(Photo: iStock)

In 2023, the EU launched a sweeping Carbon Border Adjustment Mechanism (CBAM), ushering the global carbon market into a new era; China's carbon prices saw record highs despite a lack of trading momentum; South Korea introduced its first carbon neutrality initiative to address persistently subdued market sentiment. These dramatic changes underscore the global significance of the carbon market. To help investors keep abreast of the latest market trends, Reccessary presents the annual report, focusing on market performance in 2023 and policy outlook for 2024 for markets of the EU, U.S., and Asia Pacific.

Global carbon market overview

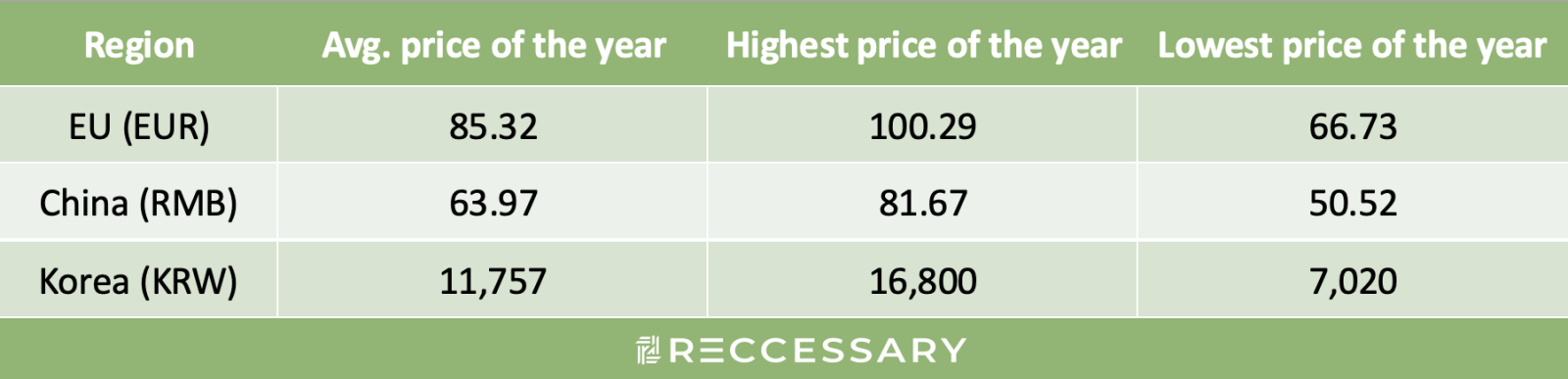

There are currently 34 carbon trading systems in the world, with the EU, China, and South Korea leading the region in terms of size and maturity. The table below illustrates the performance of the three markets in 2023.

Average prices in major global carbon markets in 2023 (Unit: national currencies/tonne)[1]

EU: Changes in power mix and weak demand push down carbon prices in 2H23

Launched in 2005, the EU emissions trading system (ETS) has undergone multiple market changes and challenges. Throughout 2023, EU carbon prices experienced fluctuations, peaking at EUR 100.29 per tonne before declining in the second half of the year. This trend was attributed to weak demand and structural shifts in the energy sector, with a significant drop in electricity supply from fossil fuels and robust growth in renewables. Looking ahead, the EU will take more aggressive measures to reduce emissions. However, given the slower economic growth momentum in Europe, average prices in 2024 are expected to be slightly lower than in 2023.

Download Reccessary's Southeast Asia Renewable Energy Market X Global Carbon Trends Annual Report now for in-depth carbon market analysis and trend forecast.

China: Lack of market momentum leads to volatile trading activity

China’s carbon market is still in its infancy since its inception in 2021, currently covering only 2,000 companies in the power sector. By the end of 2023, China's carbon price had risen by 44.4% compared to the beginning of the year. The first half of the year was characterized by low price volatility due to a lack of trading momentum. In the second half, carbon prices picked up significantly, reaching a record high of RMB 81.67 per tonne in October. Due to compliance requirements, trading volume in the two months prior to the compliance deadline surpassed the previous month's performance by 260% each. In 2024, the government should accelerate the expansion of industry coverage, prioritizing sectors affected by the EU Carbon Border Adjustment Mechanism (CBAM), which could bring 70% of the country's emissions into the national carbon trading system, thereby enhancing market activity.

