase of renewable power creation. In other words, settlements from the consumer to the power producers would be used to finance renewable energy projects. VPPAs involve another contract on top of the PPA between the consumers and their existing electricity utility. While it is a more intricate formula, VPPA accepts the condition where power users and power producers are not grid-connected.

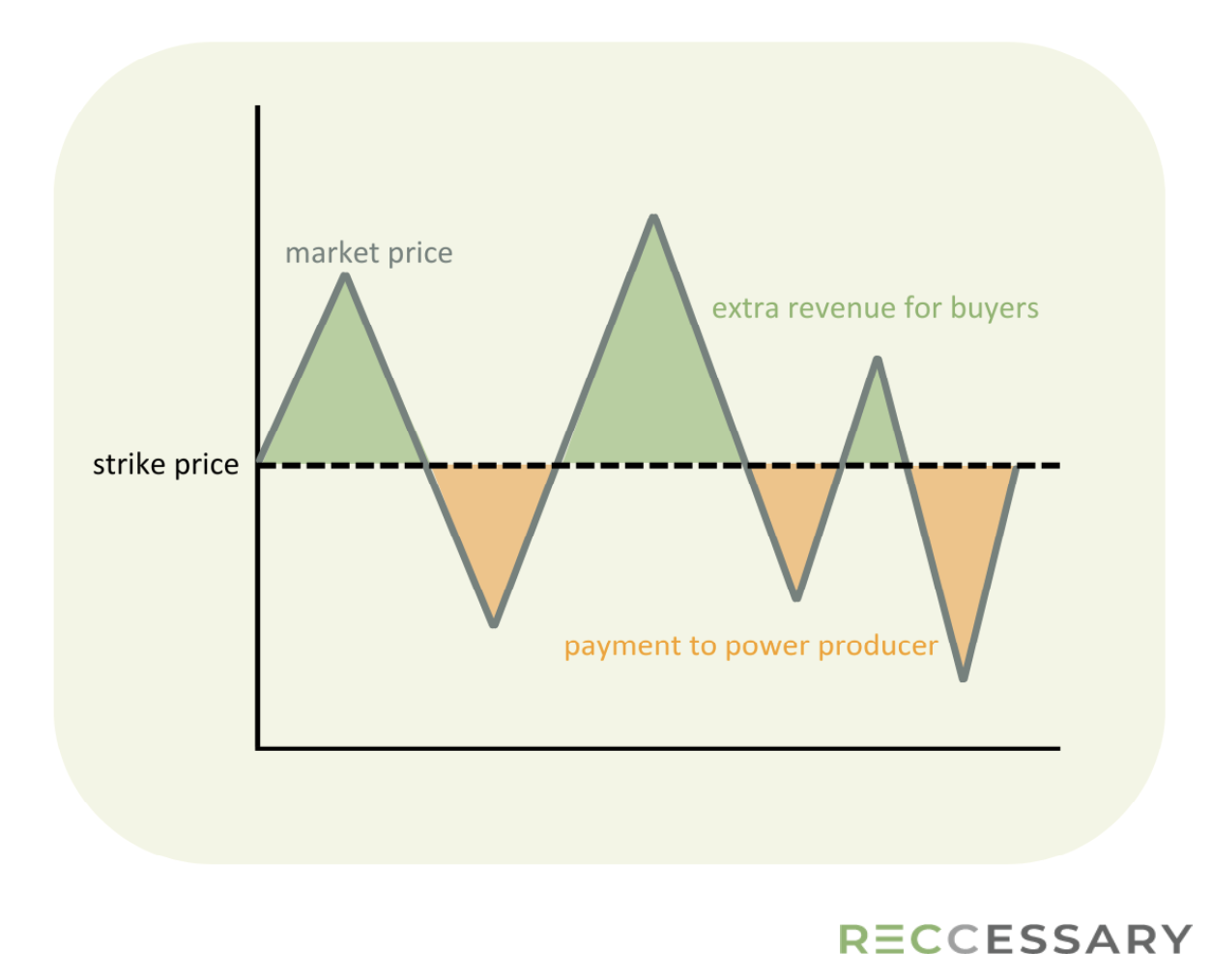

A VPPA is a contract for differences whereby corporate consumers and RE producers determine a strike price that for the contract period and pay the differences between the strike price and the market price to one another. When the strike price is set right, a VPPA can become a source of revenue for corporate consumers. On the contrary, this also exposes investors to the risks of addition costs when market price drops below strike price. For power producers, it safeguards them from losing needed project finance stream.

.png)

