.jpg)

(Photo: iStock)

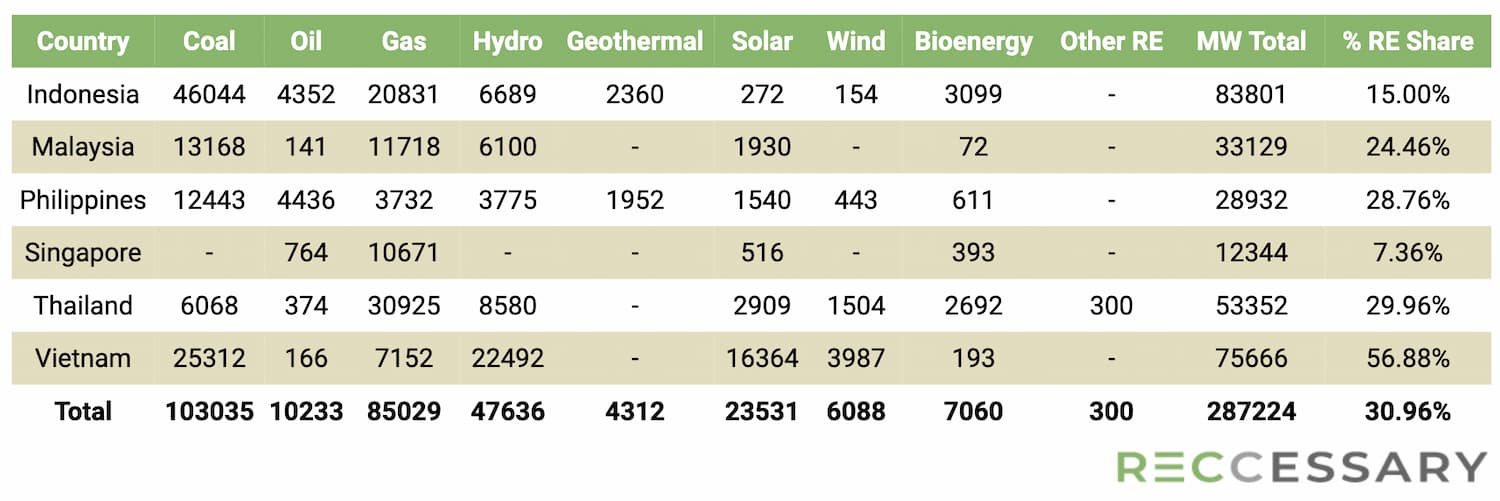

Southeast Asia stands at a critical juncture in its energy transition journey. As a region with diverse energy landscapes, it is grappling with the challenge of decarbonizing its power sector amid growing environmental and economic imperatives. This synopsis draws from the annual report to provide an overview of the developments, policies, and market mechanisms affecting the green energy landscape in Indonesia, Malaysia, Thailand, the Philippines, Vietnam, and Singapore.

Indonesia's renewable aspirations and policy paradoxes

Indonesia's participation in the Just Energy Transition Partnership (JETP) has yielded a revised renewable energy target of 44% by 2030. However, the progress has been slower than anticipated, with renewable energy reaching only 15% in 2023, trailing the national goal. Policy support has been inconsistent, as seen in the recent regulation limiting residential rooftop solar exports to the grid, contradicting the nation's renewable ambitions. Nevertheless, there are positive moves to attract foreign investment in renewable projects, with a temporary relaxation of domestic component requirements for solar development, expectedly creating more green power supply for enterprises.

Malaysia's path to green power competitiveness

Malaysia's National Energy Transition Roadmap (NETR) sets a long-term goal of 70% renewable capacity by 2050. The country is also inching towards an electricity market liberalization, with proposals in place to erode the monopoly of Tenaga Nasional Bhd (TNB). Green power purchase options have expanded for businesses, with a new 200 MW Virtual Power Purchase Agreement (VPPA) quota and relaxed capacity thresholds, making renewable energy more accessible.

Thailand's mixed signals in energy policy

Thailand's Power Development Plan (PDP) aims for a 50% renewable share by 2036, yet faces criticism for policy inconsistencies and continued gas dependence. While the government promotes renewable energy through auctions and green tariffs, it simultaneously approves additional gas power plants. Electricity market liberalization remains a distant goal, with the state retaining control over power trading. We expect that businesses will be able to meet certain level of green power demand via utility green tariff in 2024.

The Philippines' struggle with coal dependence

Despite having the highest renewable share in its mix among Southeast Asian peers, the Philippines' draft Energy Plan raises concerns over the absence of a coal exit strategy. The plan's renewable targets are seen as insufficient, with a potential fivefold increase in gas capacity looming. The indefinite suspension of feed-in-tariff has lowered electricity costs of end-users, yet grid planning issues pose barriers to the full utilization of renewable energy.

.jpg)

Wind turbines in north coastal Luzon Island, the Philippines. (Photo: Wayne S. Grazio)

Vietnam's balancing act between growth and green goals

Vietnam's Power Development Plan VIII (PDP8) outlines a strategy for a significant increase in renewable capacity, aiming for over 70% by 2050. However, conflicting interests and an outdated grid infrastructure hamper progress. A direct power purchase agreement (DPPA) proposal could facilitate corporate green power purchase but awaits government approval.

Singapore's decarbonization through imports and innovation

Singapore's energy strategy heavily relies on imported natural gas, accounting for over 94% of electricity production. To decarbonize, the nation is looking towards solar, hydrogen, and has approved 4.2 GW of imported low-carbon energy which is expected to meet 30% of Singapore’s electricity demand by 2035. The city-state is a significant player in the regional electricity grid, seeking to balance its limited domestic production with its high energy demand.

ASEAN power grid and regional integration

The ASEAN Power Grid (APG) is an example of regional collaboration, with success in multilateral power connectivity. However, national-level challenges like fossil fuel subsidies and an overall increase in coal and gas power persist. Despite these hurdles, more bilateral power trade agreements are anticipated, advancing regional integration.

Conclusion and prospects

The report demonstrates that while Southeast Asia is pushing towards ambitious renewable targets, a juxtaposition of commitment and reluctance characterizes the transition. The pace of green power procurement varies across the region, with RECs being the most accessible decarbonization tool for corporations. The energy transition in Southeast Asia is a complex tapestry of policy, ambition, and practical challenges, necessitating nuanced approaches to ensure sustainable and secure energy futures.