South Korea: Market sentiment remains subdued while oversupply continues

Despite covering 74% of the national carbon emissions, South Korea's carbon market is suffering from oversupply. In 2023, the final closing price of Korea Allowance Unit (KAU) dropped by 43.8% compared to January of the same year, signaling a downturn in market sentiment. With the allowance conversion period approaching, KAU prices once surged to KRW 14,600 per tonne in September. However, the short-lived positive signals failed to bolster investor confidence, leaving prices falling towards year-end. In response, the Korean government has introduced various reforms. Whether supply and demand of the Korean carbon market will improve in the coming year will require further attention.

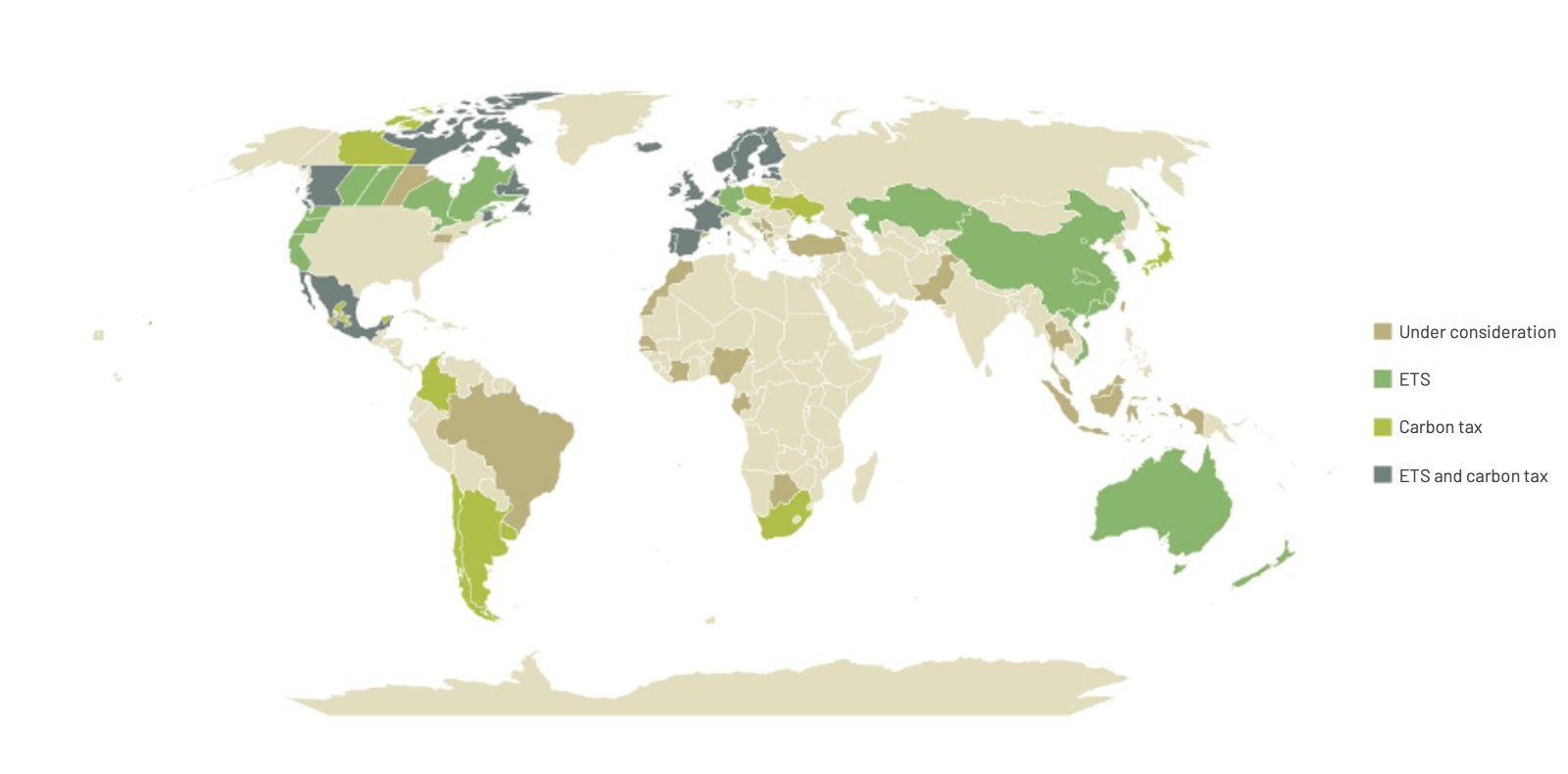

Global carbon policy tracking

In 2023, emissions trading systems were adopted by nations and regions accounting for 55% of global GDP, including those in operation and in the pipeline, contributing to 17% of the world's greenhouse gas (GHG) emissions. Since the introduction of carbon pricing worldwide, the U.S., Europe, and Asia Pacific are currently the most dynamic markets, with varying modes of operation and progress. The following section highlights the current state of development in these three regions, including past market performance and significant changes, as well as tracking new policies to be implemented in 2024.

Map of global carbon tax and emissions trading systems[2]

EU and U.S.' climate policies weigh heavily on global carbon market

In the global climate action arena, the climate policy influence of the U.S. and the EU has dominated the direction of global market development. As a major emitter, the U.S. has decoupled economic growth from carbon emissions by 2023, an achievement largely attributable to the retirement of coal-fired power plants and the growth of renewable energy installations. On the policy front, the U.S.' Clean Competition Act appears to have stalled, while the Foreign Pollution Fees Act, a new carbon tariff bill, was introduced to the U.S. Congress last November and has sparked a flurry of discussion. In terms of the carbon trading system, the issue remains that the U.S. has yet to establish a nationwide carbon trading system. It is suggested that the government refer to the successful model of the California carbon market to establish a sound market mechanism.