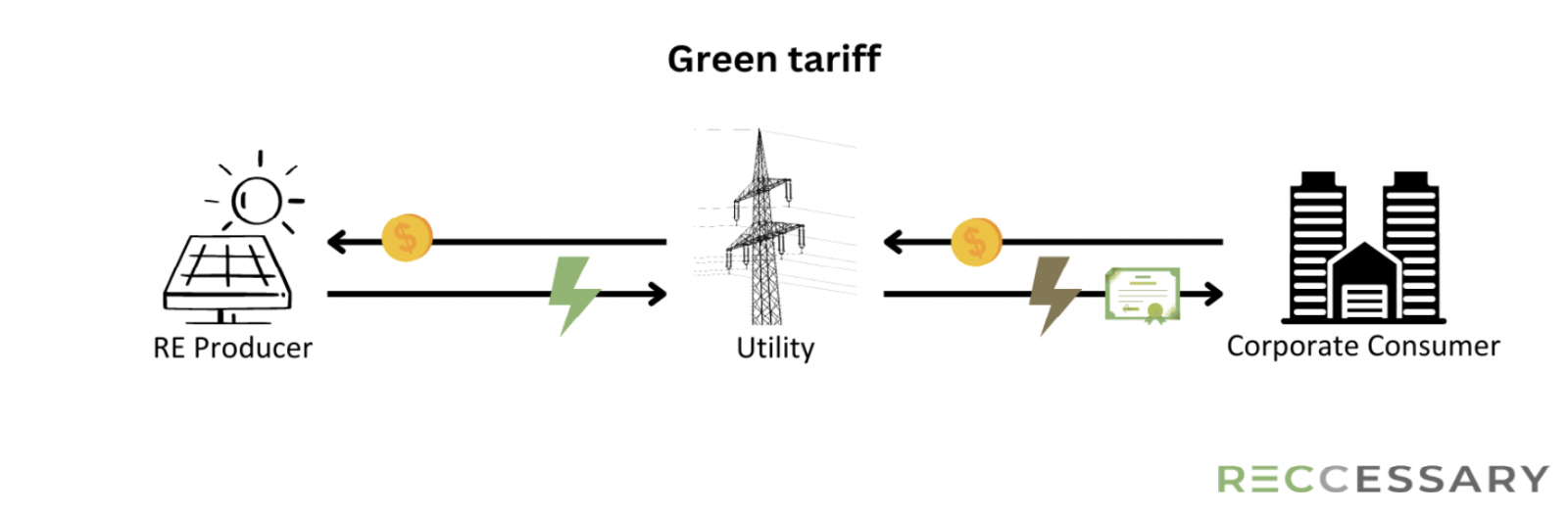

3. Green Tariff

Green tariff, or renewable electricity rate, is defined as the mechanism for individuals, households, and organizations to procure electricity from renewable sources by paying a premium on top of the existing electricity tariff. Consumers choosing to adopt a green tariff do not need to enter a PPA contract and can still obtain RECs. It is different from a DPPA in that power consumers continue the contract with their utility who delivers green power from self-owned or third-party renewable power generators. Compared with PPAs, green tariff provides a simpler arrangement but is currently only available in a few markets in Southeast Asia.

4. Self-Consumption

Self-consumption solar can be either on-site or off-site. An on-site solar for self-consumption is made possible with solar panels installation on the rooftop or nearby space of the corporate user’s facilities. This requires upfront construction and maintenance costs which can be offset by savings from power generated over the years. For those considering self-consumption we recommend also checking local regulations on selling excess power back to the grid.

Who’s the fairest of them all?

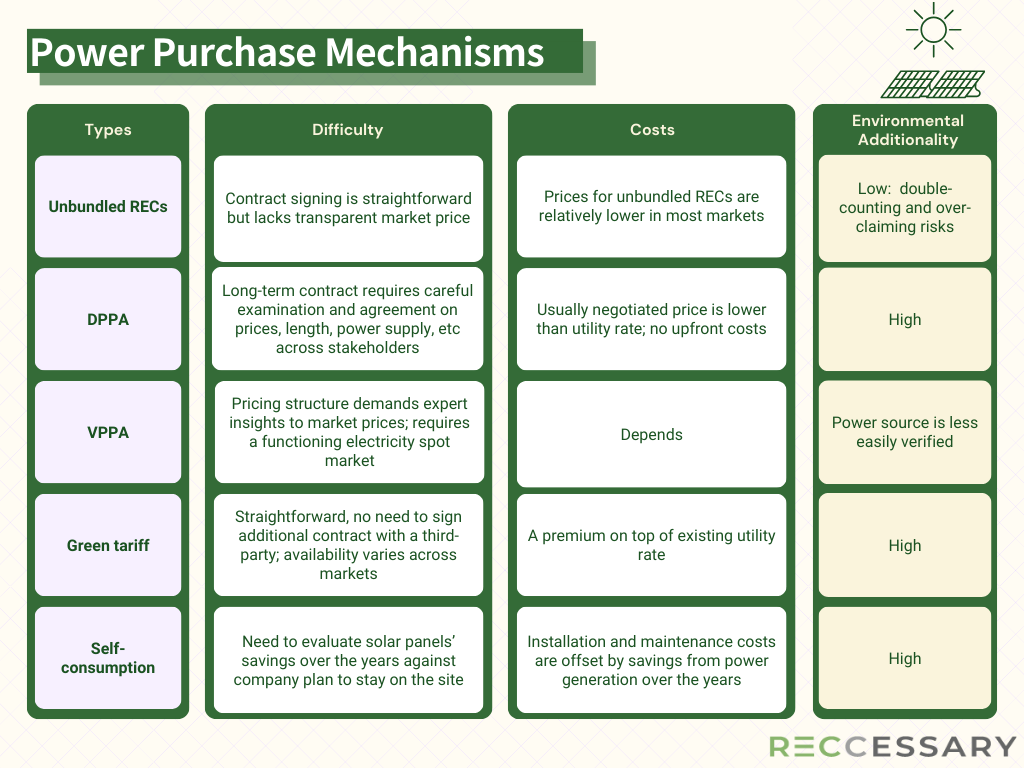

The table below compares the above mechanisms in three aspects: difficulty in contract signing and pricing, costs compared to utility rate, and the environmental additionality. Reccessary provides a buyer’s toolkit for those interested to understand available options in each ASEAN countries.

[1] Editor's note: Scope 2 emissions are indirect GHG emissions associated with the purchase of electricity, steam, heat, or cooling.