.jpg)

Thailand’s first sustainable aviation fuel (SAF) standard is expected this month, with enforcement next year. (Photo: iStock)

Thailand’s first standard for sustainable aviation fuel (SAF) specifications is expected to be released this month and enforced next year, starting at 1% and increasing to 8% by 2036. The move aims to decarbonize the aviation sector in line with international measures and support the country’s goal of achieving carbon neutrality by 2050.

Industry and government align as Thailand prepares for SAF takeoff

As the SAF standard nears launch, the industry is gearing up to build a full supply chain, from raw materials to jet fuel. Thailand’s leading biofuel producer, Bangchak, inaugurated a dedicated facility for 100% neat SAF in April, with an initial production capacity of 1 million liters per day.

The company has signed agreements with local governments and food and beverage companies to collect used cooking oil as feedstock, while its subsidiary, BBGI (Bio-Based Green Innovation), is exploring algae-based SAF to diversify future sources.

Thailand’s leading biofuel producer, Bangchak, inaugurated a dedicated facility for 100% Neat SAF in April. (Photo: Bangchak)

Thailand’s leading biofuel producer, Bangchak, inaugurated a dedicated facility for 100% Neat SAF in April. (Photo: Bangchak)

PTT Global Chemical (PTTGC), the state-owned petroleum and LNG company, produced its first batch of SAF from used cooking oil in January and plans to expand production to 24 million litres per year in the future. The company has also formed strategic partnerships with Thai Airways and Bangkok Airways to collaborate on the research, development, and adoption of SAF.

Complementing these industry efforts, the Thai government has partnered with private and industrial sectors to strengthen the SAF supply chain. Six companies have joined the initiative, including Central Group, Thai Beverage, Charoen Pokphand Foods, Thai President Foods, the Thai Food Processors Association, and Bangchak Corporation.

Under the country’s Alternative Energy Development Plan (AEDP 2024), Thailand aims for 675 million liters of SAF consumption by 2037, equivalent to 1.85 million liters per day of neat SAF.

ASEAN joins the global push for SAF

The push for SAF is gaining momentum across ASEAN, with countries advancing at different stages of policy and market readiness. Singapore has emerged as the region’s frontrunner, combining clear policy targets with strategic industrial planning. On Oct. 14, the country passed the Civil Aviation Authority of Singapore (Amendment) Bill, paving the way for a green fuel levy on all departing passengers to ensure SAF makes up at least 1% of total jet fuel use by 2026.

Malaysia is another key player, leading the region with at least eight active projects in refinery construction and feedstock development. The country delivered its first locally blended SAF in September, marking the start of continuous, scalable production and targeting 1% SAF use by 2027.

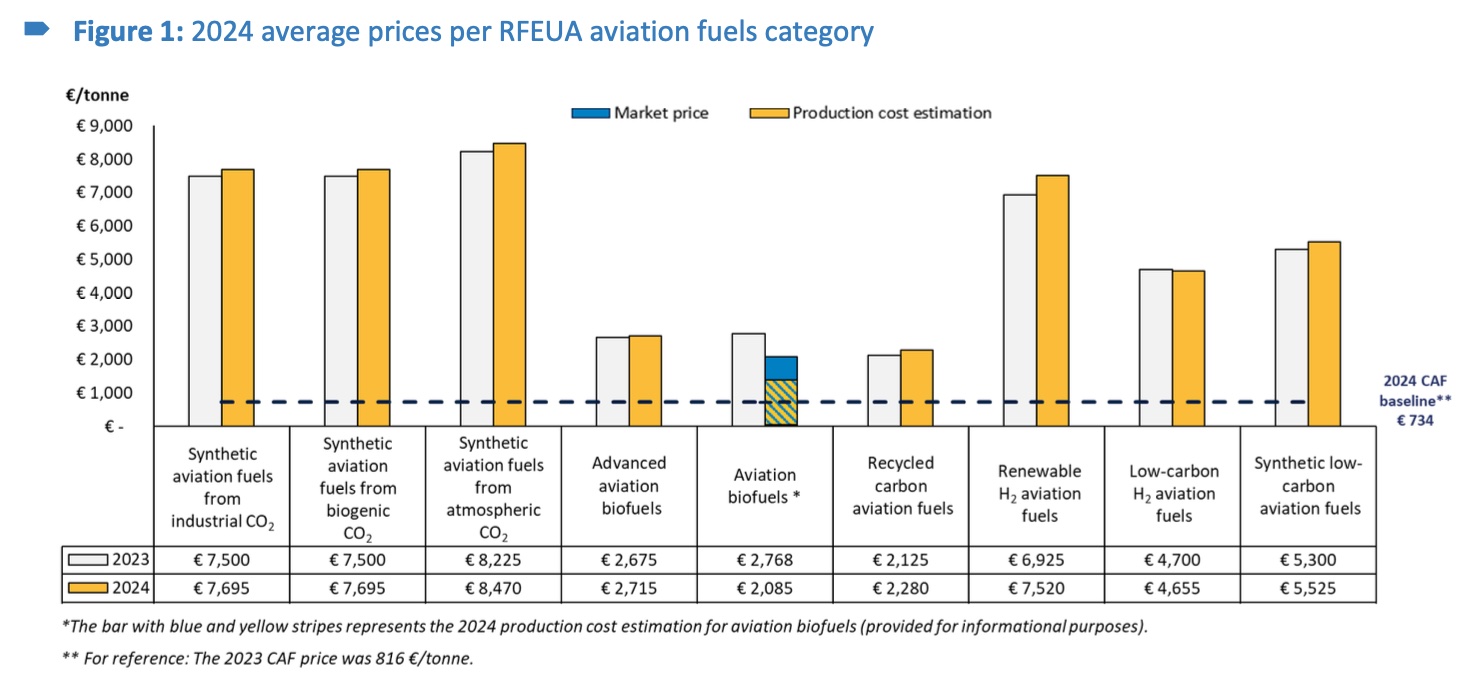

Globally, the European Union has set one of the most ambitious benchmarks, mandating 6% SAF use by 2030 under the ReFuelEU Aviation initiative. Although SAF currently costs about three times more than fossil-based jet fuel, penalties for non-compliance are roughly three times the cost of compliance, according to an analysis by Carbon Direct, underscoring how seriously governments are enforcing these mandates.

SAF currently costs about three times more than conventional fossil-based jet fuel. (RFEUA: The ReFuelEU Aviation Regulation, CAF: conventional aviation fuel) (Chart: EU Aviation Safety Agency)

As global momentum for decarbonization builds, Thailand is positioning itself to stay on board the global SAF transition. The country has an abundance of raw materials suitable for SAF production, supporting the government’s ambition to establish Thailand as a regional aviation hub, said Sarawut Kaewtathip, director-general of the Department of Energy Business.

Source: Bangkok Post, SAF Investor (1) (2), IRENA, EASA

Read more: Decarbonizing industry: How ASEAN airlines race to secure SAF supplies?

.jpg)