Asia ignites as rising star of carbon market

Today, Asia has joined the ranks of the global carbon market, with emissions trading systems gradually taking shape across the region. While Europe and the U.S. are leading the global carbon market, Asia, particularly China, South Korea, and Southeast Asian countries, is demonstrating its enormous potential for development. Taking Southeast Asia, where the development of the voluntary carbon market is the main focus, as an example, Thailand's Voluntary Emission Reduction Program (T-VER) has entered its tenth year. Despite a slight decline in carbon credit applications last year due to low investment, Thailand has become the world's first country to fulfill Article 6.2 of the Paris Agreement, successfully reaching a carbon credit transfer agreement with Switzerland. This not only lays the foundation for cross-border carbon credit transfer and trading, but also demonstrates that companies can leverage this new market to create opportunities tailored to their own needs.

How businesses can benefit from global carbon trend

With the implementation of carbon pricing mechanisms established in major economies such as the EU and the U.S., as well as carbon trading and carbon tax policies introduced in Asian countries, the carbon market has become a key issue for global enterprises. Therefore, companies can explore markets and tools to achieve their low-carbon development goals. For example, voluntary carbon markets in Southeast Asia are rapidly emerging, with Thailand and Malaysia establishing carbon exchanges that serve as a new channel for companies to purchase or sell carbon credits based on their needs. In addition, the introduction of innovative technologies and services is also essential to enhancing green competitiveness. In the future, the carbon market will continue to be subject to national and international policies, market demand, and technological developments, which requires further attention.

[1] Source: European Energy Exchange (EEX), Shanghai Environment and Energy Exchange (SEEE), Korea Exchange (KRX)

[2] Data source: World Bank